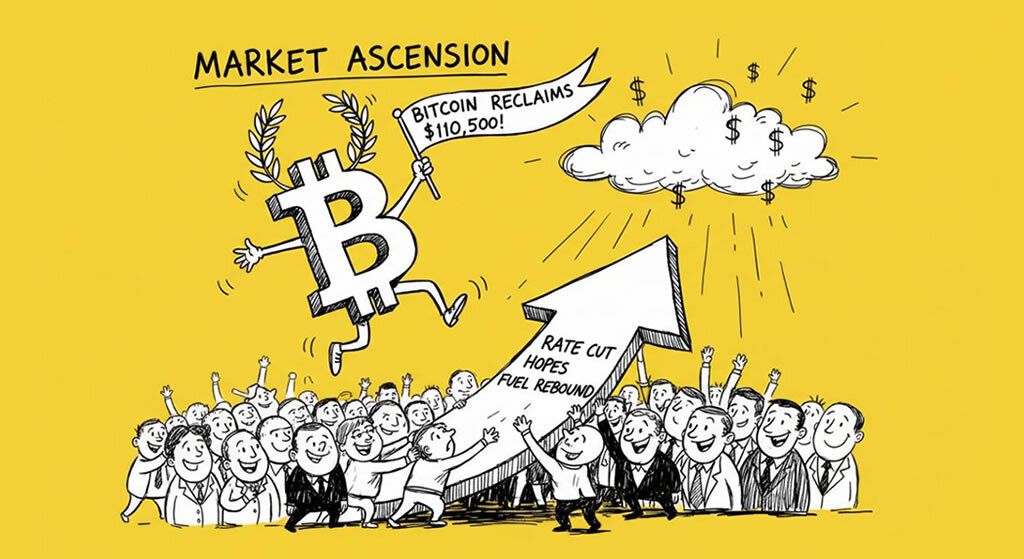

Bitcoin Rebounds Above $110,000 Amid Rate Cut Hopes and Buy-the-Dip Sentiment

- Bitcoin climbs over 3% to $110,544, reclaiming key levels after a four-day dip below $110,000.

- Institutional inflows and $6 billion in new stablecoin issuance indicate fresh capital entering the market.

- Analysts highlight resistance at $111,000, with potential for short squeezes, but warn of geopolitical risks from U.S.-China tensions.

Bitcoin has rebounded sharply, climbing above $110,000 following a recent sell-off triggered by macroeconomic concerns. Bitcoin rose 3.16% in the past 24 hours to trade at $110,544. This recovery comes amid growing expectations of a U.S. Federal Reserve interest rate cut and improved liquidity conditions for risk assets.

Institutional investors appear to be driving the rebound. Analysts note that the prior dip, influenced by U.S. President Donald Trump’s tariff announcements and banking sector worries, was viewed as a buying opportunity. Spot crypto ETFs saw renewed demand, contributing to the price surge.

Federal Reserve Chair Jerome Powell’s recent comments on persistent labor market softness have eased bond yields, creating a favorable environment for digital assets. “The recent rebound in Bitcoin, now trading above $110,000, has been driven by a combination of institutional inflows and improving macroeconomic conditions,” said Rachael Lucas, crypto analyst at BTC Markets, in a statement cited by The Block.

The broader market is participating in the rally. Ethereum climbed over 4% to surpass $4,000, while other major tokens like BNB, XRP, and Solana posted gains between 2% and 4%. On-chain data shows over $6 billion in new Tether (USDT) and Circle (USDC) stablecoins issued since last week, often a precursor to increased spot buying, as reported by CryptoSlate.

Positive developments around the U.S. government shutdown also bolstered sentiment. Bitcoin jumped to $111,711 following White House remarks suggesting the shutdown might end this week, according to Bitcoin.com News.

Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound https://t.co/rN2l9efCQG #bitcoin #cryptocrash #cryptocurrencies #frontpage #news

— Cryptopress (@CryptoPress_ok) October 20, 2025

Technical indicators suggest caution ahead. Bitcoin faces resistance between $111,700 and $115,500, where a break above $111,000 could trigger a short squeeze and further upside. However, support lies at $107,000, and a drop below this level might lead to liquidations. Geopolitical risks, including the upcoming Trump-Xi meeting, remain a concern, carrying “significant headline risk,” Lucas added.

Galaxy Research maintains a constructive outlook, stating, “Bitcoin remains well positioned as digital gold to capitalize on fundamental doubt about government fiscal and monetary prudence,”.

Cointelegraph noted that while Bitcoin staged a rebound to $111,705, on-chain data suggests sellers may continue taking profits at higher levels.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Web3 AI Conference: Blockchain Hub Announces «Crypto Yolka» event to Launch Community-Voted Investment Fund

- Bitcoin Rebounds Above $110,000 Amid Rate Cut Hopes and Buy-the-Dip Sentiment

- Crypto Weekly Roundup – Navigating Tariffs, Liquidations, and Rebound Signals

- Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound

- SEC Chairman Paul Atkins Pushes for Crypto Innovation Amid Regulatory Overhaul

Related

- Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound Bitcoin has surged back above $110,500, with Ethereum hitting $4,000, amid expectations of interest rate cuts and easing geopolitical tensions, marking a significant recovery in the crypto market....

- Bitcoin Dips Below $113,000 as Sell-Off Intensifies Amid Market Volatility Bitcoin has fallen below $113,000, marking a 1.7% decline in the past 24 hours, with analysts identifying key support levels that could determine the cryptocurrency's near-term trajectory....

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout Triggered by US-China trade tensions, the crypto market suffered its largest single-day liquidation event, but prices are recovering as leverage resets and sentiment stabilizes....

- Bitcoin Surges Past $110,000 Amid ETF Frenzy Bitcoin Hits $110,000: Institutional Demand and DeFi Fuel Record Rally....