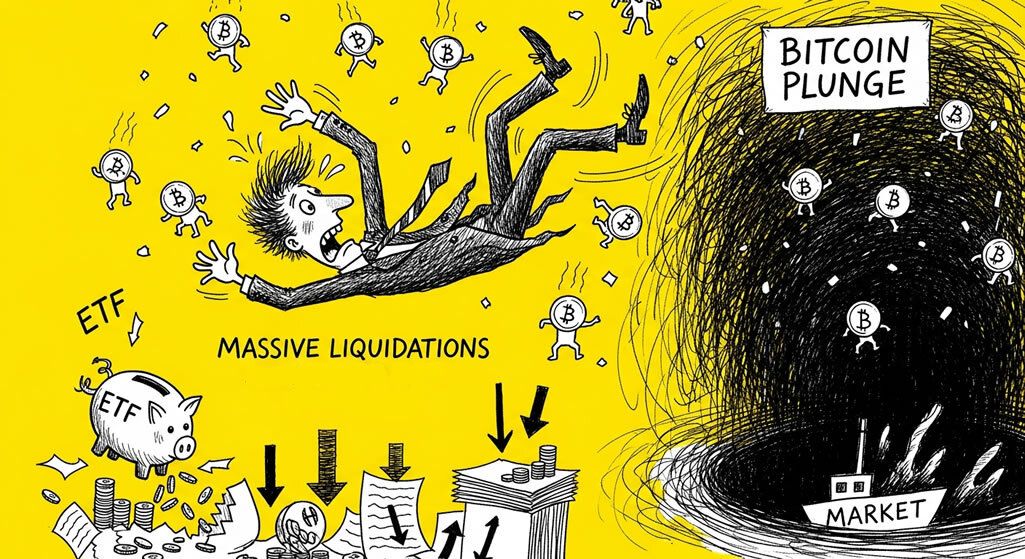

Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows

- Bitcoin fell below $95,000 for the first time since May, down 8% on the day and 24% from its all-time high of $126,200.

- Over $1.24 billion in crypto long positions were liquidated in the past 24 hours amid the market slump.

- U.S. spot Bitcoin ETFs recorded $866 million in net outflows on Thursday, the second-worst day on record.

- Shifting Federal Reserve rate cut expectations and liquidity concerns from the recent U.S. government shutdown contributed to the selloff.

Bitcoin sank below $95,000 on Friday, marking its lowest level in six months and intensifying fears of a broader bear market in cryptocurrencies.

The price drop, which saw Bitcoin decline 8% in a single day, has wiped out over 24% of its value since hitting a record high of $126,200 just five weeks ago. This move pushed Bitcoin into a “death cross,” where the 50-day simple moving average crossed below the 200-day average, signaling weakening short-term momentum.

Massive liquidations exacerbated the downturn. More than $1.24 billion in long positions were wiped out in the past 24 hours, with derivatives data showing sellers dominating perpetual markets. Open interest has risen since an October liquidation event, indicating heightened speculation amid declining cumulative volume delta.

U.S. spot Bitcoin ETFs, a key driver of 2025’s rally, saw $866 million in net outflows on Thursday—the second-highest on record after February’s $1.14 billion—despite the end of a 43-day government shutdown. This followed a fiscal surplus that drained liquidity, with experts pointing to an “information vacuum” and reduced odds of a Federal Reserve rate cut in December.

Market sentiment has soured. The Fear and Greed Index hit 16, indicating extreme fear, while CryptoQuant’s Bull Score showed 8 out of 10 on-chain metrics as bearish, including falling stablecoin liquidity and capital exiting derivatives. The Coinbase premium turned negative, signaling waning U.S. demand.

Analysts are divided on the outlook. “Judging by market movements over the past three months, we must conclude that we are currently in a bear market,” said Adam Chu, chief researcher at GreeksLive. However, Shivam Thakral, CEO of BuyUCoin, described it as a “corrective phase within a broader cycle,” dependent on economic data and regulatory developments.

