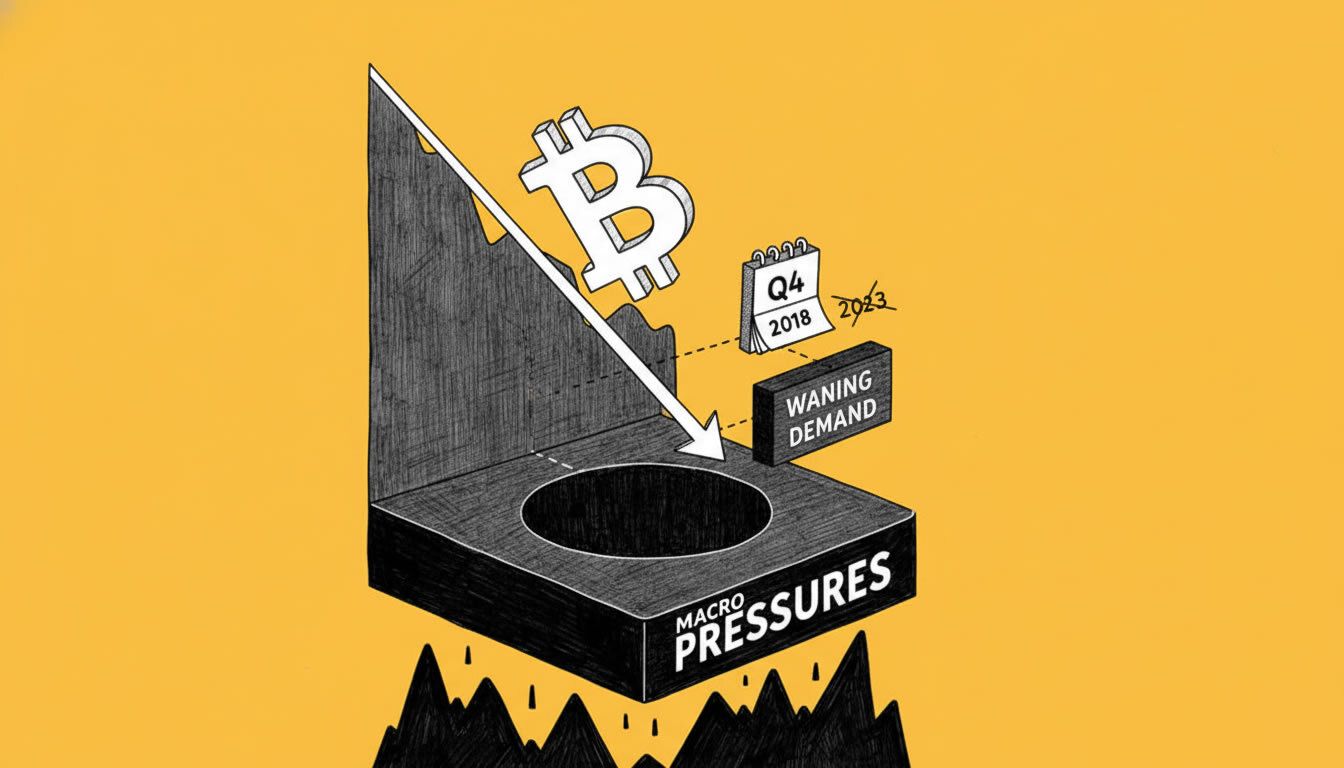

Bitcoin Set for Worst Q4 Since 2018 as Demand Wanes and Macro Pressures Mount

- Bitcoin’s Q4 slump: The cryptocurrency is down nearly 22% this quarter, its worst performance since the 2018 crash.

- Market fatigue: On-chain data shows reduced activity and leverage, signaling a ‘demand vacuum.’

- Macro influences: Recent Bank of Japan rate hikes have curbed risk appetite in crypto markets.

Bitcoin (BTC) is poised to end the fourth quarter of 2025 with a significant downturn, dropping approximately 22% according to data from CoinGlass. This marks the asset’s poorest Q4 performance since 2018, when it plummeted over 42% amid a prolonged bear market. Unlike recent years, where Q4 gains exceeded 48% in 2024 and 57% in 2023 fueled by ETF approvals and institutional interest, 2025 has seen inconsistent momentum.

The year started with an 11.8% loss in Q1, followed by a 30% rebound in Q2 and a modest 6% gain in Q3. However, Q4 has erased much of that progress, with BTC trading around $89,000—a 29% retreat from its all-time high of nearly $126,000 in early October. Daily transactions have dipped from 460,000 to 438,000, while highly active addresses fell to 41,500, per on-chain analytics.

📉 Bitcoin Dips Below 88K

— Cryptopress (@CryptoPress_ok) December 23, 2025

Bitcoin drops below 88,000 USDT with a 1.04% decrease in 24 hours.

Traders attribute the fatigue to a combination of factors. Macroeconomic pressures, including the Bank of Japan’s rate increase to 0.75% on December 19, have dampened enthusiasm for risk assets like crypto. Although anticipated, the hike has raised uncertainty about future policy, impacting yen-funded trades. Fading speculative activity and weaker capital inflows have compounded the issue, shifting the market into a ‘stop-and-go’ phase after mid-year recovery.

Analysts remain cautious. CryptoQuant’s GugaOnChain noted that Bitcoin is still in a bear market, citing a negative spread between 30-day and 365-day moving averages on the Bull-Bear Cycle indicator. ‘The market is in a cooling phase with no quick rebound in sight,’ GugaOnChain said in a recent analysis. The Coinbase Premium Index, while improving from negative territory, has yet to turn positive, indicating limited U.S.-led demand.

