Franklin Templeton Debuts Spot XRP ETF

- Franklin Templeton’s XRP ETF (XRPZ) launched on NYSE Arca, tracking the CME CF XRP-Dollar Reference Rate.

- XRP price jumped up to 9% following the debut.

- The move adds to recent launches from Grayscale, Bitwise, and Canary Capital, signaling broader altcoin ETF adoption.

Franklin Templeton, a major asset manager with over $1.6 trillion under management, has expanded its digital asset portfolio by launching a spot exchange-traded fund for XRP, providing regulated access to the cryptocurrency for traditional investors.

The Franklin XRP ETF, ticker XRPZ, began trading on the NYSE Arca on November 24, 2025. It is designed to reflect the performance of XRP, minus fees, using the New York variant of the CME CF XRP-Dollar Reference Rate as its benchmark. Coinbase Custody handles the safekeeping of the underlying assets, ensuring secure and compliant operations.

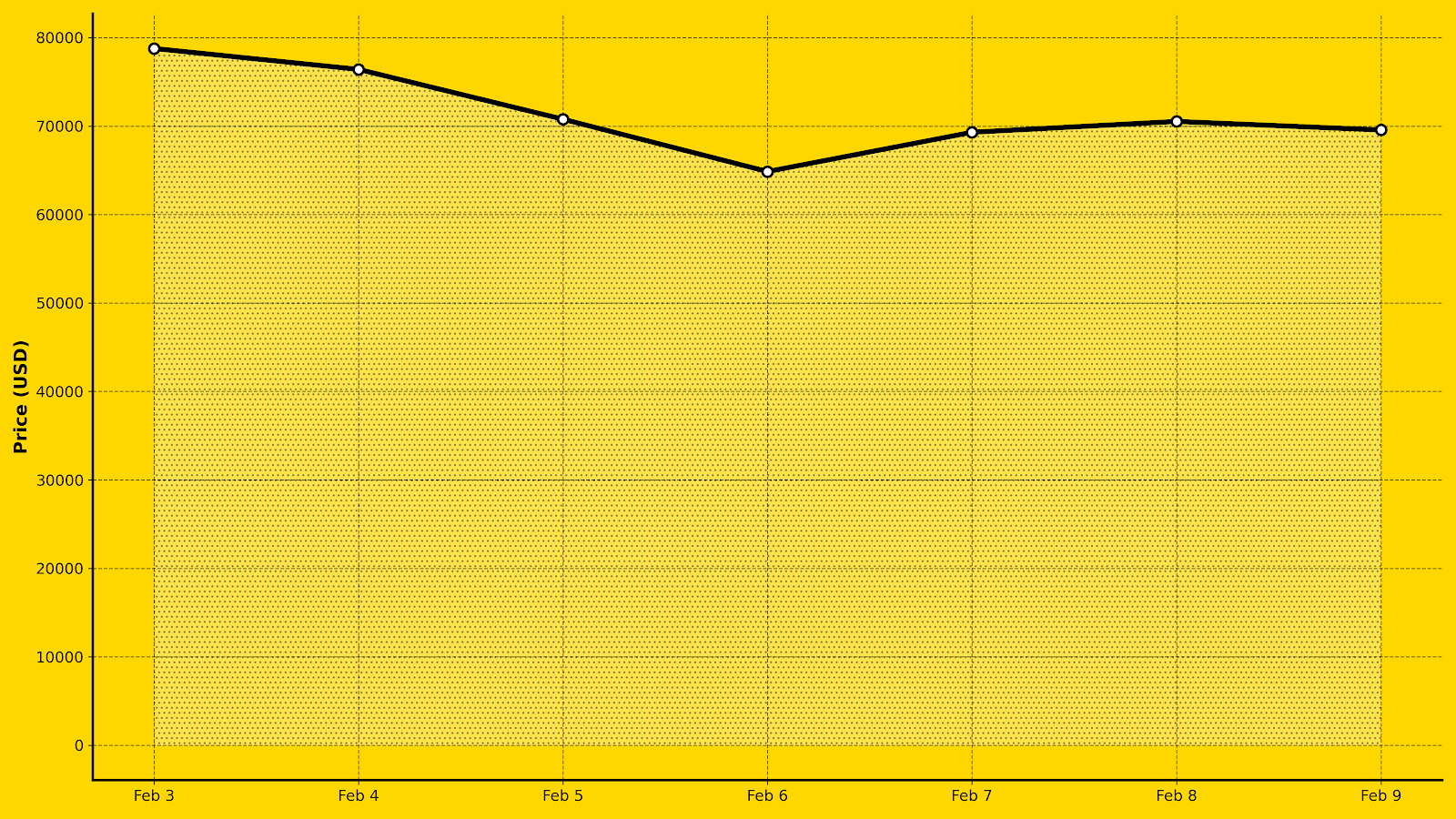

XRP responded with a notable price increase, rising as much as 9% in the 24 hours post-launch to trade around $2.24, according to CoinGecko data. This uptick reverses short-term losses, with XRP gaining 5.2% over the week despite a 13% monthly decline.

📈 Altcoins Rally Led by PayFi

— Cryptopress (@CryptoPress_ok) November 25, 2025

PayFi tokens surge 9% while XRP jumps 11% and Ethereum breaks $2,900 in a positive market shift.

“Blockchain innovation is driving fast-growing businesses, and digital asset tokens like XRP serve as powerful incentive mechanisms that help bootstrap decentralized networks and align stakeholder interests,” said Roger Bayston, head of digital assets at Franklin Templeton. (CoinDesk)

The ETF allows investors to gain exposure to XRP through standard brokerage accounts, offering daily transparency, liquidity, and SEC oversight without the need for direct token management. This structure addresses operational complexities and security concerns associated with holding cryptocurrencies.

This launch is part of an accelerating trend in altcoin ETFs, following Grayscale’s uplisting of its XRP trust to a spot ETF (GXRP) on the same day. Bitwise and Canary Capital have also recently introduced XRP funds, building on the momentum from spot Bitcoin and Ether ETFs.

Altcoin ETF Inflows

