Kraken’s SEC Lawsuit to Proceed to Trial

- The SEC’s lawsuit against Kraken will proceed to trial, focusing on securities law violations.

- The judge ruled that while the cryptocurrencies on Kraken are not securities, the transactions might be.

- This case parallels SEC actions against Binance and Coinbase, signaling broader regulatory scrutiny.

The SEC’s Legal Battle with Kraken: A Deep Dive into Crypto Regulation

The world of cryptocurrency has once again found itself at the intersection of innovation and regulation, with the U.S. Securities and Exchange Commission (SEC) setting its sights on Kraken, a prominent crypto exchange. A California judge made a pivotal decision: the SEC’s lawsuit against Kraken for allegedly violating securities laws will proceed to trial.

The Ruling and Its Implications

The judge’s decision was nuanced. While he agreed with Kraken that the cryptocurrencies listed on its platform do not inherently qualify as securities, he also sided with the SEC’s argument that certain transactions facilitated by Kraken could be considered investment contracts, thereby falling under securities laws. This distinction is crucial. It suggests that the nature of transactions, rather than the cryptocurrencies themselves, might be the battleground for defining what constitutes a security in the crypto space.

Why This Matters for Crypto Exchanges

This case isn’t isolated. The SEC has been actively pursuing legal actions against other major exchanges like Binance and Coinbase, indicating a broader regulatory crackdown. Here’s what this means:

- Regulatory Clarity or Overreach? The outcome of this trial could set a precedent for how cryptocurrencies are regulated. If the SEC wins, it might push exchanges towards more stringent compliance measures, potentially stifling innovation or pushing operations offshore.

- Market Impact: Investors are watching closely. A ruling against Kraken could lead to market volatility as investors might see this as a sign of increased regulatory risk.

- Innovation vs. Regulation: The crypto community often debates the balance between regulatory oversight and the freedom to innovate. This case could define where that line is drawn.

Public Sentiment and Industry Reaction

Kraken pays fine, case closed.

— MUMU THE BULL (@mumu_bull) August 27, 2024

Next

Looking Ahead

As we await the trial, several questions loom:

- Will this case lead to clearer guidelines on what constitutes a security in crypto transactions?

- How will other exchanges adapt if Kraken faces severe penalties or operational restrictions?

- Could this push for more decentralized exchanges or offshore operations?

The trial’s outcome will undoubtedly shape the future of cryptocurrency exchanges in the U.S., potentially affecting global crypto markets. For now, the crypto community watches, waits, and debates, with Kraken’s legal battle serving as a litmus test for the industry’s regulatory future.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

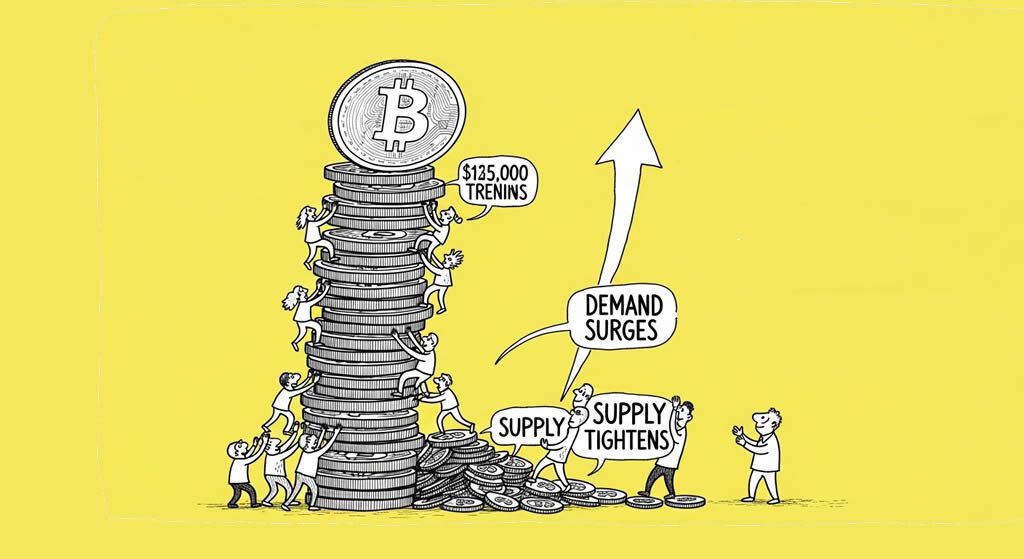

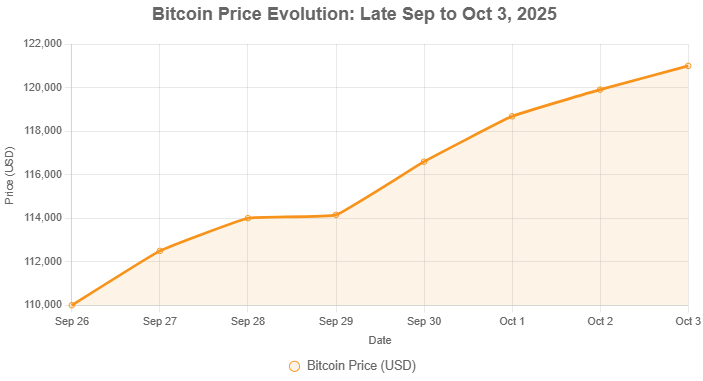

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- SEC Amends Binance Lawsuit, Drops Security Claims for Solana and Other Cryptocurrencies Recent court order and discussions between the SEC and Binance regarding the classification of these cryptocurrencies as securities....

- XRP climbs 12% following Ripple’s SEC win Ripple has won a fresh round in its long-running legal fight against the U.S. SEC....

- Blockchain Security Firm CertiK Returns $3 Million to Kraken After Exploiting Vulnerability CertiK has returned nearly $3 million to cryptocurrency exchange Kraken after exploiting a critical vulnerability in Kraken's system....

- Crypto Today: Bitcoin and Ethereum rise, XRP wins legal battle, FTX founder on trial Crypto Today: Bitcoin and Ethereum rise, XRP wins legal battle, FTX founder on trial....