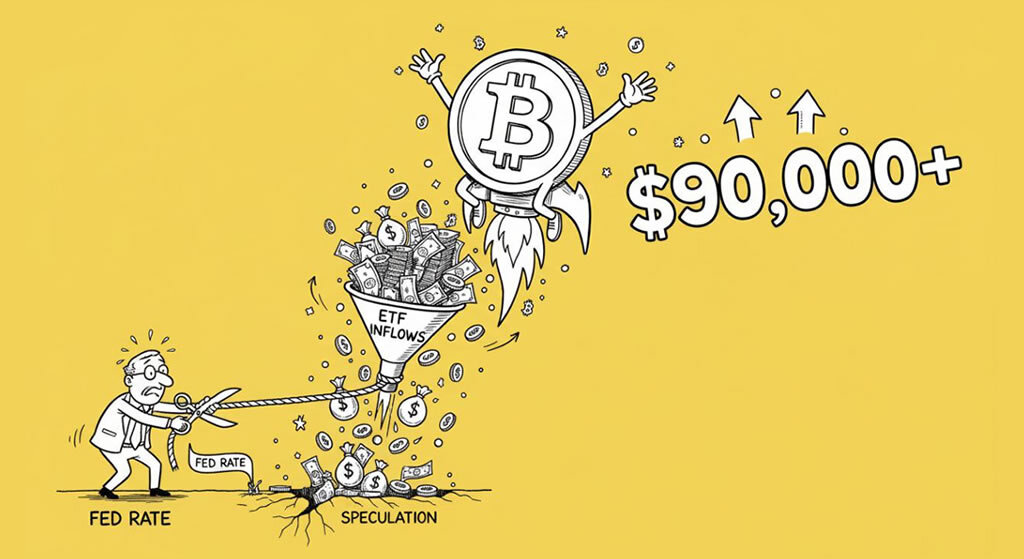

Bitcoin Rebounds Above $90,000 Amid Fed Rate Cut Speculation and ETF Inflows

- Bitcoin price recovery: BTC climbs above $91,000, up 5% in 24 hours, after dipping to $81,000 last week and erasing 2025 gains.

- Rate cut catalyst: Market prices in 85% chance of December Fed cut, boosting risk assets including crypto.

- ETF momentum: Spot Bitcoin ETFs see $21 million inflows on Nov. 26, led by BlackRock’s IBIT returning to profitability.

- Whale activity: Large holders flip to net buying for the first time since August, signaling potential bottom.

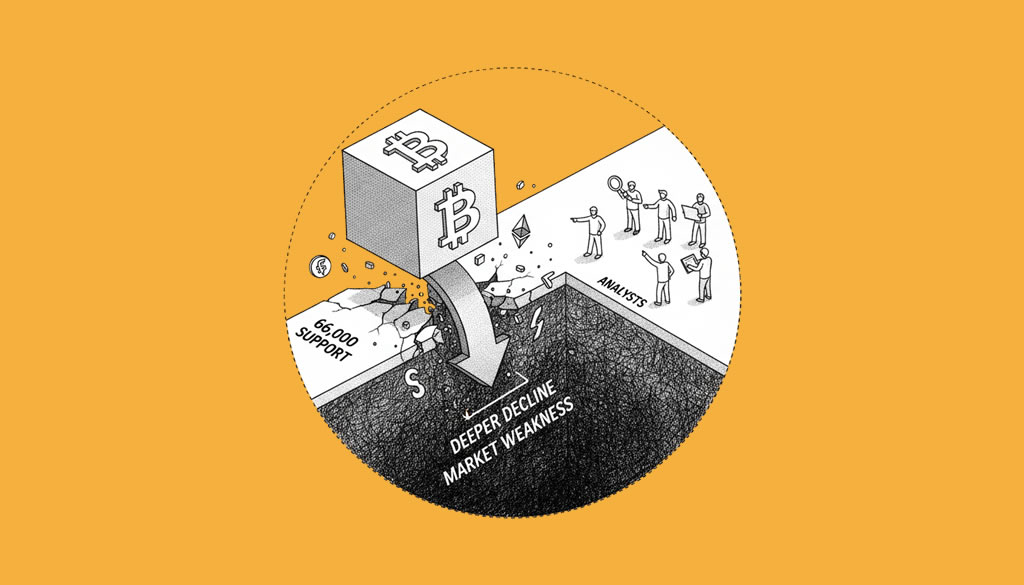

- Risks ahead: Declining trading volumes and long-term holder profit-taking could cap upside near mid-$90,000.

Bitcoin has reclaimed the $90,000 level, marking a sharp rebound from last week’s lows and offering relief to investors after a turbulent November. The cryptocurrency traded as high as $91,500 on Nov. 27, up over 5% in the past 24 hours. This surge breaks from typical pre-Thanksgiving price weakness, where BTC often faces selling pressure.

The rally aligns with broader market recovery signals, including rising expectations for a Federal Reserve rate cut in December. Traders now assign an 85% probability to the cut, up from earlier estimates, driving capital into risk assets like Bitcoin. “Bitcoin’s break past $90K was driven by a repricing of December rate-cut odds,” analysts at QCP Capital noted in a report.

