Bitcoin Pushes Above $90,000 as Traders Eye Change in Pattern

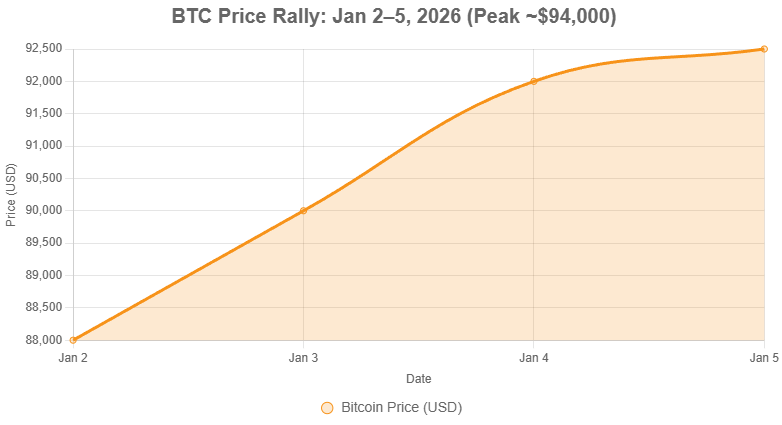

- Bitcoin traded above $90,000 during U.S. hours on January 2, up over 2% in 24 hours.

- Price action reflects a potential shift from late-2025 patterns, with gains during American trading sessions.

- Spot Bitcoin ETFs saw record outflows in late 2025, but analysts expect inflows to resume in early 2026.

- Market focus shifts to the upcoming U.S. jobs report on January 9, which could influence Fed rate cut expectations.

Bitcoin (BTC) edged higher on the first full trading day of 2026, briefly surpassing the psychologically significant $90,000 level as traders monitored potential changes in market dynamics.

As of January 2, BTC traded around $89,900–$90,000, marking a roughly 2.5% gain over the previous 24 hours. This move stood out amid historically thin holiday liquidity, with the cryptocurrency showing rare

strength during U.S. trading hours—a departure from late-2025 trends where prices often weakened when American markets were active.

The price has remained range-bound between roughly $85,000 and $90,000 for weeks, following a 20% correction from October highs above $126,000. Technical indicators, including a Bollinger Bands squeeze, suggest an impending volatility breakout in either direction.

ETF flows remain a key driver. U.S. spot Bitcoin ETFs recorded record net outflows of $4.57 billion in November-December 2025, coinciding with the price decline and signaling reduced institutional demand at year-end. However, some analysts anticipate a reversal in early 2026 as tax-loss harvesting concludes and liquidity returns.

Looking ahead, the December 2025 U.S. nonfarm payrolls report, scheduled for release on January 9, 2026, is in focus. Stronger-than-expected data could temper expectations for aggressive Federal Reserve rate cuts, potentially pressuring risk assets like Bitcoin. Conversely, signs of labor market cooling might bolster hopes for easier monetary policy.

“The price is compressing as both sides wait for liquidity to return in January,” noted Vikram Subburaj, CEO of Giottus exchange, highlighting the equilibrium amid outflows and liquidations.

Overall, while short-term volatility looms, longer-term sentiment remains constructive for many institutions, with projections for significant growth in ETF assets throughout 2026.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

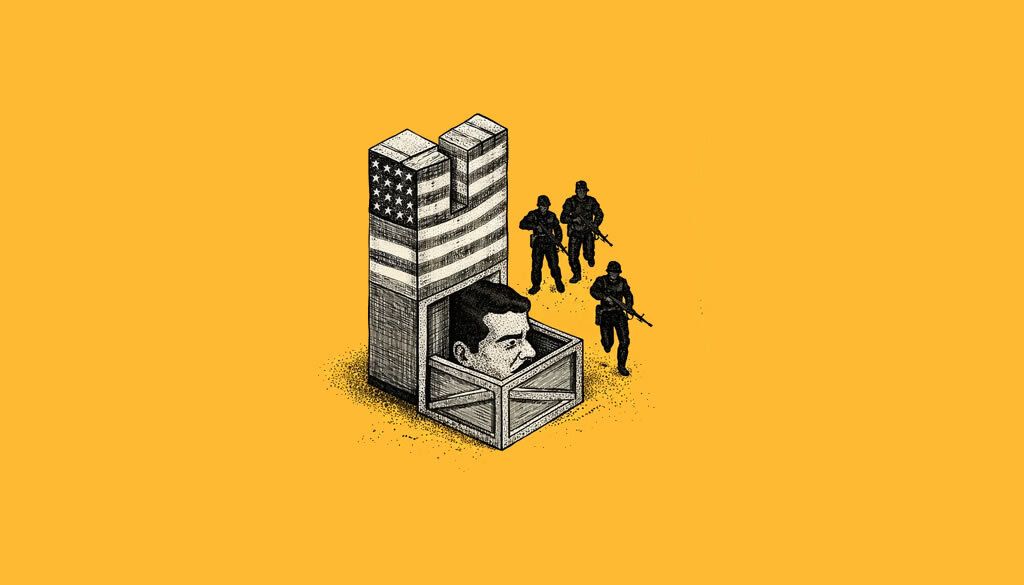

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Cross-Chain Bridges: The Gateways of Blockchain Interoperability

- Shiny Coins #3 – Bloodbath Survivors Rise from the Ashes

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Bitcoin Holds Above $105K as Traders Eye Government Shutdown Deal and Liquidity Boost Bitcoin stabilizes near $106K amid hopes for an end to the U.S. government shutdown, potentially unlocking $150-200 billion in liquidity, though regulatory delays pose risks for the crypto sector....

- Bitcoin and Ethereum Lead 2025’s $7.5B Crypto Fund Rally Crypto Funds Hit $7.5B in 2025 Inflows as Institutional Appetite Grows....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....