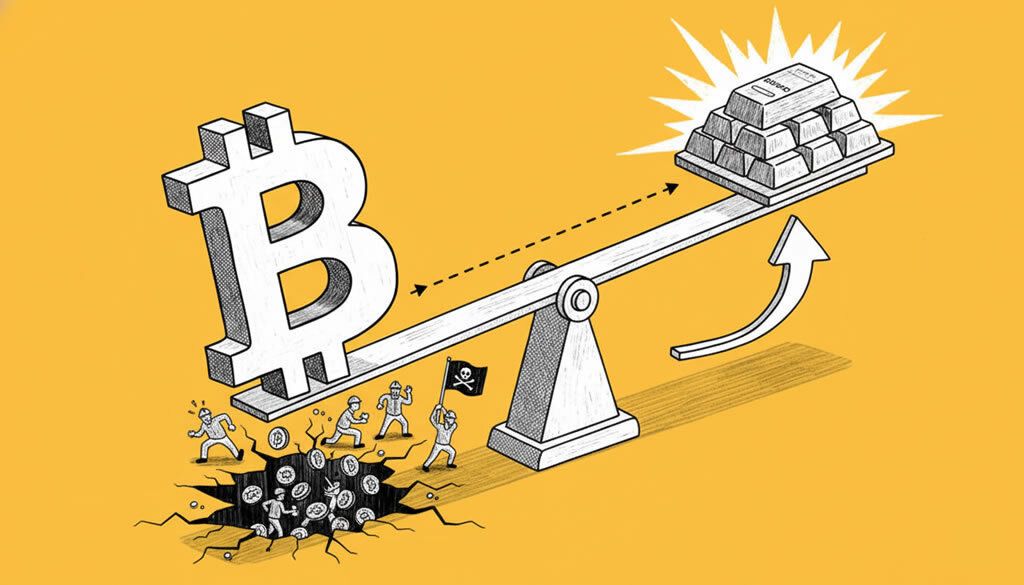

Leverage metrics show excess speculation has been cleared, but without rebuilding, prices remain range-bound between $85,000 and $90,000. Over the past month, BTC is up 6%, but year-to-date it’s down 7%, underperforming tangible assets like gold and copper, which have surged on ‘fear and AI’ trades.

This Q4 decline echoes 2018’s pattern of mid-year rebounds failing to sustain, though less severe. Risks include upcoming $28.5 billion options expiry on Deribit, which could amplify volatility. Balanced against this, some see defensive positioning as a setup for 2026 recovery if institutional inflows resume.

For context, key X accounts like @amy_liqag have highlighted the ‘demand vacuum’ in recent posts. As always, market participants should monitor on-chain indicators and global policy shifts closely.

1/4

— Amy | Sui × AI × DeFi (@amy_liqag) December 23, 2025

✨ Amy's Daily Crypto (Dec 23)

📉 Bitcoin worst Q4 since 2018—down 22%

BTC slipped below $88K with $28.5B Deribit options expiry looming this week. On-chain data confirms "demand vacuum" and defensive positioning.

Bear market deepens, but builders keep shipping.…

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Top 10 Best Staking Coins for Passive Income in 2026

- Bitcoin Slips Against Surging Gold as Miner Capitulation Signals Potential Market Bottom

- Bitcoin Set for Worst Q4 Since 2018 as Demand Wanes and Macro Pressures Mount

- Crypto Weekly Snapshot – Volatility, Outflows, and Hopes for 2026 Recovery

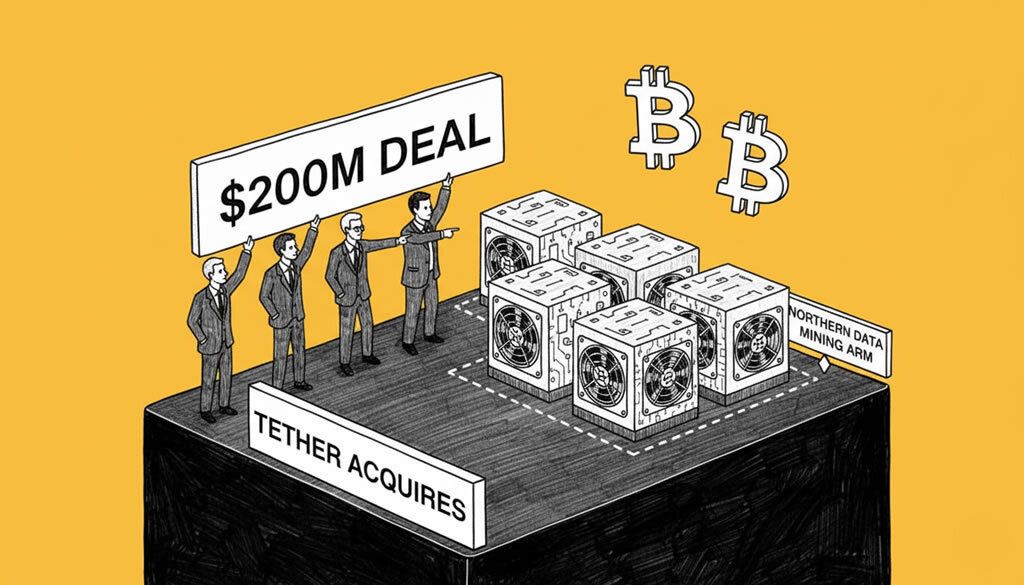

- Tether Executives Acquire Northern Data’s Bitcoin Mining Arm in $200M Deal

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- How Crypto Bear Markets Function Cryptocurrencies are currently in the middle of a massive bear market. It's easy to be scared out of your wits....

- Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows Bitcoin dropped to a six-month low below, triggering over $1.2 billion in liquidations....

- Crypto Today: The worst; BTC Decoupling; FTX Impact Crypto Today: Is the worst over?; BTC Decoupling; FTX Impact to the crypto industry....