Finding The Best Crypto To Buy Now: $TAP, $BFX, or $BDAG

Choosing the best crypto to buy now only makes sense when a project ships real utility and the token captures part of that usage. Digitap is a fiat-crypto money app with an official iOS and Android beta live, and the $TAP crypto presale is currently running, giving buyers a clear entry before listings, hence the focus on TAP versus more speculative profiles.

For anyone comparing crypto bank options, Digitap brings crypto and fiat into one place, with physical or virtual cards, Apple Pay, and Google Pay tap-to-pay, fast on and off-ramps, and remittances to more than 180 countries. The iOS and Android beta is live, giving TAP a concrete user path today.

Digitap: Crypto-Fiat Utility You Can Use

Digitap is an omnibank. A single application to hold, send, convert, and spend money in crypto and fiat, with virtual and physical cards integrated with tap-to-pay and acceptance at more than 100 million merchants. The idea is to let users pay in the physical world and move balances across accounts, wallets, and banks with minimal friction.

The app is listed on the App Store, the core is already functional on both desktop and mobile, and it supports cards and day-to-day operations. These points suggest a product in early production with ongoing iteration.

From a token perspective, $TAP is an ERC-20 deployed on Ethereum, hard-capped at 2 billion tokens; trading is tax-free (no buy or sell fees), and the economics are structured to be deflationary via programmed burns. There are incentives as well.

The staking module indicates up to 124% APR during the presale phase and up to 100% post-launch, with rewards coming from a pre-allocated pool (no extra inflation) and penalties that burn part of the rewards in case of early exit. It is a design that combines retention with programmed scarcity. $TAP Cashback Rewards aligns the token with the app’s transactional benefits.

BlockchainFX: Multi-Asset Exchange Ambition

BlockchainFX is a multi-asset trading platform, offering crypto, stocks, forex, and ETFs, with a utility token ($BFX) tied to early access, rewards, and ecosystem benefits. The team states that 70% of trading fees would be redistributed to the community, linking business performance to the token, partly through staking pools and rewards, and partly via buybacks with token burns.

The multi-asset pitch brings both opportunity and friction. On one hand, an app that aggregates multiple asset classes can reduce switching costs across platforms and expand network effects if the experience is strong. On the other hand, different regulatory and operational requirements arise for securities, FX, and crypto, such as licensing, custody, client segregation, and market data origination.

BlockDAG: L1 PoW And DAG Narrative

BlockDAG outlines a Layer-1 that pairs Proof-of-Work security with a DAG-style block graph: miners can produce blocks in parallel, and the protocol later orders those blocks into a single canonical history. The goal is to increase throughput and shorten confirmation times while retaining PoW’s security. The maximum supply is 150 billion BDAG, with allocation to miners (50%), presale (33.3%), community (12.7%), liquidity (3%), and team (1%).

The architecture promises interoperability between a Bitcoin-style ledger and the EVM via a 1:1 bridge of the native asset, preserving security and avoiding double-spending when moving value between the two domains. It is an interesting design for those who want EVM contracts without giving up UTXO-like components. However, the utility of this bridge depends on implementation and dApp adoption.

Quick Comparison: Digitap vs BlockchainFX vs BlockDAG

$TAP

- Core proposition: crypto-fiat app with cards, on and off-ramp, and tap-to-pay.

- Expected stage: presale live; iOS and Android beta in operation.

- Value driver: recurring usage and token utilities.

- Portfolio profile: utility focus; moderate weight with quarterly reviews.

$BFX

- Core proposition: multi-asset exchange with fee distribution to the token.

- Expected stage: in development with promised modules.

- Value driver: trading volume, rewards policy, and buybacks.

- Risks: multi-asset regulatory requirements, licenses, custody, security, technical execution.

- Portfolio profile: bet on regulatory delivery; conservative size until confirmations.

$BDAG

- Core proposition: L1 combining PoW with DAG ordering.

- Expected stage: testnet moving toward a functional network.

- Value driver: transition to mainnet with active mining and dapps; tokenomics design.

- Risks: UTXO–EVM bridge, need for sustained hashrate, unlock schedule.

- Portfolio profile: higher tech beta; tactical position re-evaluated by milestones.

Final Thoughts

Choosing a crypto to buy now makes sense when there is provable delivery or a clear delivery path. $BFX offers upside conditioned on regulatory execution and real activation of multi-asset markets. $BDAG combines a technical thesis of PoW and DAG with the risk of transitioning from presale to a productive network.

$TAP, however, leans on everyday usage such as payments and conversions, and can serve as a utility pillar. For that reason, it sits at the top of the list as the best crypto to buy now.

Project Links:

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

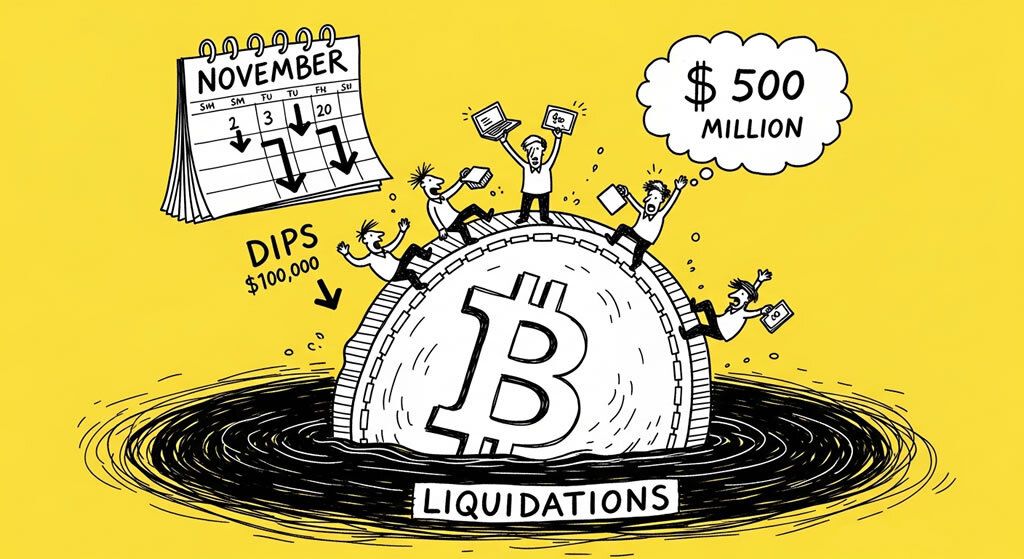

- Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows

- Strategy Buys Bitcoin Every Day This Week Amid Dip, Saylor Denies Sale Rumors

- What is the Revenue Meta in Crypto?

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

Related

- X Payments Enters Limited Beta, Sparking Crypto Speculation Elon Musk’s X Money Beta Launches with Crypto Speculation....

- What is a Crypto Card and How Does it Work? Crypto Cards Are Turning Digital Assets into Everyday Currency....

- Best Altcoins to Buy Now: BlockDAG Leads DOGE, ETH, and SOL Discover the best altcoins to buy now. Explore BlockDAG’s 1,566% ROI presale, DOGE’s meme power, ETH’s stability, and SOL’s fast-growing ecosystem....

- Top Tap-to-Earn Games What exactly are these games? How do they work? And which ones should you be playing?...