Leveraged Ether ETFs Launch in the U.S.: A Deep Dive into the Impact and Implications

- Volatility Shares launches the first 2x leveraged Ether ETF in the U.S. on June 4, 2024.

- ProShares set to debut the ProShares Ultra Ether ETF (ETHT) and ProShares UltraShort Ether ETF (ETHD) on June 7, offering long and short exposure to Ether at 2x leverage.

- The launch of leveraged Ether ETFs indicates a growing appetite for crypto-lined ETFs among U.S. regulators.

- These products provide investors with new opportunities to amplify their exposure to Ether’s price movements.

Leveraged Ether ETFs Enter the Market: A Game-Changer for Crypto Investors?

The cryptocurrency investment landscape has seen a significant development with the launch of the first 2x leveraged Ether ETF in the U.S. Volatility Shares’ 2x Ether ETF (ETHU) started trading on June 4, 2024, marking a milestone in the evolving relationship between cryptocurrency investments and regulatory frameworks.

“the launch of a 2x Ether ETF would certainly indicate the SEC’s growing appetite for further crypto-lined ETFs.”

Stuart Barton

This launch comes nearly a year after the Volatility Shares 2x Bitcoin fund began operations in June 2023, following a long regulatory process. The approval and launch of the Volatility Shares 2x Ether ETF signify a positive trend in regulatory attitudes towards crypto ETFs.

According to Stuart Barton, Chief Investment Officer at Volatility Shares, “the launch of a 2x Ether ETF would certainly indicate the SEC’s growing appetite for further crypto-lined ETFs.“

ProShares is set to debut two leveraged ETFs investing in Ether derivatives on June 7:

- ProShares Ultra Ether ETF (ETHT): Offers investors long exposure to Ether at 2x leverage.

- ProShares UltraShort Ether ETF (ETHD): Provides short exposure to Ether at 2x leverage.

ETHD will comprise the first 2x short ETF to launch in the United States, addressing the challenge of acquiring leveraged or short exposure to Ether, which can be onerous and expensive.

The introduction of these leveraged Ether ETFs opens new opportunities for investors seeking amplified exposure to Ether’s price movements. As the first leveraged Ether ETF in the U.S., it sets the stage for further innovation and growth in the cryptocurrency investment space.

The approval and launch of these leveraged Ether ETFs suggest a positive trend in regulatory attitudes towards crypto ETFs, paving the way for the approval of spot Ether ETFs in the future. As the regulatory environment develops, more investment products will likely emerge, giving investors new opportunities to diversify and participate in the cryptocurrency market’s growth.

In summary, the launch of the Volatility Shares 2x Ether ETF on June 4 and the upcoming debut of ProShares’ leveraged Ether ETFs on June 7 are significant steps for crypto investments. These moves could lead to the approval of spot Ether ETFs, integrating digital assets further into mainstream finance.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

