Ethereum Daily Transactions Surge to All-Time High as Gas Fees Fall to Record Lows

Ethereum’s seven-day moving average for daily transactions approaches 2.5 million, nearly double last year’s levels, while average gas fees drop to $0.15 — the lowest in recent network history — following key protocol upgrades and rising stablecoin adoption.

– Ethereum transaction volume hits record levels with the 7-day moving average nearing 2.5 million, almost double from one year ago.

– Gas fees plummet to an average of $0.15 per The Block data, with Etherscan showing even lower estimates around $0.04 for swaps.

– Recent Fusaka upgrade and doubled gas limit drive efficiency, shifting execution to Layer 2 while boosting mainnet activity amid stablecoin surge.

Ethereum is processing more transactions than ever before while costing users less than at any point in the network’s recent history, marking a significant milestone for the blockchain.

The seven-day moving average of daily transactions on Ethereum is nearing 2.5 million — a record high that’s nearly double its value from one year ago — according to The Block’s data. This surge in activity began accelerating in mid-December, reversing a prior slowdown observed since mid-2025.

At the same time, average gas fees have fallen sharply to $0.15 based on The Block’s metrics, representing the lowest levels in the network’s recent history. Etherscan data indicates even lower costs, with estimated fees averaging around $0.04 for a typical swap on recent days. This unusual combination of peak throughput and minimal costs addresses long-standing criticisms of Ethereum’s high and unpredictable fees during congestion periods.

The improvements stem largely from Ethereum’s December 2025 Fusaka hard fork, which introduced PeerDAS (Peer Data Availability Sampling) and initiated a new twice-yearly upgrade cadence. Additionally, the network’s block gas limit was increased from 45 million to 60 million in late November — a 100% rise from the start of 2025 — enhancing mainnet capacity without proportional fee spikes.

As more execution shifts to Layer 2 networks, demand for mainnet blockspace has eased even as overall ecosystem activity climbs. The transaction spike also aligns with record stablecoin usage, which now accounts for roughly 35% to 40% of all Ethereum transactions, per recent industry observations.

This development highlights Ethereum’s progress toward scalable financial infrastructure, where Layer 2 solutions handle high-volume execution while mainnet provides secure settlement. While lower fees reduce ETH burn via EIP-1559, potentially easing deflationary pressure, they make the network more accessible for retail users, developers, and institutional applications.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- Venice AI Valuation Surges Past $600 Million Following OpenClaw Integration

- BTC and ETH Spot ETFs Snap Five-Week Outflow Streak with $1B Inflows

- Iranian Crypto Outflows Surge 700% Following US-Israeli Airstrikes

- Crypto Weekly Snapshot – Crypto Amid War Risks, Fund Flows Signal Rebound

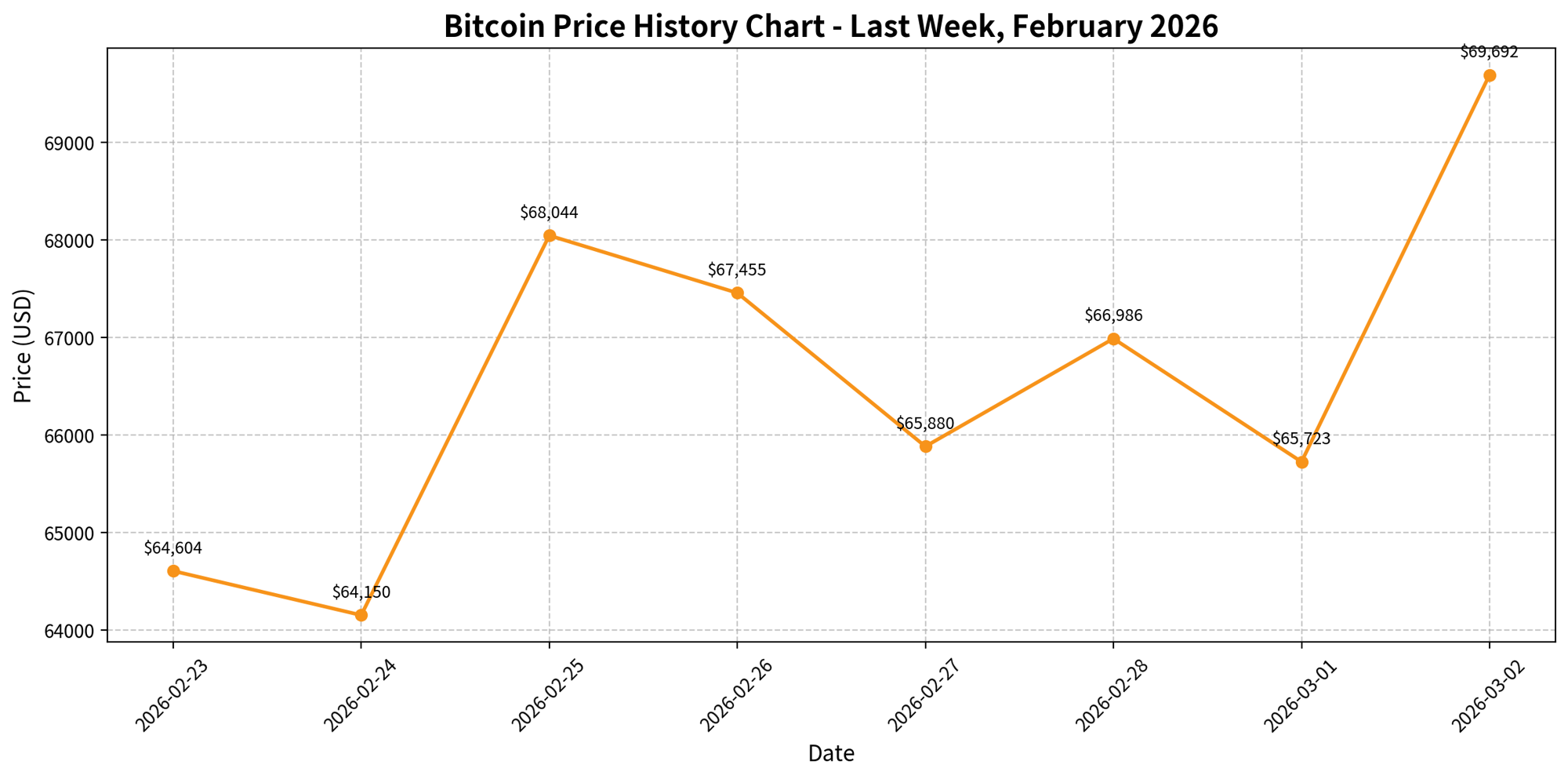

- Bitcoin Rebounds Above $68,000 Amid Iran Conflict After Initial Sell-Off

Related

- Plasma: The Blockchain Challenging DeFi’s Stablecoin Status Quo Plasma aims to offer zero-fee USDT transactions and lightning-fast settlement by leveraging Bitcoin's security and an EVM-compatible environment....

- Will Ethereum’s Dencun upgrade lower ETH fees? The Dencun upgrade on Ethereum will greatly affect transaction fees, especially for layer-2 networks....

- Top 10 Best Staking Coins for Passive Income in 2026 Discover the best staking coins for 2026 passive income. Compare crypto staking rewards, APY rates & top coins for earning cryptocurrency yields....

- Berachain (BERA): A Deep Dive into the Proof-of-Liquidity Blockchain Revolution Berachain Explained: EVM-Identical Chain, Tri-Token Model, and Governance Innovation....