Milei’s LIBRA Memecoin Scandal

- Javier Milei promotes LIBRA memecoin on Solana, leading to a massive surge in value.

- LIBRA’s market cap exceeds $4 billion before crashing 95% after Milei’s retraction.

- Milei faces 112 criminal denunciations related to the LIBRA debacle.

- Investors suffer significant losses as the token collapses.

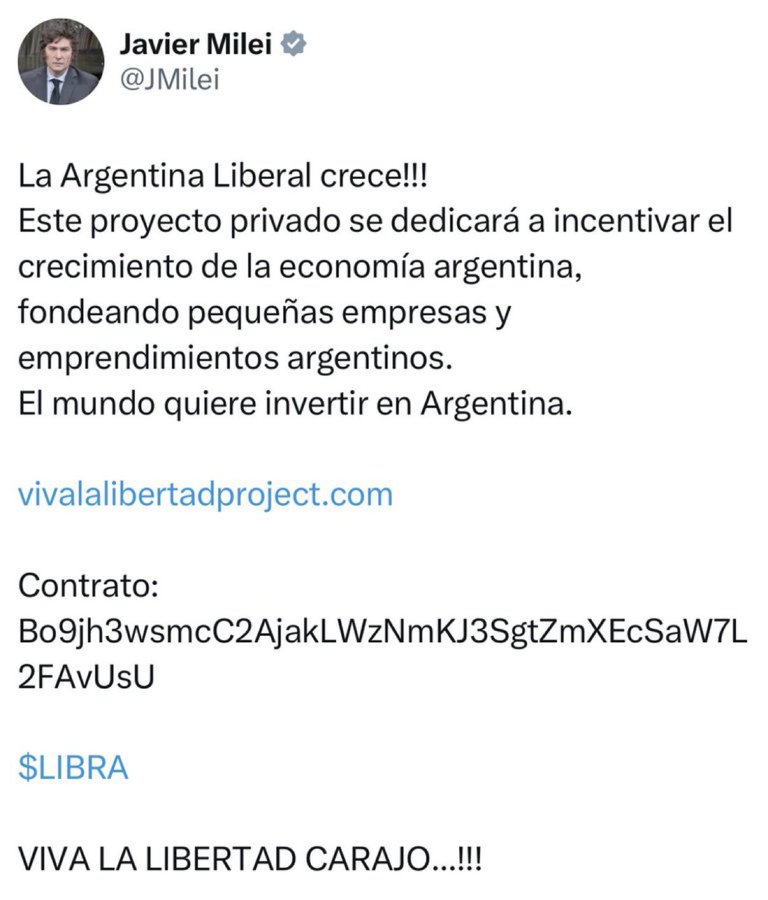

LIBRA, a memecoin on the Solana blockchain, went from zero to hero after President Javier Milei of Argentina decided to give it his public endorsement.

On social networks, Milei announced LIBRA with the intention to “foster the growth of the Argentine economy.” This statement alone was enough to skyrocket LIBRA’s value, pushing its market capitalization beyond an astonishing $4 billion.

The Sudden Retraction and Collapse

Just hours after his endorsement, he deleted his posts and clarified that he was “not aware of the details of the project.”

This retraction led to a catastrophic 95% drop in LIBRA’s value, wiping out billions in market cap. Investors, who had bought into the hype, were left holding nearly worthless tokens. Here’s a stark reality check: within hours, the token that was valued at $4.50 fell to under $0.60, according to trading platforms like DexScreener.

According to data from DeFi Llama, LIBRA’s market cap dropped from over $4 billion to less than $200 million in just three hours, illustrating one of the most rapid declines in crypto market history.

President Milei is now facing 112 criminal denunciations, accused of orchestrating or being complicit in what some are calling a classic “rug pull” – a scheme where developers abandon a project after inflating its value. Critics and investors alike are questioning the transparency and ethics behind such endorsements.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Web3 AI Conference: Blockchain Hub Announces «Crypto Yolka» event to Launch Community-Voted Investment Fund

- Bitcoin Rebounds Above $110,000 Amid Rate Cut Hopes and Buy-the-Dip Sentiment

- Crypto Weekly Roundup – Navigating Tariffs, Liquidations, and Rebound Signals

- Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound

- SEC Chairman Paul Atkins Pushes for Crypto Innovation Amid Regulatory Overhaul

Related

- Cryptocurrency Trading Soars in Argentina Amid Economic Uncertainty Argentine pesos are the fastest-growing crypto trading pair in Latin America....

- CHILLGUY Memecoin: TikTok Trend or Investment Craze? Legal threats loom from the original artist, yet the memecoin continues to gain traction....

- “WATER” Memecoin Soars on Solana Following High-Profile Promotions: Messi and Ronaldinho Solana-based memecoin "WATER" has seen a surge in interest and value following endorsements from football legends Lionel Messi and Ronaldinho....

- Martin Shkreli, Barron Trump, and the DJT Memecoin: Unraveling the Crypto Controversy Shkreli and Barron Trump's collaboration raises questions about the token's legitimacy....