Bitcoin Holds Steady Near $116K as Traders Await Fed’s Rate Cut Decision

- Fed rate cut: Markets price in 96% chance of 25 basis point reduction today.

- Bitcoin price: Trades around $116,000, up slightly amid anticipation.

- ETF inflows: U.S. spot Bitcoin ETFs record $260 million inflows on Monday.

- Expert outlook: Cut largely priced in; Powell’s comments key for future policy signals.

Bitcoin and major altcoins showed resilience on Tuesday, September 16, 2025, as investors positioned for the Federal Reserve’s anticipated interest rate decision.

The flagship cryptocurrency fluctuated between $115,000 and $116,000, reflecting cautious optimism, while Ethereum maintained levels near $4,200. The overall crypto market cap hovered at $4.1 trillion, buoyed by renewed institutional inflows.

Traders overwhelmingly expect the Fed to implement a 25 basis point cut to its benchmark rate, bringing it to 4.25%-4.50%. This would mark the central bank’s first easing move since 2020, despite August inflation ticking up to 2.9% year-over-year.

According to CoinDesk, the decision could introduce short-term volatility, but sustained easier monetary policy bodes well for risk assets like Bitcoin, which is currently trading below its August all-time high of $124,000.

“It does seem to be pretty priced in. [A cut] has been digested by the markets. Where it gets interesting is what Powell says afterwards—that’s where you’ll see crypto markets flatten out or rally,” Juan Leon, head of strategy at Bitwise, told Decrypt.

U.S. spot Bitcoin ETFs continued their hot streak, attracting $260 million in inflows on September 15 for the sixth straight day, while Ethereum products saw $360 million over five days, per data from The Block.

A surprise 50 basis point cut remains a low-probability wildcard, with Polymarket assigning it just 4% odds. Matt Mena, crypto research strategist at 21Shares, suggested such a move could “spark a renewed leg higher” in crypto prices, especially if paired with a dovish outlook on future cuts.

Historical patterns support a bullish longer-term view. Research cited by CoinDesk indicates that in 20 instances since 1980 where the Fed cut rates near S&P 500 highs, the index rose an average 14% one year later, though monthly dips occurred in over half the cases.

Lower rates typically flood markets with liquidity, directing capital toward high-yield opportunities like cryptocurrencies. Samantha Bohbot, chief growth officer at Rockaway Blockchain Fund, noted to Decrypt: “Lower interest rates increase the liquidity in circulation, and investors deploy capital into more risky assets such as stocks and crypto.”

Yet risks linger if Chair Jerome Powell adopts a hawkish tone, potentially bolstering the dollar and capping upside. Cointelegraph forecasts Bitcoin could breach $120,000 on dovish cues, fueled by ETF demand and a 44,000 BTC net withdrawal from exchanges in September, reducing selling pressure.

Eric Trump, co-founder of American Bitcoin, reinforced Bitcoin’s appeal as an inflation hedge, calling it “the greatest asset of our time” in comments to Cointelegraph.

As the FOMC wraps up, focus will shift to Powell’s press conference for hints on additional easing in 2025, which could propel Bitcoin toward fresh records amid robust corporate and institutional adoption.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

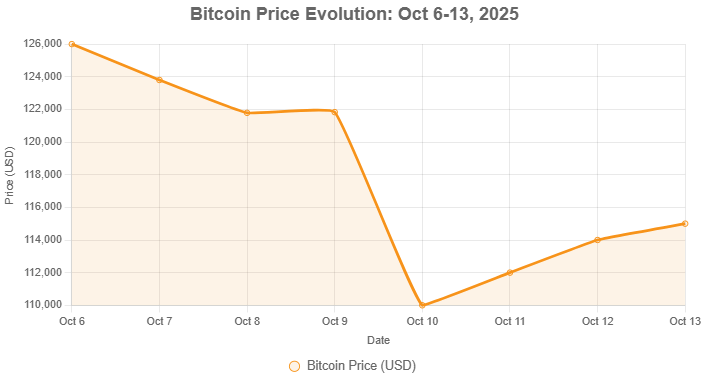

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

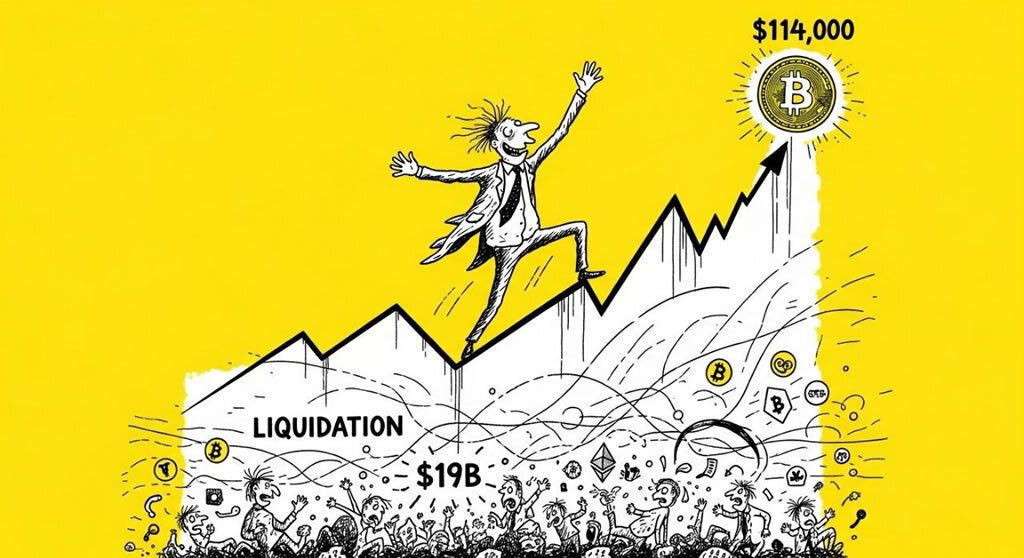

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure

Related

- The Federal Reserve’s Interest Rate Decision Bitcoin and Ethereum saw notable dips, reflecting investor caution amidst the rate cut anticipation....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Bitcoin Reclaims $115,000 as Traders Parse Fed Rate Cut Clues Bitcoin surged above $115,000 on September 12, fueled by softer U.S. CPI data and rate cut expectations, with ETF inflows hitting $552.7 million and analysts eyeing resistance at $116,000....

- 21Shares Files for Spot Dogecoin ETF 21Shares Files for Spot Dogecoin ETF, Aims to Bring Meme Coin to Mainstream Investors....