Cynthia Lummis Proposes Bitcoin Reserve to Fortify Dollar and Boost National Economy

- Senator Cynthia Lummis proposes a Bitcoin reserve bill to strengthen the U.S. dollar and secure the nation’s financial future.

- The bill aims to establish a strategic reserve of 1 million BTC, approximately 5% of the total Bitcoin supply.

- The initiative would begin by transferring the 210,000 BTC already held by the U.S. government into a Treasury-managed reserve.

- The Bitcoin reserve will be held for at least 20 years and used only to reduce the country’s national debt.

Senator Cynthia Lummis of Wyoming has introduced a bill to establish a Bitcoin reserve for the United States. This strategic reserve aims to fortify the U.S. dollar against rising inflation and cement the nation’s leadership in the rapidly evolving global financial system.

The U.S. already has reserves in assets such as gold and petroleum, Lummis said in a statement on July 27.

“Establishing a strategic Bitcoin reserve to bolster the U.S. dollar with a digital hard asset will secure our nation’s standing as the global financial leader for decades to come,” Lummis said.

The draft bill includes language around adjustments made to gold certificates.

“Within 6 months of the date of enactment of this section, the Federal reserve banks shall tender all outstanding gold certificates in their custody to the Secretary,” the draft bill read. “Within 90 days of the tender of the last such certificate, the Secretary shall issue new gold certificates to the Federal reserve banks that reflect the fair market value price of the gold held against such certificates by the Treasury, as of the date specified by the Secretary on each certificate.”

This is the solution.

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

The bill proposes the acquisition of 1 million BTC, which is approximately 5% of the total Bitcoin supply. The initiative would begin by transferring the 210,000 BTC already held by the U.S. government into a Treasury-managed reserve. Under the bill, the Bitcoin reserve will be held for at least 20 years and used only to reduce the country’s national debt.

Senator Lummis believes that establishing a strategic Bitcoin reserve would “secure our nation’s standing as the global financial leader for decades to come.” She argues that families across Wyoming and the U.S. are struggling to keep up with soaring inflation rates and record-breaking costs, and that diversifying into Bitcoin and securing the nation’s economic future is crucial.

The bill has garnered support from various quarters, with some experts calling it a “game changer” for the U.S. economy. However, there are also concerns about the volatility of Bitcoin and its potential impact on the U.S. economy.

According to a recent survey, 45% of Americans believe that Bitcoin has the potential to revolutionize the global financial system, while 30% are skeptical about its long-term viability.

Senator Lummis’s proposal to establish a Bitcoin reserve for the U.S. is a bold move that could have far-reaching implications for the nation’s economy. While there are risks associated with Bitcoin, the potential benefits of diversifying into this digital asset cannot be ignored. As the global financial landscape continues to evolve, it will be interesting to see how the U.S. government responds to this proposal and whether it will pave the way for other countries to follow suit.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

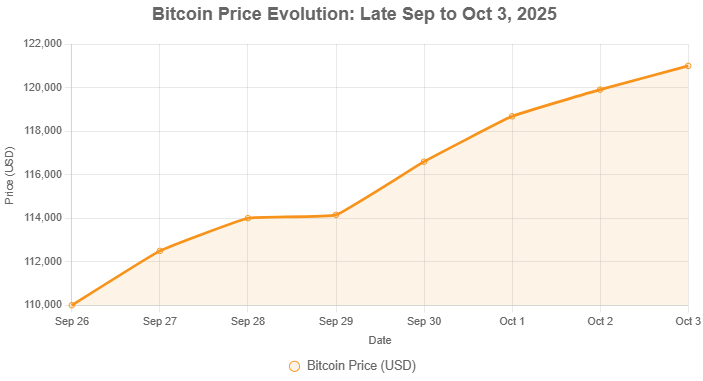

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- US Lawmakers Introduce Bill to Fire SEC Chair Gary Gensler Crypto-friendly lawmakers introduce legislation to remove SEC Chair Gary Gensler, whom they say has been "incompetent" in governing the crypto market....

- AppViewX and Fortanix Partner to Deliver Enterprises Streamlined and Secure Machine Identity Management and Code Signing Solutions AppViewX, the leader in automated machine identity management (MIM) and application security, and Fortanix, a leader in data-first security and pioneer of Confidential Computing, today announced a partnership to offer cloud-delivered secure digital identity management and code signing....

- OlympusDAO continues its long-term plan to revive with inverse bonds OlympusDAO is continuing its long-term plan to revive its project....

- Non-Fungible Tokens: The Guide Non-fungible tokens (NFTs) are a new type of token which is represented by unique cryptographic units, meaning that each token has a unique value. ...