Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

- Bitwise filed a post-effective amendment with the SEC on December 30, 2025, for 11 single-asset crypto strategy ETFs.

- The ETFs target tokens including AAVE, UNI, ZEC, SUI, TAO, NEAR, TRX, ENA, STRK, HYPE, and CC, covering DeFi, AI, privacy, and layer-1 sectors.

- Each fund will invest up to 60% directly in the underlying token, with the remainder in exchange-traded products and derivatives for exposure.

Bitwise Asset Management has expanded its push into cryptocurrency products by filing for 11 new strategy exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC), aiming to offer regulated exposure to a diverse set of altcoins.

The filings, dated December 30, 2025, come as the crypto ETF market matures following approvals for spot Bitcoin and Ether funds. This move signals strong institutional demand for altcoins beyond major cryptocurrencies like Bitcoin and Ethereum.

According to the official SEC document, the ETFs are structured under the Bitwise Funds Trust and intend to list on NYSE Arca. Each fund focuses on capital appreciation through a single token, with at least 80% of assets providing exposure via direct holdings, non-U.S. ETPs, and derivatives like futures and swaps.

Key tokens include AAVE for decentralized lending, UNI for Uniswap’s exchange protocol (see UNI on CryptoPress), ZEC for privacy features, TAO for Bittensor’s AI network, and others such as SUI, NEAR, TRX, ENA, STRK, Hyperliquid (HYPE), and Canton Network (CC).

ETF analyst Eric Balchunas commented on the development via X: “Money (and ETF filings) Never Sleeps.” This reflects the rapid pace of innovation in the sector.

Money (and ETF filings) Never Sleeps https://t.co/o0Z7twHqNq

— Eric Balchunas (@EricBalchunas) December 31, 2025

The filings leverage the SEC’s October 2025 generic listing standards, which simplify approvals for crypto ETFs. Industry experts note that this could accelerate altcoin adoption, building on the success of Solana and XRP ETFs, which have attracted over $1 billion in inflows combined, as reported by CryptoPotato.

However, the prospectuses highlight risks such as high volatility, cybersecurity threats, regulatory changes, and liquidity issues. Analysts caution that while these ETFs could democratize access, they may not perfectly track spot prices due to fees and structural factors.

Bitwise’s initiative aligns with broader trends, including Grayscale’s efforts to convert trusts into ETPs for assets like TAO. For related ETF developments, see Bitwise Spot Solana ETF Debuts on CryptoPress.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

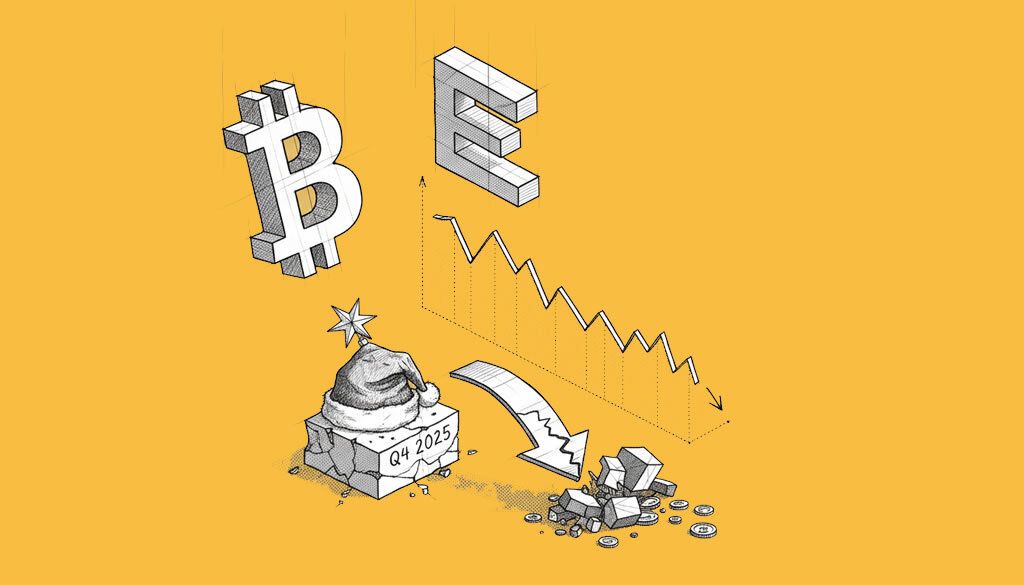

- Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

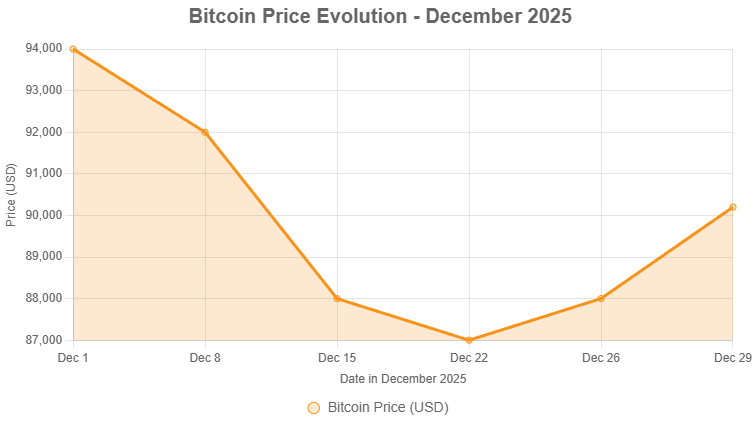

- Crypto Weekly Snapshot – End-of-Year Consolidation

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

Related

- 21Shares Files for Spot Dogecoin ETF 21Shares Files for Spot Dogecoin ETF, Aims to Bring Meme Coin to Mainstream Investors....

- A List of Available Bitcoin ETFs List of Bitcoin ETFs: current Bitcoin ETFs available....

- Crypto ETFs 2024: SEC’s Decisions on Solana, XRP, Litecoin, and More The SEC has been flooded with applications for altcoin ETFs, with major players....

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....