Bitcoin Holds Above $105K as Traders Eye Government Shutdown Deal and Liquidity Boost

- Bitcoin recovery: The leading cryptocurrency rebounded to near $106,000 after an initial dip, driven by optimism over a potential resolution to the 39-day U.S. government shutdown.

- Liquidity potential: Ending the shutdown could release $150-200 billion from the Treasury General Account, boosting bank reserves and risk assets like crypto.

- Regulatory risks: A prolonged stalemate may stall key legislation, including the CLARITY Act and Senate digital asset bills, delaying clarity needed for institutional adoption.

Bitcoin (BTC) held firm above $105,000 on Monday, recovering from an early 1.5% drop to approach $106,000 by late afternoon. This resilience comes as traders anticipate a deal to end the ongoing U.S. government shutdown, which could inject significant liquidity into financial markets. The positive sentiment was further fueled by a recent post from President Donald Trump teasing a $2,000 dividend funded by tariffs, according to CoinDesk.

Ether (ETH) saw a modest 0.5% decline to below $3,600, while Solana’s SOL gained 1.1% to $167. XRP led altcoin performers with a 9% surge, amid speculation over U.S. spot ETF approvals. Privacy coins like Zcash (ZEC) and Monero (XMR) cooled off, dropping 9% and 11%, respectively.

📈 Bitcoin Hits $105K Bitcoin rises to $105,000 as a deal to reopen the government advances through Congress.

— Cryptopress (@CryptoPress_ok) November 11, 2025

Crypto equities also rebounded, with Coinbase (COIN) up 4.1%, Robinhood (HOOD) rising 4.8%, and others like Circle posting gains. This mirrored broader market rallies, with the S&P 500 climbing 1.6% and Nasdaq up 2.2%.

Polymarket betting odds indicate an 86% chance the shutdown ends between November 12-15. David Nage, head of research at Arca, highlighted the dual implications in a note: “If the shutdown ends in November, we may benefit from both a liquidity injection and a legislative opportunity. If it drags into December, the legislation may miss its window.”

While the liquidity boost could propel risk assets, Nage warned of downsides. The shutdown has halted progress on crypto-friendly bills, potentially pushing regulatory clarity to 2026 or beyond. “If comprehensive digital asset legislation is delayed until 2026 and then dies in midterm politics, the industry will miss out on the regulatory clarity needed to attract institutional capital and achieve sustainable growth,” he added, per Yahoo Finance.

Market analysts note that the shutdown’s impact on crypto policy remains understated but critical, with key committee work stalled. Investors should monitor shutdown negotiations closely, as resolution could catalyze further upside in Bitcoin and the broader market.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Dogecoin Leads Meme Coin Surge as Sector Kicks Off 2026 with Strong Gains

