BlackRock’s Bitcoin ETF Reaches New Heights with Over 350,000 BTC

- BlackRock’s ETF now holds over 350,000 BTC.

- This marks a significant milestone in crypto adoption by traditional finance.

- The move could lead to increased regulatory clarity and market stability.

BlackRock’s Bitcoin ETF Surpasses 350,000 BTC

In a landmark moment for cryptocurrency and traditional finance intersection, BlackRock’s iShares Bitcoin Trust (IBIT) has now crossed the threshold of holding over 350,000 Bitcoins. This achievement not only underscores the growing acceptance of Bitcoin as an asset class but also highlights the significant shift in investment strategies towards digital currencies.

A New Era for Bitcoin Investment

BlackRock’s ETF became the world’s largest Bitcoin fund by assets under management earlier this year, overtaking Grayscale’s Bitcoin Trust. This shift was marked by a significant inflow of $102 million on a single day, signaling robust investor interest.

As of August 20, 2024, BlackRock’s ETF holds over 350,000 BTC, which at current market prices, equates to billions in assets. This figure represents not just numbers but a testament to Bitcoin’s legitimacy in the eyes of institutional investors.

Why This Matters

The milestone reflects a vote of confidence from one of the world’s largest asset managers in Bitcoin’s future. BlackRock’s involvement could pave the way for other institutions to follow suit, potentially leading to increased liquidity and stability in the crypto market.

With such a significant holding, BlackRock’s ETF could influence Bitcoin’s price dynamics, potentially reducing volatility through the sheer volume of assets under its management.

The Broader Impact on Crypto Markets

- Increased Legitimacy: The integration of Bitcoin into BlackRock’s portfolio, especially through an ETF, adds a layer of legitimacy to cryptocurrencies, making them more accessible to retail investors who might have been wary of direct crypto investments.

- Regulatory Implications: This move might encourage regulatory bodies to refine their approach towards cryptocurrencies, possibly leading to clearer guidelines and frameworks for crypto investments.

Yesterday, BlackRock's Bitcoin Exchange-Traded Fund experienced a significant increase in investment, with an inflow of $93 million.

— Lucky (@LLuciano_BTC) August 20, 2024

This means that investors added $93 million worth of Bitcoin to this fund in just one day.

As a result of this and previous investments,… https://t.co/ZTQ9NojNzN

Looking Ahead

The journey of BlackRock’s Bitcoin ETF from inception to holding over 350,000 BTC is a narrative of acceptance, innovation, and the evolving landscape of finance. As we move forward, this milestone could be seen as a catalyst for further integration of blockchain technologies into the financial systems worldwide.

This development not only signifies a major step for Bitcoin but also for how the financial world views and integrates digital assets into its traditional frameworks.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Web3 AI Conference: Blockchain Hub Announces «Crypto Yolka» event to Launch Community-Voted Investment Fund

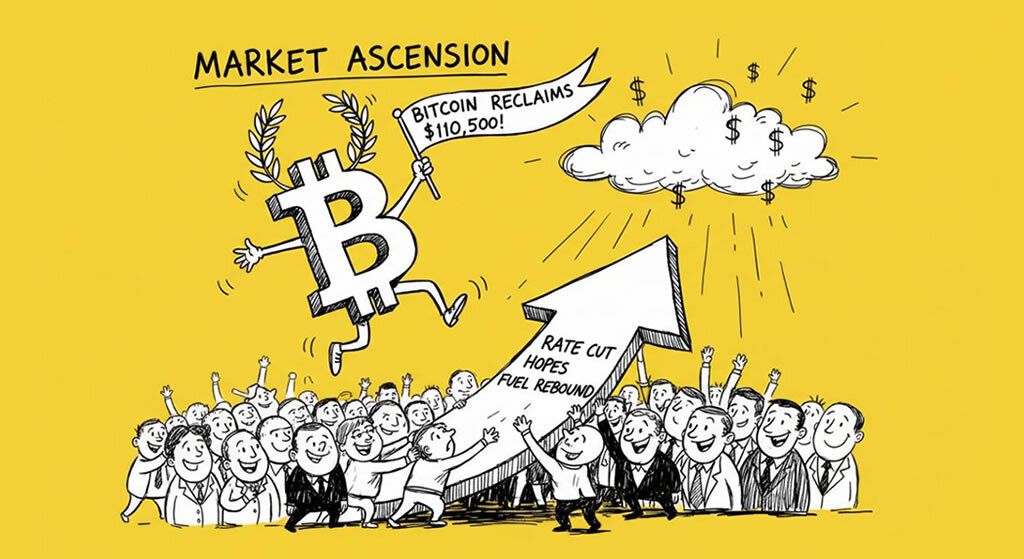

- Bitcoin Rebounds Above $110,000 Amid Rate Cut Hopes and Buy-the-Dip Sentiment

- Crypto Weekly Roundup – Navigating Tariffs, Liquidations, and Rebound Signals

- Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound

- SEC Chairman Paul Atkins Pushes for Crypto Innovation Amid Regulatory Overhaul

Related

- Ethereum ETFs Set to Launch in June, Boosting Crypto Market Outlook Ethereum ETFs receive SEC approval, paving the way for potential June launch....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Bitcoin ETFs Unlike mutual funds, ETF trades like a common stock on a stock exchange....

- Will Bitcoin ever die? Bitcoin is going through a huge transition right now. Bitcoin has been used in transactions all over the world, and it continues to grow in popularity. Many people wonder if Bitcoin will ever die, just like people used to wonder...