Coinbase Pulls Support for Senate Crypto Market Structure Bill Ahead of Key Vote

Quick Take

- Coinbase has announced it

cannot support the current draft of the Senate Banking Committee’s crypto

market structure bill. - CEO Brian Armstrong highlighted issues

including a de facto ban on tokenized equities, DeFi prohibitions that

erode privacy, erosion of CFTC authority, and threats to stablecoin

rewards. - The Senate Banking Committee is scheduled to mark up the

bill on Thursday, January 15, 2026. - The decision comes amid

ongoing tensions between crypto firms and banking lobbies over yield

programs.

Coinbase’s Sudden

Withdrawal

In a significant shift, Coinbase, one of the

leading voices in crypto advocacy, has pulled its support from the Senate’s

Digital Asset Market Clarity Act (CLARITY Act). CEO Brian Armstrong stated

on X that after reviewing the draft text, the exchange "unfortunately

can’t support the bill as written." He emphasized that the current

version would be "materially worse than the current status quo,"

preferring no bill over a bad one. (Source: Armstrong’s X post)

Key Concerns

Raised

Armstrong outlined several red-line issues, including a de facto ban on tokenized equities, which could stifle innovation in blending traditional finance with blockchain. He also criticized DeFi prohibitions that grant the government broad access to financial records, undermining user privacy—a core tenet of decentralized finance. Additionally, the bill erodes the Commodity Futures Trading Commission’s (CFTC) authority, making it subservient to the Securities and Exchange Commission (SEC), potentially centralizing oversight and hindering growth.

Stablecoin Rewards at the Center of

Debate

A major sticking point is the treatment of stablecoin rewards. Draft amendments could eliminate yield programs offered by platforms like Coinbase, which Armstrong described as allowing banks to "ban their competition." This echoes community sentiments that banks are lobbying to prevent "deposit flight" to crypto platforms, protecting their monopoly on interest while stifling innovation. Coinbase views this as a "red line" issue, arguing it would evaporate the competitiveness of U.S. stablecoins like USDC. The bill builds on the GENIUS Act, signed in July 2025, but banks have ramped up efforts to restrict non-bank rewards.

Industry and Community Reactions

The move has sparked mixed reactions. Supporters of the bill argue it provides much-needed clarity for the industry, dividing oversight between the SEC and CFTC. However, critics, including DeFi advocates, warn of overreach that could drive innovation overseas. Community opinions on X highlight frustration with bank greed, with some calling it "funny how banks want to ban crypto rewards just because they’re scared." Balanced views note risks, such as potential consumer harm from unregulated yields, but emphasize the need for fair competition.

Broader Implications for Crypto

This development could impact major cryptocurrencies like Bitcoin, Ethereum, and stablecoins such as USDC (from CryptoPress coins list). If passed in its current form, the bill might weaken U.S. leadership in crypto, especially amid global advancements. Coinbase remains committed to pushing for revisions, appreciating bipartisan efforts but insisting on a level playing field.

For more context on regulatory pushes, see this related note from CryptoPress: Brian Armstrong Champions Crypto Clarity.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Latin America Tightens Crypto Rules As Brazil Launches Stablecoin

- ICP Token Surges 41% Weekly Amid Tokenomics Proposal and AI Sector Momentum

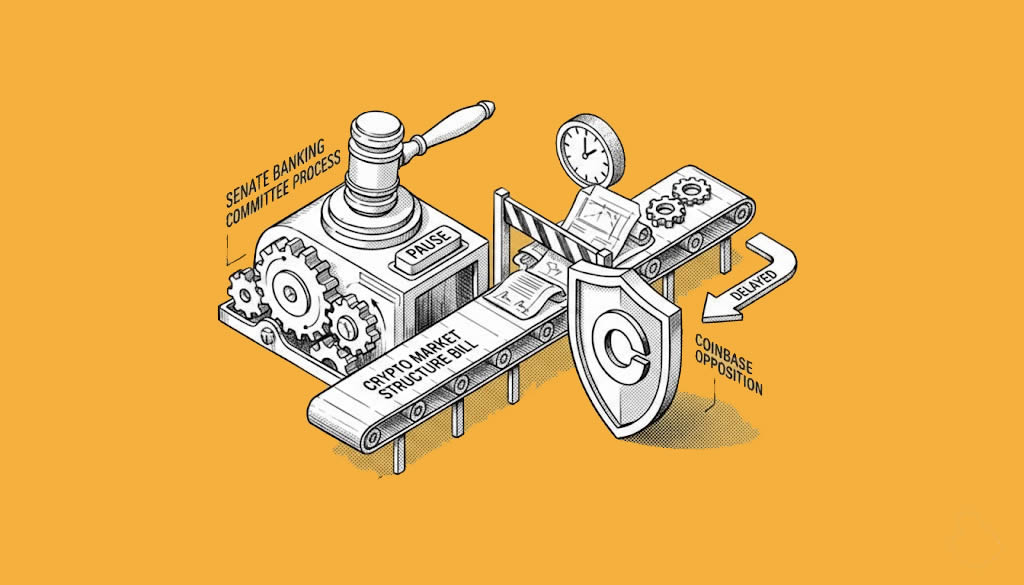

- Senate Banking Committee Delays Crypto Bill Markup Following Coinbase Opposition

- Senate Banking Committee Delays Crypto Market Structure Bill Markup Amid Coinbase Opposition

- Coinbase Pulls Support for Senate Crypto Market Structure Bill Ahead of Key Vote

Related

- Bitcoin Payments Get Green Light in California California Assembly Passes Bitcoin Payment Bill, Paving the Way for Crypto in Government Transactions....

- Brian Armstrong Champions Crypto Clarity: Urging Swift Action on U.S. Regulation Brian Armstrong on U.S. Crypto Regulation: Latest Insights and Calls for Action....

- CFTC Chair Declares 70% of Crypto Assets as Commodities CFTC Chair Rostin Behnam declares 70% of crypto assets are not securities....

- US Senate Unveils Updated Crypto Bill with SEC-CFTC Committee, DeFi Safeguards, and Airdrop Guidelines An updated draft of the US Senate's crypto market structure bill proposes a joint SEC-CFTC advisory committee, protections for DeFi developers, exemptions for DePIN projects, and regulatory clarity on airdrops, potentially reshaping the US crypto landscape....