JPMorgan Resets Bitcoin Miner Ratings

- JPMorgan upgrades Cipher Mining and CleanSpark to overweight, citing superior hash rate growth and cost efficiency in the evolving bitcoin mining landscape.

- Price targets trimmed for MARA and Riot Platforms, reflecting concerns over higher energy costs and potential post-halving pressures on profitability.

- Broader reset signals caution for the sector as bitcoin prices stabilize, with analysts forecasting varied performance among miners through 2026.

New York – In a comprehensive recalibration of the bitcoin mining sector, JPMorgan Chase analysts on Monday issued upgraded ratings for Cipher Mining (CIFR) and CleanSpark (CLSK), while modestly reducing price targets for Marathon Digital Holdings (MARA) and Riot Platforms (RIOT).

The moves come as the industry navigates lingering effects from April’s bitcoin halving, which halved mining rewards and intensified competition for low-cost energy. Cipher and CleanSpark were elevated to overweight from neutral, with JPMorgan highlighting their aggressive expansion plans and operational efficiencies. “Cipher’s focus on high-performance immersion cooling and CleanSpark’s renewable energy commitments position them favorably for sustained margins,” the report stated, setting new price targets at $8 for CIFR (up from $5) and $25 for CLSK (up from $18).

Conversely, MARA and RIOT saw their targets trimmed to $24 and $15, respectively, down from $28 and $18. Analysts pointed to elevated debt levels and exposure to volatile power markets as key risks. “While both remain leaders in hash rate capacity, near-term cash flow pressures could weigh on valuations,” noted JPMorgan’s Joseph Moore in the note.

The sector as a whole has faced headwinds since bitcoin’s rally cooled in late 2025, with miners’ stocks down an average of 15% year-to-date. Community sentiment on platforms like X reflects cautious optimism, with traders praising Cipher’s recent 20 EH/s milestone but warning of regulatory scrutiny on energy use. One analyst from Galaxy Digital echoed the report, telling CoinDesk that “diversification into AI compute could be a lifeline for underperformers like MARA.”

Bitcoin traded flat around $92,000 on Monday, underscoring the miners’ sensitivity to crypto’s price swings. Investors are watching for Q4 earnings to gauge adaptation to thinner rewards, with JPMorgan forecasting a 10-15% hash rate growth across the board in 2026.

This reset underscores a maturing sector, where efficiency trumps scale. As Moore concluded, “The winners will be those who mine smarter, not harder.”

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

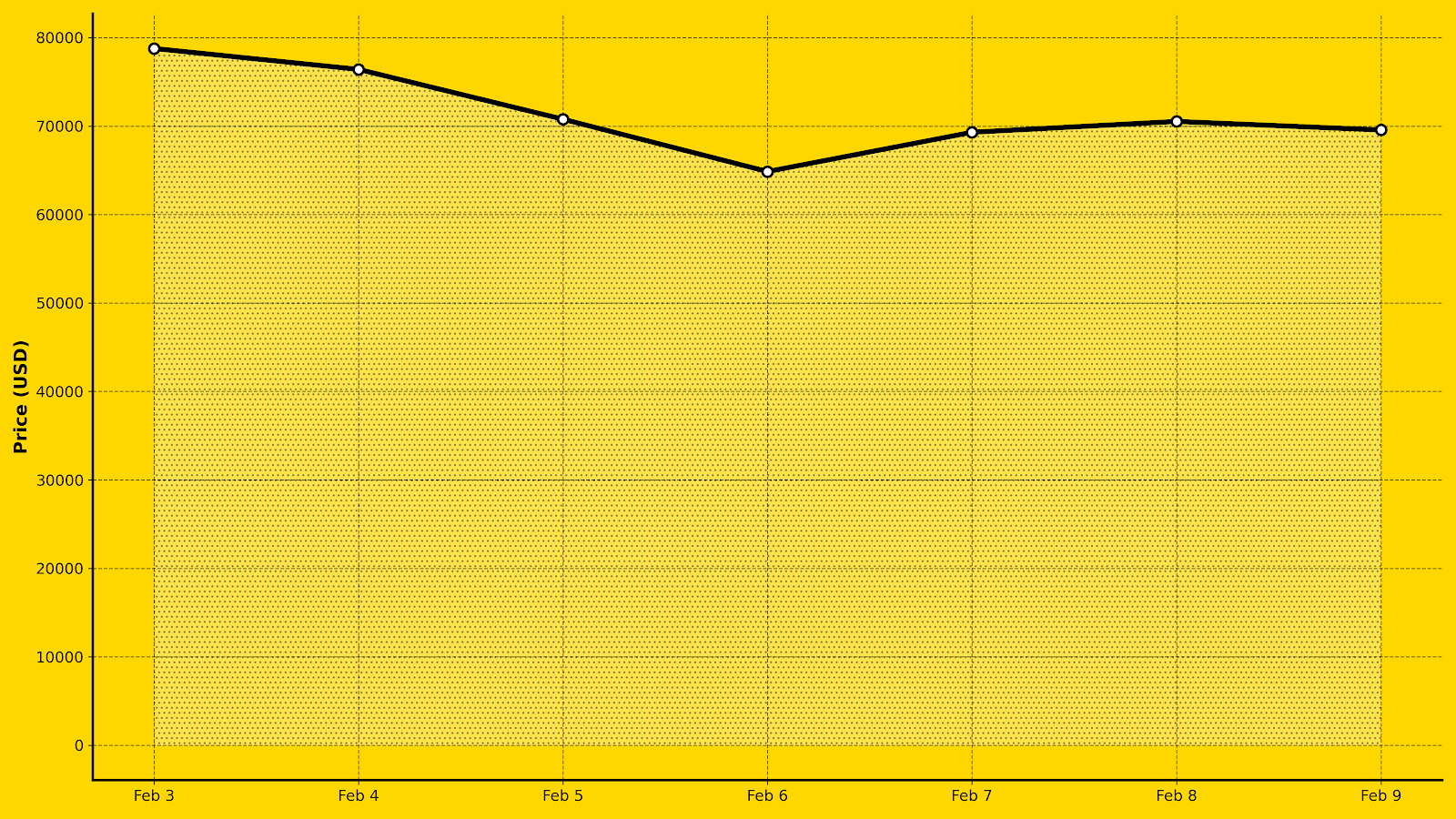

- Bitcoin Whales Accumulate as Institutional Sentiment Remains Fragmented Near $69,000

- Bitcoin ETFs Record $145 Million Monday Inflows as Market Signals Potential Inflection Point

- South Korea Intensifies Probe into Bithumb After $43 Billion Bitcoin Fat-Finger Fiasco

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Bitcoin Miners Hit $22.8B High Amidst Industry Challengers U.S.-listed Bitcoin miners have achieved a record total market capitalization of $22.8 billion as of June 15, 2024, according to a recent report by JPMorgan....

- Where is Trump’s Promise to be the Crypto Mining Powerhouse? Supply chains for Bitcoin mining, concentrated in Asia, face disruptions....

- How to Earn Extra Money with Cloud Mining from Your Home Cloud mining is a method of using distant servers to mine cryptocurrencies without needing or managing any hardware....