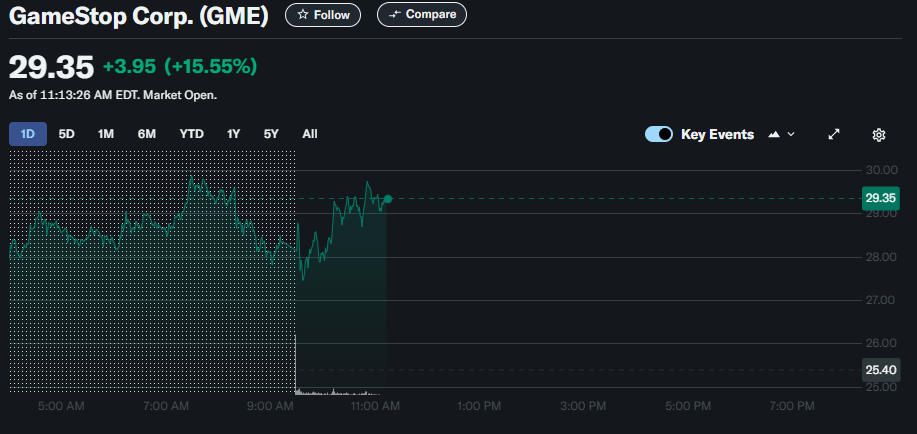

- GameStop’s stock likely jumped about 13% after announcing a Bitcoin investment strategy.

- With shares opening at $28.84 on March 26, 2025, from a close of $25.40 the previous day.

- The company plans to invest part of its $4.8 billion cash reserve in Bitcoin and stablecoins, following Strategy’s model.

- This move seems aimed at diversifying assets and attracting retail investors, given Bitcoin’s current price around $87,000.

- Research suggests this could boost demand for Bitcoin, though the impact may vary based on market reactions.

GameStop Corp. (GME) made headlines with a significant stock price movement following an announcement to invest in Bitcoin. This decision, revealed after market close on March 25, 2025, has sparked discussions about corporate strategies in decentralized finance and their implications for both stock and cryptocurrency markets.

Stock Price Movement and Announcement Details

GameStop’s stock closed at $25.40 on March 25, 2025, and opened at $28.84 on March 26, 2025, reflecting a 13.54% increase from close to open. By the end of March 26, the stock closed at $29.41, indicating a total jump of about 15.79% from the previous day’s close.

This movement was triggered by the company’s board approving the addition of Bitcoin to its treasury reserve, with plans to invest a portion of its $4.8 billion cash or future debt and equity issuances in Bitcoin and stablecoins, without setting a maximum purchase limit.

The announcement, made after market close on March 25, was detailed in various reports, such as CNBC, which noted a 14% jump, though historical data from Yahoo Finance for GME supports the 13.54% figure from close to open.

Corporate Strategy and Motivation

GameStop, under CEO Ryan Cohen, has been grappling with declining sales in its brick-and-mortar video game retail business, driven by the shift to digital distribution. The company’s strategy, as outlined in reports like Investopedia, includes cost-cutting and exploring new revenue streams.

Investing in Bitcoin, following the model of Strategy (formerly MicroStrategy), is seen as a diversification move to generate returns from the volatile but potentially lucrative cryptocurrency market.

With a cash pile of $4.8 billion, GameStop’s decision to allocate funds to Bitcoin could serve multiple purposes: as a hedge against inflation, a store of value, and a way to attract retail investors familiar with both GameStop’s meme stock history and cryptocurrency trends.

Reports suggest CEO Ryan Cohen’s meeting with Strategy’s co-founder Michael Saylor, may have influenced this strategy, given Strategy’s success with Bitcoin investments.

Bitcoin Market Context and Potential Impact

As of March 26, 2025, Bitcoin’s price stands at approximately $87,000, with a 24-hour trading volume of $28.40 billion, according to Coinbase. This valuation, up 4.96% in the past week, underscores Bitcoin’s recent performance, making it an attractive asset for corporate investment. If GameStop invests, say, $1 billion at this price, it could purchase around 11,494 BTC, a significant amount given Bitcoin’s market cap of $1.75 trillion.

The broader impact could be psychological, encouraging other firms to follow suit, potentially increasing institutional demand. This aligns with trends seen in Strategy, which holds billions in Bitcoin, transforming from a software stock to a crypto holding vehicle. Such moves could bolster Bitcoin’s legitimacy as a corporate asset, though volatility remains a concern, with prices fluctuating significantly.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Market Analysis: Bitcoin, Ether, and Tariff Impacts

- Renova (RVA) Completes 90% of Its Presale at a Price of $0.008 and Announces Upcoming Listing at $0.06 on Platforms such as KuCoin, Huobi, LBank, Kraken, and Bybit

- US Commerce Department Publishes GDP Data on Nine Blockchains in Proof-of-Concept

- The 2nd Edition of the CoinFerenceX Decentralized Web3 Summit: Builders, Investors, and Developers Meet Again to Shape The Web Space

- Google Cloud Unveils Universal Ledger: A Neutral Layer-1 Blockchain for Financial Institutions

Related

- What is $STRF? What is this investment opportunity and how it works?...

- MicroStrategy Announces Second Quarter 2021 Financial Results July 29, 2021 04:01 PM Eastern Daylight Time TYSONS CORNER, Va.–(BUSINESS WIRE)–MicroStrategy® (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced financial results for the three-month period ended June 30, 2021 (the second quarter of its 2021 fiscal year)....

- Bitcoin Cash Vs. Bitcoin: What is the difference? Does Bitcoin cash have advantages over Bitcoin? If you’re new to the crypto world, you might not even know what Bitcoin Cash is. Basically, Bitcoin Cash (BCH) is a cryptocurrency branch created from the original Bitcoin currency. It came into...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....