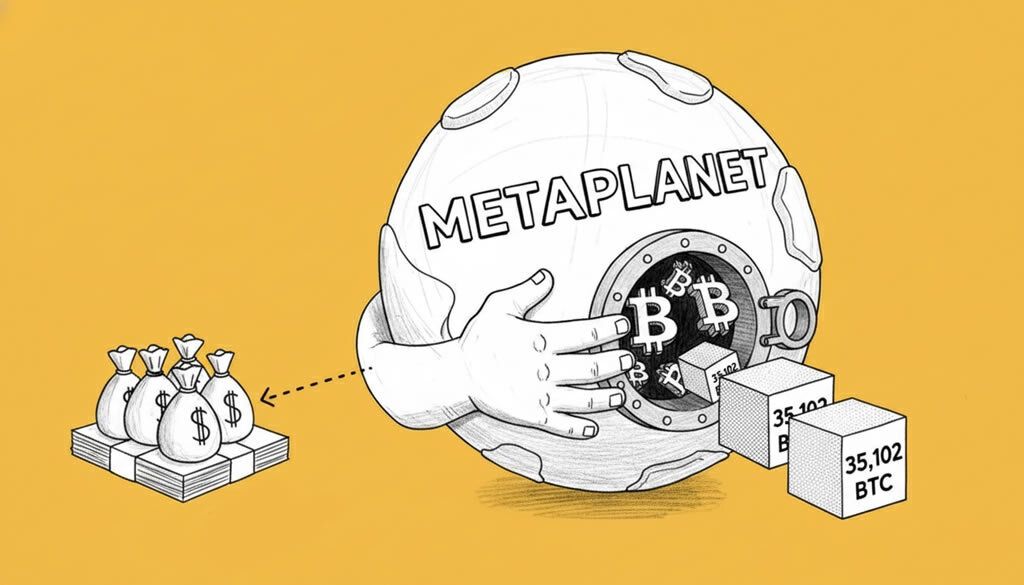

Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Metaplanet purchased 4,279 BTC for approximately $451 million in Q4 2025.

- The acquisition brings the company’s total Bitcoin holdings to 35,102 BTC.

- Metaplanet reported a 568.2% BTC yield for 2025, surpassing initial forecasts.

Japanese publicly traded company Metaplanet has capped off 2025 with a significant Bitcoin acquisition, adding 4,279 BTC to its treasury in the fourth quarter.

The purchase, valued at around $451 million, was executed at an average price of $105,412 per Bitcoin, according to the company’s official announcement.

*Metaplanet Acquires Additional 4,279 BTC, Total Holdings Reach 35,102 BTC* pic.twitter.com/Bkas5kCZGY

— Metaplanet Inc. (@Metaplanet) December 30, 2025

This latest move solidifies Metaplanet’s position as one of the largest corporate Bitcoin holders globally, with total holdings now standing at 35,102 BTC acquired at an average cost of $107,606 per coin.

The Tokyo Stock Exchange-listed firm (3350) has been aggressively accumulating Bitcoin throughout the year, drawing comparisons to U.S.-based MicroStrategy’s strategy.

Metaplanet’s Bitcoin Income Generation business has performed strongly, generating approximately $55 million in revenue for 2025, exceeding expectations.

“Metaplanet has acquired 4279 BTC during Q4 2025 for $451.06 million at ~$105,412 per bitcoin and has achieved BTC Yield of 568.2% YTD 2025,” said CEO Simon Gerovich in a post on X.

Metaplanet has acquired 4279 BTC during Q4 2025 for $451.06 million at ~$105,412 per bitcoin and has achieved BTC Yield of 568.2% YTD 2025. As of 12/30/2025, we hold 35,102 $BTC acquired for ~$3.78 billion at ~$107,606 per bitcoin. $MTPLF $MPJPY pic.twitter.com/AFRldH4hVI

— Simon Gerovich (@gerovich) December 30, 2025

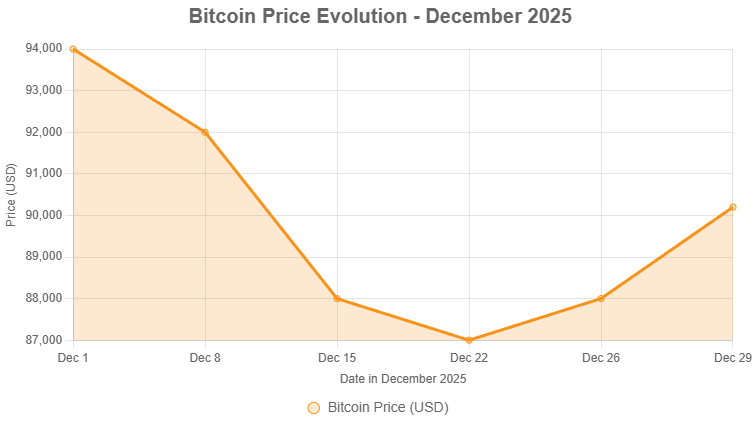

Despite the impressive yield, the company’s holdings are currently underwater given Bitcoin’s recent price around $87,000. However, Metaplanet views Bitcoin as a long-term store of value, undeterred by short-term volatility.

Industry observers note that such corporate adoptions could bolster Bitcoin’s legitimacy as a treasury asset, potentially encouraging more firms to follow suit amid evolving regulatory clarity in Japan and globally.