Spot Bitcoin exchange-traded funds (ETFs) contributed to the momentum, recording two consecutive days of inflows totaling $21 million on Nov. 26—the first such streak in two weeks. BlackRock’s iShares Bitcoin Trust (IBIT) led the gains, pushing its investors back into profit territory after BTC’s recent dip. This comes amid Nasdaq’s proposal to expand options trading limits for IBIT from 250,000 to 1 million contracts, potentially unlocking more institutional participation.

On-chain data shows whales and early holders shifting to net buying for the first time since August, reversing months of profit-taking above $100,000. However, trading volumes remain subdued at $69.56 billion over 24 hours, hinting at fragile liquidity. A trading firm warned that BTC’s ascent “may hit a wall around mid-$90K” if spot demand doesn’t revive.

Analysts predict a potential return to $100,000 if current levels hold, but year-end risks like retail selling and tariff tensions could spur downside hedging. Vincent Liu, CIO of Kronos Research, described the move as a “classic oversold snapback,” with buyers stepping in post-drawdown. Options markets imply only a 30% chance of closing 2025 above $100,000, underscoring the balanced risks.

📈 Bitcoin Surpasses $90K

— Cryptopress (@CryptoPress_ok) November 28, 2025

Bitcoin rebounds above $90,000 as strategists predict a potential return to $100,000 soon amid market recovery signals.

Community sentiment on X reflects cautious optimism, with posts highlighting the short squeeze that liquidated $131 million in BTC shorts. As markets digest Thanksgiving liquidity, bulls must defend $90,000 to extend the rally toward psychological resistance at $93,000.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- BlackRock Integrates BUIDL Fund with Uniswap to Enable On-Chain Institutional Trading

- Aztec Network Token Launch Meets Volatility as Early Investors Face Double-Digit Drops

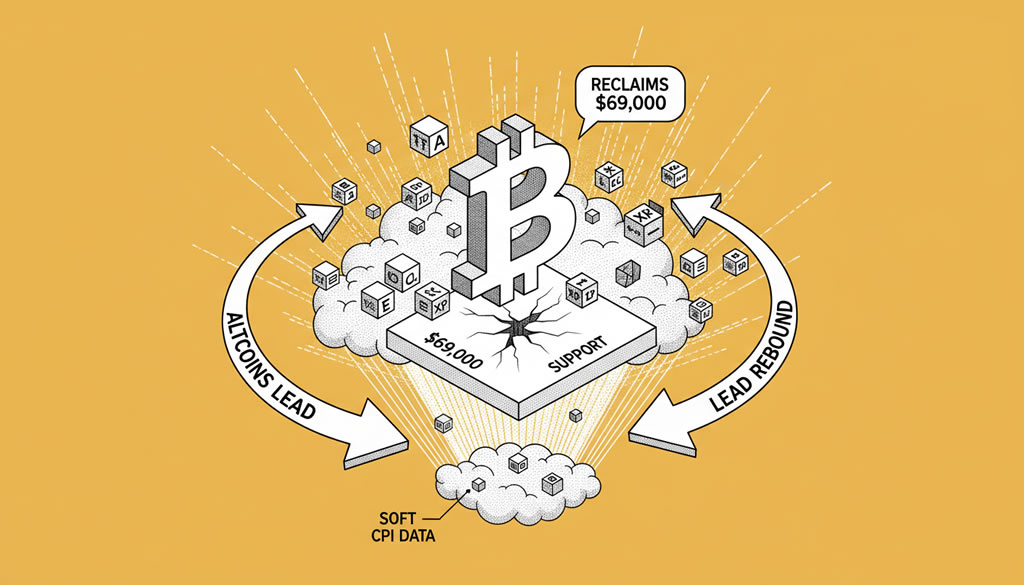

- Bitcoin Briefly Reclaims $69,000 as Altcoins Lead Market Rebound Following Soft CPI Data

- Crypto Crashes and Comebacks: Lessons from History and Narratives for a 2026 Bull Revival

- 81% APR on USDT? Unlocking the Best Merkl Yield Opportunities Today 📈

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Bitcoin Surges Above $117K Following Fed’s First 2025 Rate Cut Bitcoin's price climbed past $117,000 after the U.S. Federal Reserve implemented a 25 basis point interest rate cut, enhancing liquidity and boosting market sentiment amid economic uncertainties....

- Bitcoin Holds Steady Near $116K as Traders Await Fed’s Rate Cut Decision Cryptocurrencies remain stable ahead of the Federal Reserve's expected 25 basis point rate cut on September 17, with analysts anticipating potential short-term volatility but long-term gains for Bitcoin and risk assets....

- Bitcoin Dips Below $103K as Fed Rate Cut Odds Dim Ahead of Key Inflation Data Bitcoin's price fell to around $103,000 amid growing uncertainty over a December Federal Reserve rate cut, with traders eyeing tomorrow's U.S. inflation report for clues on monetary policy....