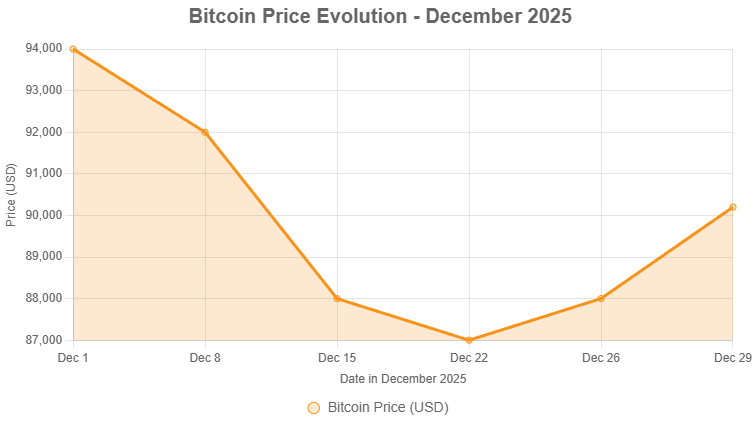

- Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

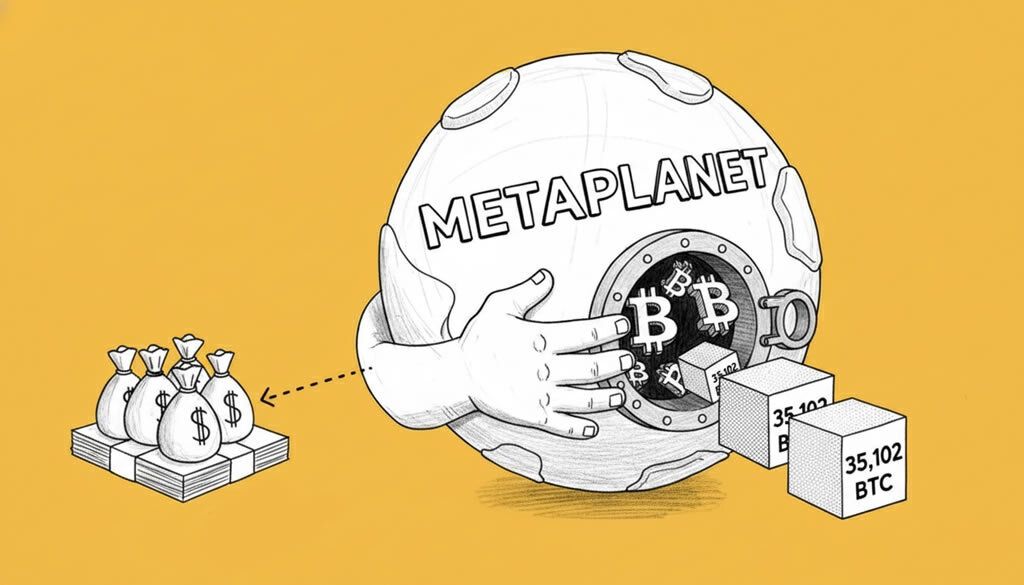

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Crypto Weekly Snapshot – End-of-Year Consolidation

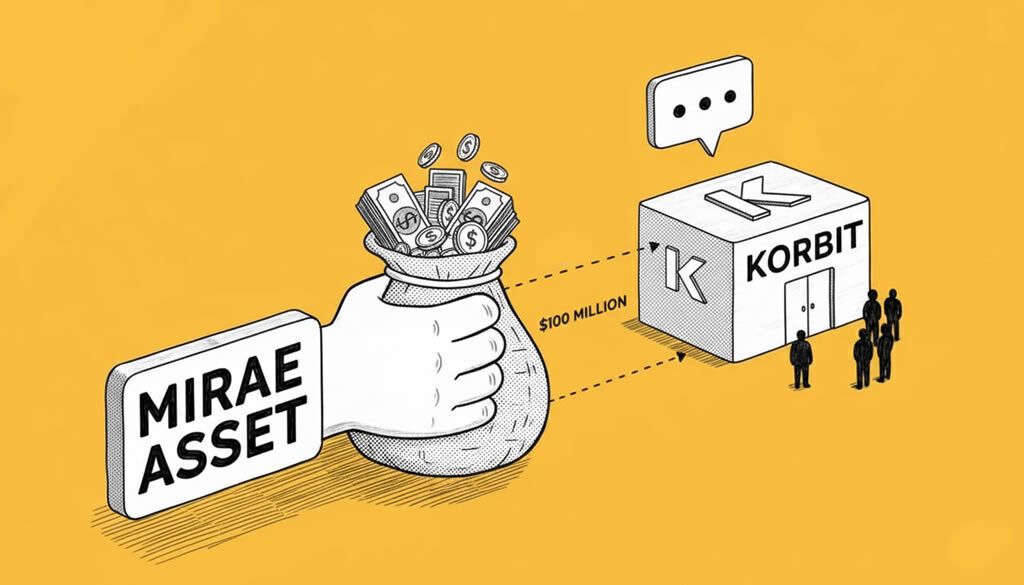

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

Related

- ProShares Launches First ETF to Target 2x Daily Bitcoin Returns Today, ProShares, a premier provider of ETFs, is launching ProShares Ultra Bitcoin ETF (BITU), the first ETF to target 2x daily bitcoin returns....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Ethereum ETFs Set to Launch in June, Boosting Crypto Market Outlook Ethereum ETFs receive SEC approval, paving the way for potential June launch....

- Ethereum ETF Approval: Impact, Controversy, and the Road Ahead The U.S. SEC approved the launch of Ethereum ETFs, marking a significant milestone in the cryptocurrency world. Ethereum loyalists believe the ETF news isn't fully priced in, suggesting potential for further growth....