Bitcoin’s Surge and Trump’s Regulatory Impact

- Bitcoin’s price inches closer to $70,000 after Trump’s pledge to retain federal government’s Bitcoin holdings

- Trump vows to fire SEC Chair Gary Gensler and establish a crypto-friendly regulatory environment

- Cryptocurrency market responds positively to Trump’s statements, with Bitcoin experiencing a 10% increase in value

- The future of cryptocurrency regulation remains uncertain, but Trump’s vision offers hope for increased adoption and growth

- As Bitcoin continues to rally, the promise of regulatory clarity and government support offers a glimmer of hope for the future

Trump’s Pledge to Retain Bitcoin Holdings Boosts Market Confidence

Former President Donald Trump’s recent statements on Bitcoin and cryptocurrency regulation have sparked renewed interest and optimism among investors and enthusiasts. At the Bitcoin 2024 conference in Nashville, Trump pledged to retain the federal government’s Bitcoin holdings and vowed to fire SEC Chair Gary Gensler if he is re-elected. These bold declarations have contributed to Bitcoin’s ongoing rally, with the cryptocurrency inching closer to the $70,000 mark.

Amidst Trump’s Regulatory Promises Bitcoin’s price has been steadily climbing, buoyed by Trump’s promise to retain the government’s Bitcoin holdings. As of July 29, 2024, Bitcoin is trading at $69,875, up from $63,255 just a month ago. This surge in price has been attributed to Trump’s statements, which have instilled confidence in the cryptocurrency market and highlighted the potential for increased adoption and regulatory clarity under his administration.

"Never sell your #Bitcoin." – Donald J. Trumppic.twitter.com/Cusnkib64h

— Michael Saylor⚡️ (@saylor) July 28, 2024

Trump’s Vision for a Crypto-Friendly America

Trump’s keynote address at the Bitcoin 2024 conference outlined his vision for the United States to become a “crypto capital of the world.” He emphasized the importance of clear regulatory guidance and the need to protect the industry from what he perceives as harmful policies. By promising to create a crypto advisory council and establish a framework for stablecoin expansion, Trump aims to foster a more conducive environment for the growth of the cryptocurrency sector.

Trump’s pledge to retain the federal government’s Bitcoin holdings and fire SEC Chair Gary Gensler has had a significant impact on Bitcoin’s price. The market has responded positively to these statements, with Bitcoin experiencing a 10% increase in value since the conference. This rally is a testament to the influence that regulatory clarity and government support can have on cryptocurrency prices.

The Road Ahead for Bitcoin and Cryptocurrency Regulation

While Trump’s promises have generated excitement and optimism, the road ahead for cryptocurrency regulation remains uncertain. The cryptocurrency industry has been plagued by regulatory uncertainty and inconsistent policies, which have hindered its growth and adoption. Trump’s vision for a crypto-friendly America offers a glimmer of hope, but it remains to be seen how his administration will navigate the complex landscape of cryptocurrency regulation.

As Bitcoin inches closer to the $70,000 mark, the cryptocurrency market is buoyed by Trump’s pledge to retain the federal government’s Bitcoin holdings and his commitment to establishing a crypto-friendly regulatory environment. While the future of cryptocurrency regulation remains uncertain, Trump’s statements have instilled confidence in the market and highlighted the potential for increased adoption and growth under his administration. As the industry continues to evolve, the promise of regulatory clarity and government support offers a glimmer of hope for the future of Bitcoin and cryptocurrency.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

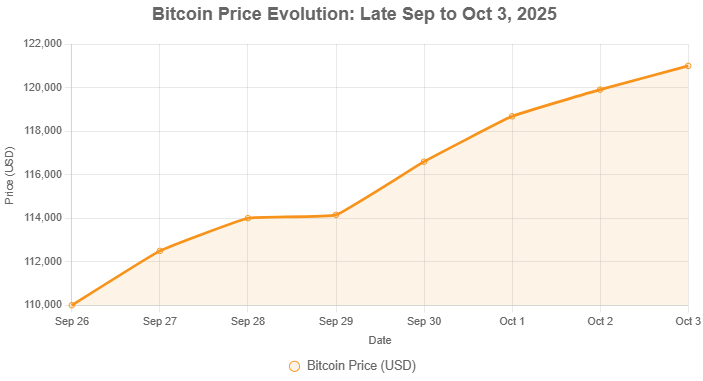

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- Bitcoin’s carbon footprint There has been a lot of talk about the carbon footprint of Bitcoin. In this article, we will examine where Bitcoin’s power consumption comes from, and potential ways to mitigate the power hunger of Bitcoin. More than a literal footprint,...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Usio, Inc. to Participate in 36th Annual Roth Conference Usio, Inc. (Nasdaq: USIO), a cloud-based, integrated FinTech electronic payment solutions provider, today announced that the Company will be participating in the 36th Annual Roth Conference, to be held March 17-19, 2024, at Dana Point, California....

- Core Scientific Files Registration Statement for Shares Held by Existing Shareholders a leader in bitcoin mining and application-specific digital infrastructure for emerging high-value compute,today announced the filing of a registration statement for 10.8 million shares held by existing shareholders....