Figures represent net inflows where available; note that XRP ETFs are nascent (launched mid-November), so early data is preliminary and trading volume-heavy.

| ETF Ticker | Asset | Launch Date | Cumulative Net Inflows (USD) | Notable Highlight |

|---|---|---|---|---|

| Various (e.g., ETHA) | Ethereum (ETH) | January 2025 (spot ETFs) | $4 billion (Q3 2025) | 77% of Q3 crypto ETF inflows; BlackRock’s ETHA saw $266M single-day peak. |

| SSK (Solana REX-Osprey) | Solana (SOL) | July 2025 | $78 million (past month as of July) | Led altcoin category with $476M total across 6 SOL funds since October. |

| XRPC (Canary Capital) | XRP | November 13, 2025 | $250 million (day-one inflows) | Record 2025 ETF debut volume ($58M trading); total XRP ETFs at $422M since launch. |

| XRP (Bitwise) | XRP | November 20, 2025 | $118 million (first week) | Fee waiver on first $500M; part of $180M XRP ETF surge post-Franklin/Grayscale debuts. |

| Various (e.g., BSOL) | Solana (SOL) | October 2025 | $10–20 billion projected (mid-2026) | Bitwise’s BSOL hit $57M day-one; institutional rotation amid BTC outflows. |

While the influx of institutional products could enhance XRP’s liquidity and adoption in cross-border payments, analysts caution about risks. Market volatility, potential regulatory shifts, and broader crypto sentiment could impact performance. As one expert noted, “The ETF structure mitigates some risks but doesn’t eliminate market exposure.”

For additional context, see CryptoPress insights on XRP and Bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Whales Accumulate as Institutional Sentiment Remains Fragmented Near $69,000

- Bitcoin ETFs Record $145 Million Monday Inflows as Market Signals Potential Inflection Point

- South Korea Intensifies Probe into Bithumb After $43 Billion Bitcoin Fat-Finger Fiasco

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- WiseCryptoNews Portal Launches While Polymarket Puts XRP ETF Approval Odds at 79% XRP ETF approval odds rise to 79% on Polymarket as Ripple wins legal relief and investors eye SEC's next moves on pending ETF applications....

- Crypto ETFs 2024: SEC’s Decisions on Solana, XRP, Litecoin, and More The SEC has been flooded with applications for altcoin ETFs, with major players....

- 21Shares Files for Spot Dogecoin ETF 21Shares Files for Spot Dogecoin ETF, Aims to Bring Meme Coin to Mainstream Investors....