Ki Young Ju, CEO of CryptoQuant, noted the bull market remains intact above $94,000, the average cost basis for mid-term holders.

Risks include further macro uncertainty. With Fed rate cut odds at roughly 50/50, and a liquidity crunch from the shutdown, Bitcoin could test lower levels like $84,000, according to Ledn’s CIO. Yet, impending fiscal stimulus under the Trump administration may reverse the trend, as suggested by market watcher Mel Mattison.

On X, users highlighted the carnage, with one post noting “260,435 traders liquidated and total liquidations hitting $1.19B” (@kshitizkapoor_).

Tough day, $BTC has dropped to 95K, with 260,435 traders liquidated and total liquidations hitting $1.19B.

— Kapoor Kshitiz (@kshitizkapoor_) November 14, 2025

Let’s take a look at how things are shaping up from here🧵 https://t.co/6GAlarUuWz pic.twitter.com/3n28hDbwiH

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows

- Strategy Buys Bitcoin Every Day This Week Amid Dip, Saylor Denies Sale Rumors

- What is the Revenue Meta in Crypto?

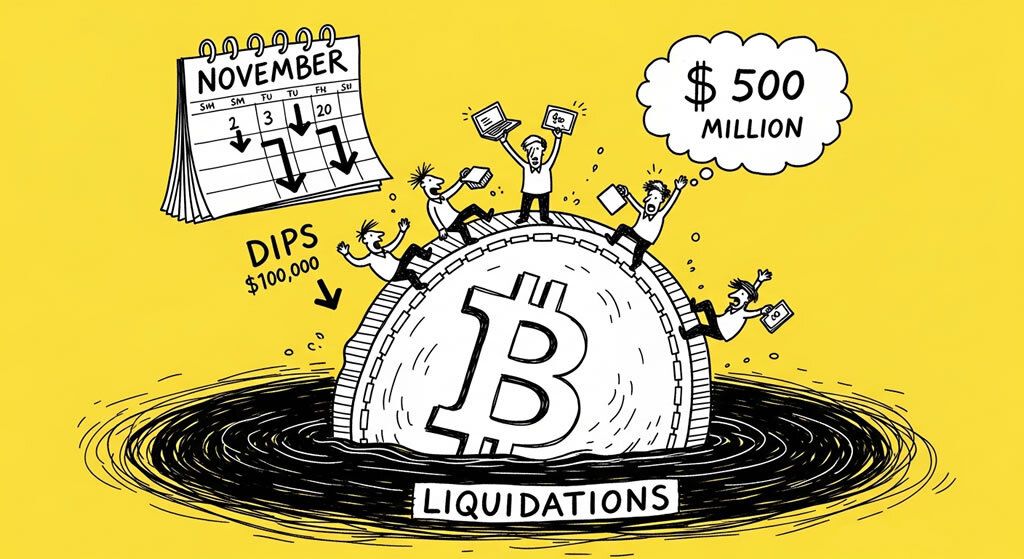

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

Related

- Bitcoin Holds Above $105K as Traders Eye Government Shutdown Deal and Liquidity Boost Bitcoin stabilizes near $106K amid hopes for an end to the U.S. government shutdown, potentially unlocking $150-200 billion in liquidity, though regulatory delays pose risks for the crypto sector....

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million Bitcoin fell below the key $100,000 threshold amid market volatility, triggering over $500 million in crypto liquidations and declines in major altcoins like ETH and SOL....

- US Government Shutdown Freezes Crypto ETF Approvals: Solana, Litecoin in Limbo As the US government shutdown enters its third day, the SEC's skeleton crew has stalled reviews for over 90 crypto ETF applications, including key altcoin funds. Analysts eye year-end approvals amid new listing standards....

- Bitcoin Surges Above $119K as US Government Shutdown Fuels Liquidity Expectations Bitcoin climbed to a seven-week high amid the US government shutdown, with analysts pointing to potential Federal Reserve rate cuts and increased market liquidity as catalysts for the rally....