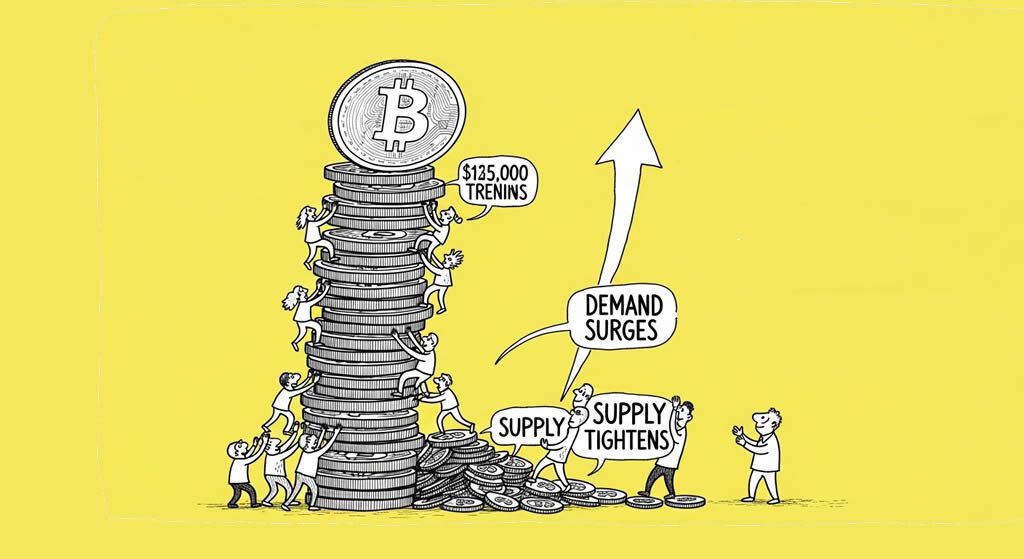

Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

- Bitcoin surged to a new ATH of $125,899, driven by nearly $50 billion in 24-hour trading volume.

- Over $200 million in short positions liquidated, fueling the rally.

- Analysts predict further gains, with Standard Chartered forecasting $200,000 by year-end.

Bitcoin has climbed to a fresh all-time high, touching $125,899 on major exchanges, as institutional demand and favorable macro conditions propel the cryptocurrency higher.

The rally comes amid tightening supply and surging interest from investors seeking hedges against economic uncertainty. ETF inflows hit $3.2 billion last week, marking the second-highest since January, according to data from Investopedia.

Short sellers faced significant pain, with over $200 million in Bitcoin shorts liquidated in the past 24 hours, per CoinGlass, as reported by Decrypt. This forced buying contributed to the upward momentum.

Macro factors, including a potential U.S. government shutdown and geopolitical tensions, are driving the “debasement trade,” where investors turn to hard assets like Bitcoin and gold, notes JP Morgan analysts.

Joe DiPasquale, CEO of BitBull Capital, commented: “The broader setup remains bullish, with a prolonged government shutdown likely to continue driving interest in hard assets and supporting demand for Bitcoin as an alternative store of value,”.

Analysts at Standard Chartered project Bitcoin could reach $135,000 in the near term and surpass $200,000 by the end of 2025.

While the surge is exciting, risks remain. Technical indicators suggest room for further upside, but pullbacks could test support levels at $107,000 and below, according to analysts from Reuters.

For context on leading cryptocurrencies, see Cryptopress.site listings for Bitcoin (BTC) and Ethereum (ETH).

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

- US Lawmaker Proposes Crypto Trading Ban for Elected Officials Amid Backlash Over CZ Pardon

- Crypto Market Cap Surges to $3.88 Trillion Amid US-China Trade Deal Optimism

- Democratic Pushback Intensifies Against Trump’s Pardon of Binance Founder CZ

- 5 Best Crypto Prop Trading Firms in 2025

Related

- Standard Chartered Bank Enters Crypto Trading with Bitcoin and Ethereum Desk Standard Chartered Bank is set to launch a Bitcoin and Ethereum trading desk in London....

- Standard Chartered Predicts Massive 2025 Gains for Bitcoin and Ethereum Bitcoin projected to reach $200,000 by 2025....

- Bitcoin Hits New All-Time High Above $125,000 Amid Institutional Inflows and Market Uncertainty Bitcoin surges to a record $125,689, driven by ETF inflows and economic concerns, marking a significant milestone in the cryptocurrency market....

- Bitcoin Surges Past $110,000 Amid ETF Frenzy Bitcoin Hits $110,000: Institutional Demand and DeFi Fuel Record Rally....