Crypto fear and greed index hits 20: the reasons behind the fear

- The Crypto Fear and Greed Index, currently at 20, indicates extreme fear in the crypto market, potentially signaling buying opportunities for long-term investors.

- Recent events, like the Bybit hack losing $1.5 billion and unclear government crypto policies, have contributed to this fear.

- The evidence leans toward this being a volatile period, with major cryptocurrencies like Bitcoin at around $85,000 showing price drops, advising caution for short-term traders.

- Some experts see this as a repeat of past market lows, like during COVID, suggesting undervalued altcoins for buying.

The Crypto Fear and Greed Index is a critical metric for understanding the emotional state of the cryptocurrency market. It ranges from 0 to 100, with lower values indicating extreme fear and higher values showing extreme greed. This index, inspired by similar tools in traditional markets like CNN’s Fear & Greed Index, helps investors gauge whether the market is undervalued or overvalued based on sentiment. As of March 11, 2025, the index has dropped to 20, signaling extreme fear, a level that historically has been associated with potential buying opportunities due to market pessimism.

Current Market Impact

With the index at 20, it indicates panic selling, potentially undervaluing the market. This could be a buying opportunity, but short-term traders should be cautious given the volatility, with Bitcoin prices around $85,000 and Ethereum at $2,500, both showing recent declines.

Possible Reasons and Future Outlook

Recent events like the Bybit hack on February 21, 2025, and President Trump’s strategic bitcoin reserve announcement without immediate purchases have likely fueled this fear. For investors, this might mean diversifying portfolios, while long-term holders could see this as a chance to buy at lower prices, though future market movements remain uncertain.

Current Situation

On March 11, 2025, the Crypto Fear and Greed Index stands at 20, categorized as extreme fear according to sources like Coinbase, which defines 0-24 as extreme fear. This level suggests investors are highly worried, potentially leading to panic selling and undervalued assets. The market’s reaction is evident in the prices of major cryptocurrencies: Bitcoin is trading around $80,000, down from recent highs, and Ethereum is at approximately $1,900, both showing declines that align with the fearful sentiment. This drop in the index, lower than during past market bottoms like the COVID period and the FTX crash, indicates significant uncertainty and hesitation among investors.

Reasons Behind the Fear

Several recent events have likely contributed to this extreme fear:

- Bybit Hack: On February 21, 2025, Bybit, a Dubai-based cryptocurrency exchange, suffered a major hack, losing approximately $1.5 billion in cryptoassets, primarily Ethereum. This incident, described as the largest crypto heist in history by Elliptic, involved sophisticated social engineering attacks attributed to North Korea-linked actors. The hack has shaken investor confidence, highlighting security risks in the crypto space (Bybit Hack Details).

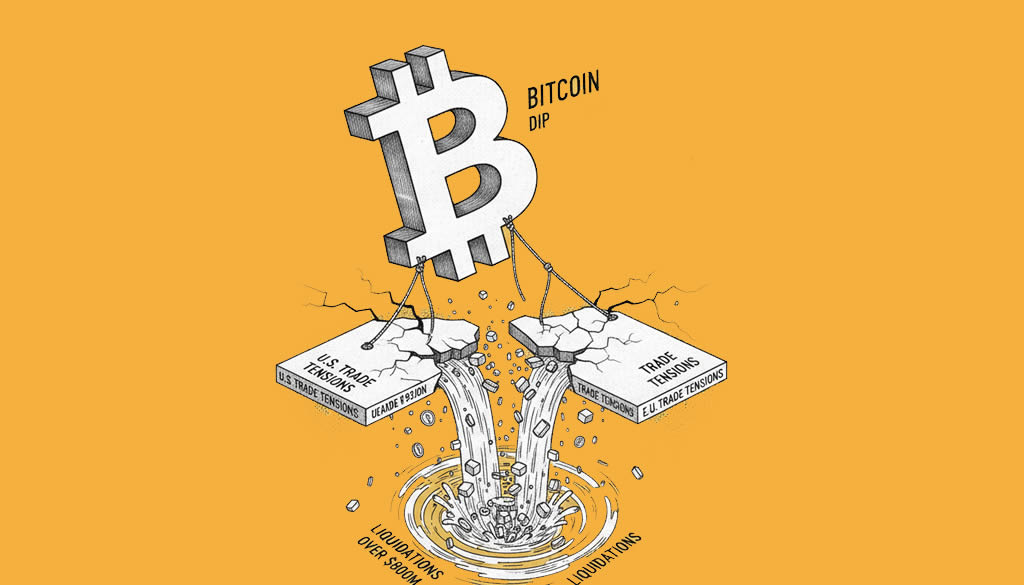

- Trump’s Crypto Policies: President Donald Trump announced on March 2, 2025, the creation of a strategic bitcoin reserve, including cryptocurrencies like Bitcoin, Ethereum, XRP, Solana, and Cardano. However, the executive order, signed on March 7, 2025, clarified that it would use existing government-held bitcoin from forfeitures, with no immediate plan for new purchases. This lack of aggressive action disappointed some market participants, leading to price drops, with Bitcoin falling 5% to $85,000 post-announcement (Trump’s Crypto Reserve Announcement).