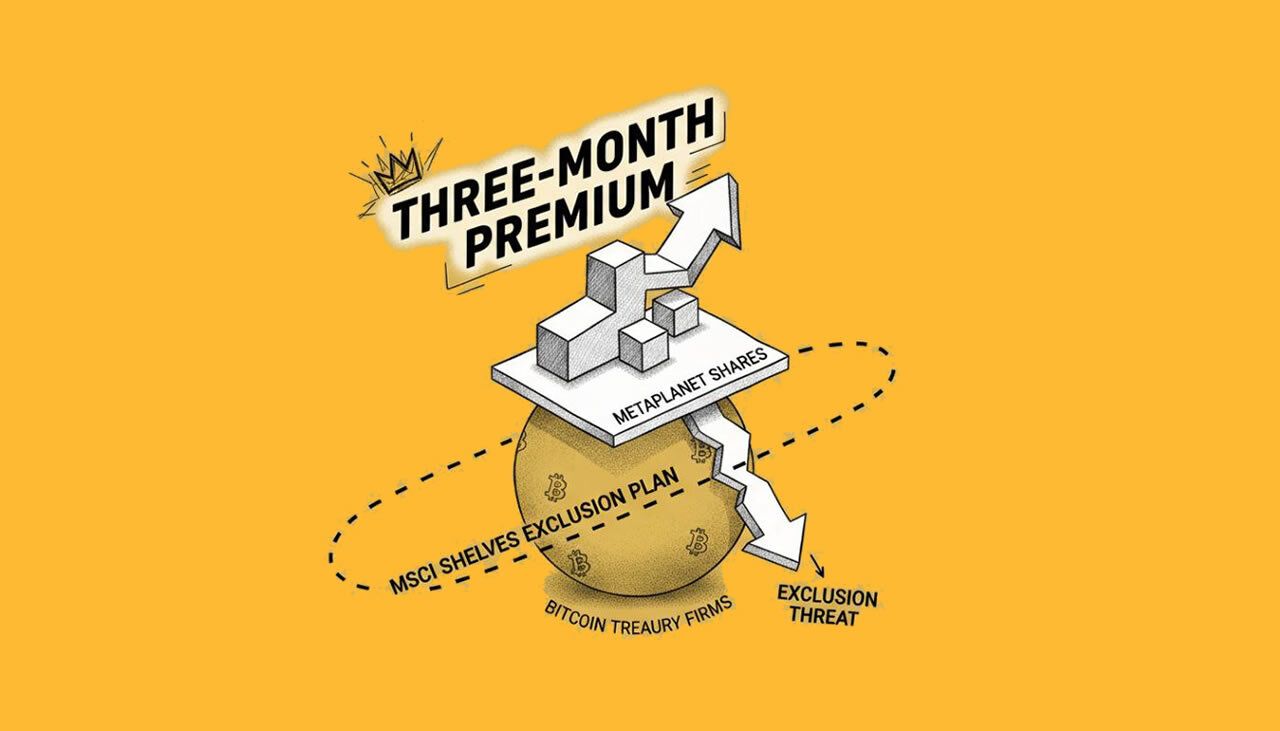

- Metaplanet Shares Hit Three-Month Premium After MSCI Shelves Exclusion Plan for Bitcoin Treasury Firms

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

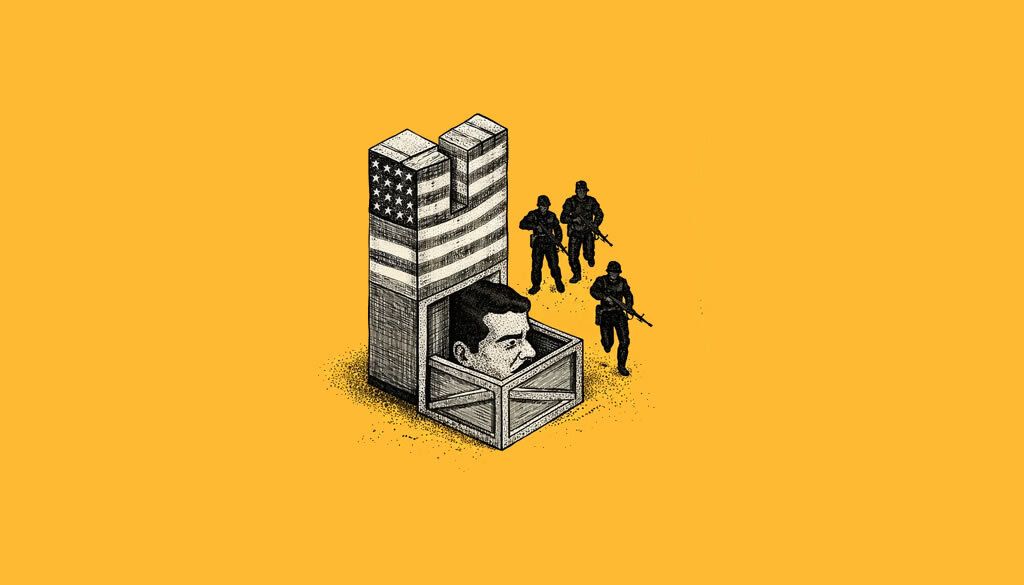

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Bitcoin surges above $106K as US Senate advances bill to end government shutdown Crypto markets rebound sharply as lawmakers reach a bipartisan deal to resolve the 40-day US government shutdown, with Bitcoin climbing 4.4% and Ethereum jumping 7.8%....

- Weekly Crypto Snapshot – Crypto’s Post-Shutdown Rebound Rally Crypto's Volatile November: Shutdown End Sparks $106K Bitcoin Breakout....

- US Government Shutdown Freezes Crypto ETF Approvals: Solana, Litecoin in Limbo As the US government shutdown enters its third day, the SEC's skeleton crew has stalled reviews for over 90 crypto ETF applications, including key altcoin funds. Analysts eye year-end approvals amid new listing standards....