The acquisition comes amid a mixed year-end for crypto markets, with Bitcoin facing pressure from holiday trading volumes but maintaining institutional interest.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Crypto Weekly Snapshot – End-of-Year Consolidation

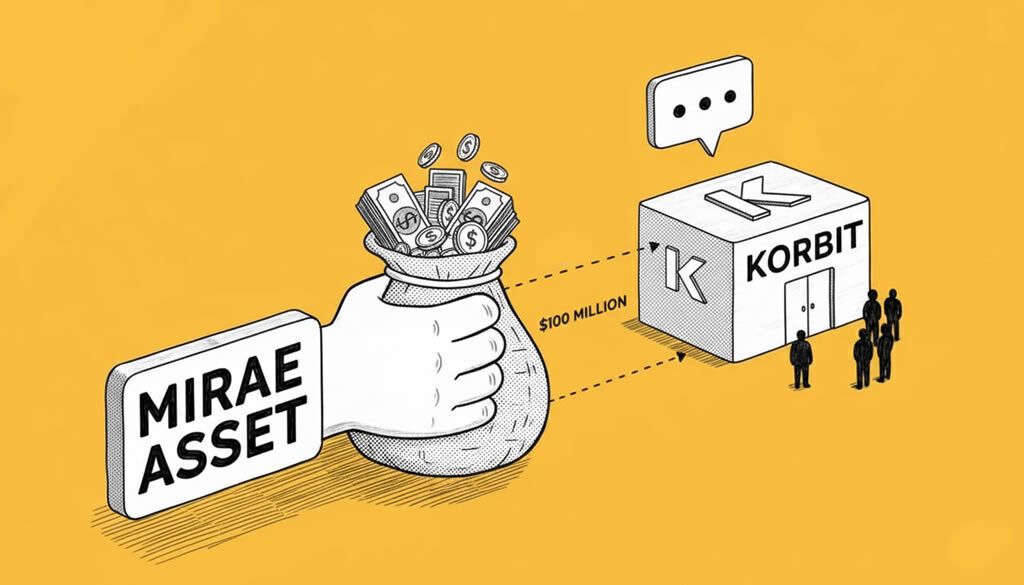

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

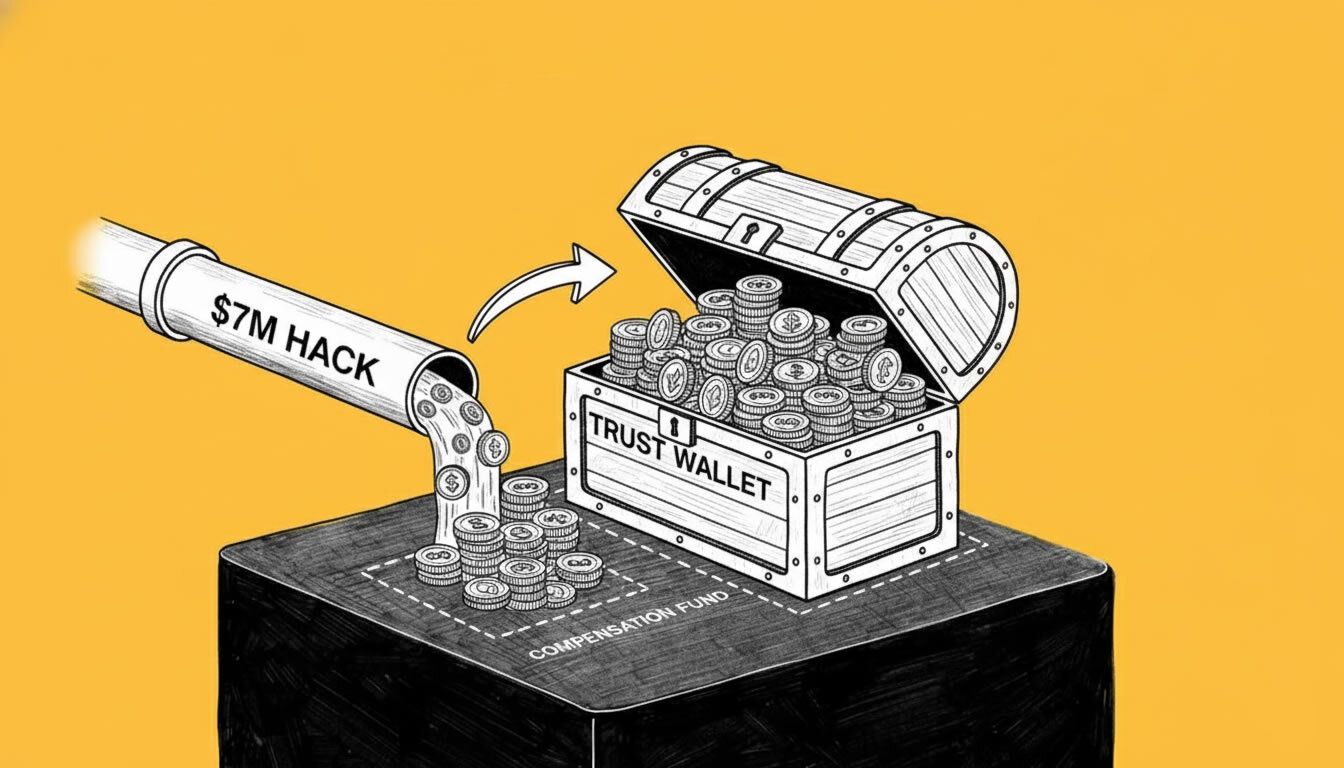

- Trust Wallet Launches Compensation Process After $7M Browser Extension Hack

- The Top Crypto Investments of 2025: A Year of Utility and Maturity

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Supercharge Your Stablecoins: Yield Yak’s Secret Weapon for Higher APYs 🔥 Yield Yak on Avalanche, is offering auto-compounding farms, a DEX aggregator, and innovative Milk Vaults powered by restaking and AI agents....

- What is $STRF? What is this investment opportunity and how it works?...

- Bitcoin Yield Finally Arrives: Yield Opportunities with Babylon Protocol Babylon Labs is creating groundbreaking yield opportunities for Bitcoin holders through native staking....