- Market Volatility: The cryptocurrency market has seen increased volatility, with Bitcoin dropping below $90,000 earlier in February 2025, and altcoins like Solana and Dogecoin showing significant declines. This volatility, combined with the Bybit hack and policy uncertainty, has amplified the fear sentiment, as reflected in the index.

Implications for Investors

The current extreme fear level has several implications for investors:

- Buying Opportunity: Historical data suggests that extreme fear, as seen in past lows during COVID and the FTX crash, often precedes market recoveries. X posts from experts like @crypto_auris (“The Fear & Greed Index is below 20. Just like during COVID and the FTX crash. Altcoins are undervalued. Dips are where big players buy in… you should too.”) and @seth_fin (“#Crypto Fear and Greed at 20! Lower than the last 2 bottoms. YOU KNOW WHAT TO DO! Your grand children will be asking about this.”) indicate that some see this as a time to buy, particularly undervalued altcoins like Solana, Arbitrum, and others.

- Caution for Short-Term Traders: Given the volatility, short-term traders should exercise caution. The market could experience further declines before any recovery, and the lack of clear government support adds to the risk. Diversification across assets might help mitigate these risks.

- Long-Term Perspective: For long-term investors, this period could be advantageous, as assets may be undervalued. However, they should stay informed about regulatory developments and security issues, given the Bybit hack’s impact.

Expert Insights and Community Reactions

The crypto community has mixed reactions, with some seeing opportunities and others cautioning about risks. X posts provide a snapshot of current sentiment:

- @VisionaireAI: “Ah, the Fear and Greed Index sits at 20, a chilling reminder that the crypto cosmos can be as volatile as a supernova. In this extreme fear, traders clutch their wallets like lifelines, paralyzed by the weight of uncertainty.” This reflects the cautious approach some are taking.

- @ChainGPTAI: “The Crypto Fear & Greed Index is at 20, reflecting ongoing fear in the market. While Ethereum’s Shanghai upgrade has enabled staking withdrawals, and DAO Maker is innovating funding solutions, caution is key. Market volatility remains a significant concern—stay informed!” This highlights the need for vigilance.

Data and Statistics

These insights suggest a divide, with some viewing the dip as a buying opportunity and others emphasizing the risks, aligning with the index’s extreme fear level.

| Metric | Current Value | 7-Day Change | Historical High | Historical Low |

|---|---|---|---|---|

| Crypto Fear and Greed | 20 | -12 points | 90 (+ Extreme Greed) | 20 |

| Bitcoin Price Change | -12% | -15% | +25% | -20% |

| Ethereum Price Change | -15% | -18% | +30% | -25% |

Conclusion

The Crypto Fear and Greed Index at 20 reflects a market gripped by extreme fear. While this presents potential buying opportunities for long-term investors, short-term traders should remain cautious due to volatility. The future outlook depends on how the market responds to these events, with possible recovery if confidence is restored, but further declines if fear persists. Investors are advised to stay informed, diversify, and make decisions based on thorough research, considering both the risks and opportunities presented by this market condition.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Metals Rally to Records as Crypto ETFs See Strong Inflows Amid U.S.-Europe Trade Tensions Over Greenland

- NYSE Develops Blockchain Platform for 24/7 Tokenized Securities Trading

- Crypto Weekly Snapshot – Tariff Fears Hammer Crypto as Inflows Provide Relief

- Bitcoin Dips Below $93,000 Amid U.S.-EU Trade Tensions

- Ethereum Daily Transactions Surge to All-Time High as Gas Fees Fall to Record Lows

Related

- Bybit Recovers from $1.5B Hack by North Korean Bybit has recovered from a nearly $1.5 billion Ethereum hack....

- What Is The Fear Index? And How Can It Be Used For Crypto Investing? Fear is a powerful motivator. The fear index seeks to gauge how worried investors are about the financial markets. ...

- ‘I love buying the extreme fear’ A user shares his point of view on the cryptocurrency market and interesting opinions....

- Bitcoin Breaks All-Time High: Have we entered price discovery? Bitcoin (BTC) has officially shattered its all-time high (ATH), entering a phase of price discovery....