March FOMC Meeting Looms as Potential Catalyst for Crypto Market Pivot

- Interest rate expectations for the January meeting suggest a “dovish pause,” keeping the fed funds rate at 3.50%–3.75%.

- Traders are pricing in a 52% probability of a rate cut at the March 17-18 FOMC meeting, according to prediction market data.

- Bitcoin remains rangebound near $88,000, with market sentiment stuck in “Fear” territory as participants await Jerome Powell’s 2026 policy guidance.

As the Federal Reserve concludes its first policy gathering of 2026, the cryptocurrency market has entered a period of macro-driven suspense, with the upcoming March FOMC meeting emerging as the primary decider for the industry’s short-term direction. While the consensus among economists is a hold on interest rates this week, the prospect of the Fed signaling a faster rate-cutting cycle later this quarter has traders preparing for a potential return of retail-driven liquidity.

Following a volatile end to 2025 that saw Bitcoin retreat nearly 30% from its October highs, the market has struggled to reclaim its momentum. Current data suggests that liquidity conditions remain the dominant factor for digital assets. “The Fed’s interest rate decision is one of the main catalysts for the crypto space in 2026,” noted Owen Lau, managing director at Clear Street. According to Lau, both retail and institutional investors are likely to show increased appetite for risk assets if the central bank continues to ease monetary policy.

The market is currently split on the Fed’s trajectory for the remainder of the year. While the CME FedWatch Tool and platforms like Polymarket indicate only a marginal chance of a cut in January, the odds for a March reduction have climbed significantly. Analysts at TD Securities suggest that while Chair Jerome Powell may sound noncommittal in the near term, the median Fed official still favors easing this year to manage labor market softening. Such a shift would be a boon for Bitcoin, which has historically thrived in environments of expanding global liquidity.

Conversely, a more hawkish stance—driven by concerns over sticky inflation or geopolitical tariff impacts—could dampen hopes for a spring rally. A failure to signal cuts in March might lead to a prolonged period of short-term volatility and a further test of support levels near the $85,000 mark. Some institutional reports, including those from Coinbase Institutional, suggest the market is currently in a “risk-defense” mode, with investors prioritizing options hedging over aggressive leverage.

Ultimately, the crypto market’s ability to break out of its current range depends on whether the Fed prioritizes economic growth over inflation targets. If the March meeting confirms a transition back to a simultaneous easing cycle, the “four-year cycle” narrative may see a resurgence, potentially pushing digital asset valuations toward new records in the first half of 2026.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- Base Network Shifts to Unified Tech Stack in Major Departure From Optimism OP Stack

- Global Blockchain Show 2026 – Postponed to 29–30 June 2026

- Riyadh to Host Global AI Show 2026 – Postponed to 29–30 June 2026

- Ethereum’s Tokenized RWA Market Surpasses $17 Billion as Solana Records 90% Monthly Surge

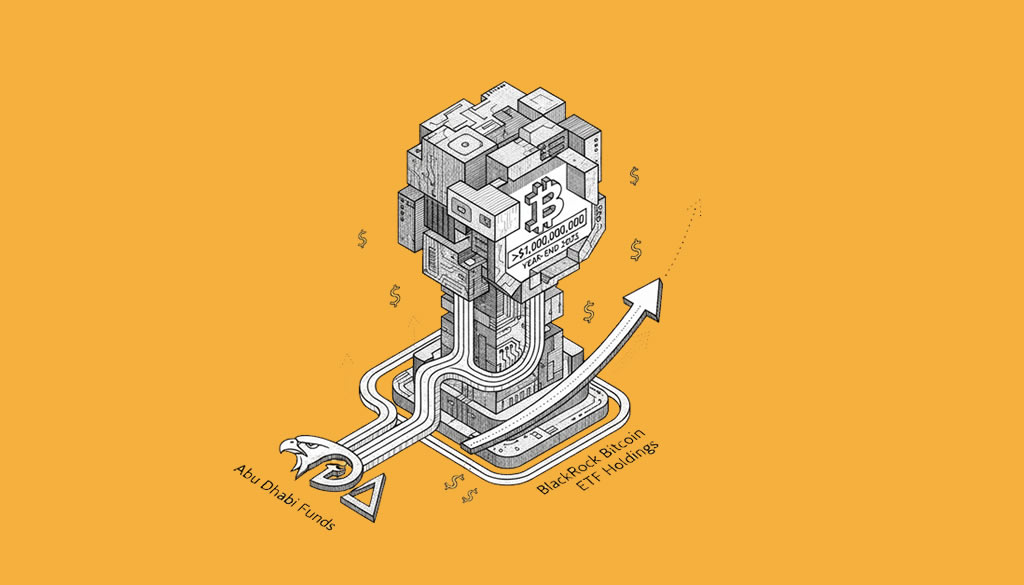

- Abu Dhabi Funds Surpass $1 Billion in BlackRock Bitcoin ETF Holdings by Year-End 2025

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Interest Rates Unchanged in the United States, Bitcoin $84k The Federal Reserve kept interest rates unchanged at 4.25%-4.5%....

- FOMC Sparks Crypto Rally: BTC and ETH Surge, Altcoins Follow Suit Crypto Market Reacts to FOMC’s May 2025 Rate Decision....

- Crypto portfolios of top analysts and influencers in June 2025 The portfolios of prominent crypto analysts and influencers play a key role in shaping public sentiment and investment decisions. (This is not financial advice.)...