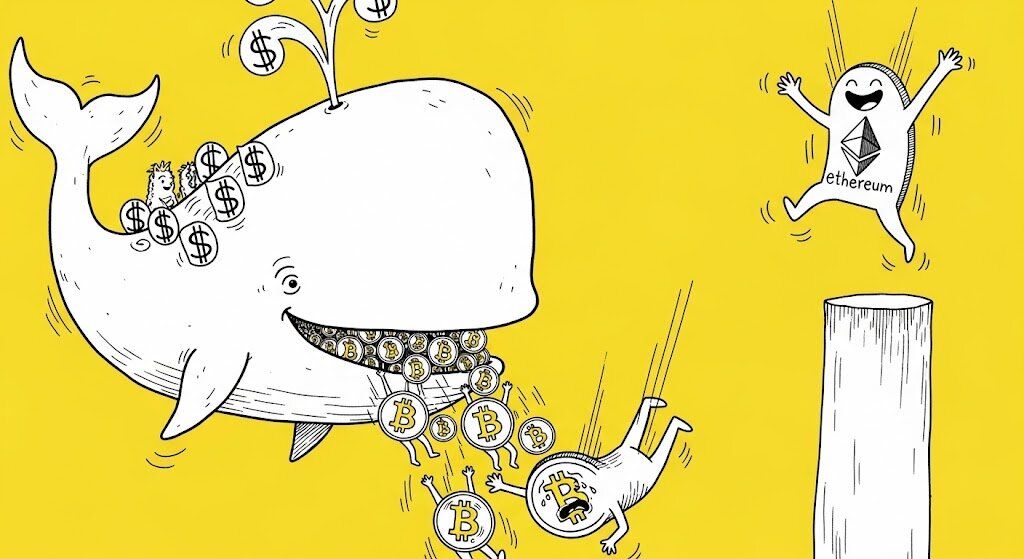

Bitcoin Flash Crashes Below $112,000 as Whale Sells $2.7B in BTC, Fueling Ethereum’s New All-Time High

- Flash Crash Triggered by Whale: A major Bitcoin holder sold 24,000 BTC, causing a 2%+ drop in minutes to below $112,000.

- Massive Liquidations: The event led to $550 million in total crypto liquidations, including $238 million in Bitcoin positions.

- Ethereum’s Record Rally: ETH hit a new all-time high of $4,935, up 220% from its April low, as whales rotate funds from BTC.

- Market Rotation: Bitcoin dominance fell to 57.94%, signaling investor shift to altcoins amid Fed rate cut expectations.

Bitcoin‘s price plummeted in a flash crash on Sunday, August 24, 2025,dropping over 2% in under ten minutes to a low of $112,174. The sudden decline was triggered by a large whale selling approximately 24,000 BTC, valued at around $2.7 billion, with much of the proceeds rotated into Ethereum. This event erased recent gains spurred by Federal Reserve Chair Jerome Powell’s hints at a September rate cut.

On-chain data reveals the whale’s strategy: The address, dormant for years, moved funds to platforms like Hyperliquid, converting BTC to ETH and staking over $1.3 billion. Analysts estimate the whale profited $185 million from the trade, frontrunning market participants and causing a cascade of sell orders due to thin weekend liquidity.

Meanwhile, Ethereum demonstrated resilience, surging to a new all-time high of $4,935 amid increased institutional interest and ETF inflows. Year-to-date, ETH has gained 45%, outpacing Bitcoin in recent weeks as investors bet on its smaller market cap and potential for greater upside in a low-rate environment.

“Bitcoin’s spike after Powell’s speech was driven by thin liquidity, not lasting conviction,”

Vincent Liu

“Bitcoin’s spike after Powell’s speech was driven by thin liquidity, not lasting conviction,” said Vincent Liu, CIO at Kronos Research. Similarly, various users commented on X that OG whales are slowing BTC’s rise, requiring over $110,000 in new capital per sold Bitcoin.

A massive 24,000 $BTC ($2.7B) whale sell order triggered Bitcoin’s weekend dip, causing a flash crash.

— Licorne Web3 (@licorneweb3) August 25, 2025

Over $623M in liquidations followed as $BTC slid to $110,484 before recovering above $113K.#Bitcoin #WhaleWatch #CryptoUpdates #licorneweb3 pic.twitter.com/JvvnqP5hgW

This rotation underscores a broader trend of whales shifting from Bitcoin to Ethereum, potentially influenced by upcoming ETH staking approvals in ETFs. However, risks remain, including further volatility from macroeconomic uncertainties and potential additional whale sales.

For related coverage on Bitcoin’s dip amid ETF outflows, see this article from Cryptopress.site.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, investment, or financial advice. Readers should conduct their own research before making investment decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- 5 Best Crypto Prop Trading Firms in 2025

- Unlock Bitcoin Yields: Earn Up to 0.23% APR with Babylon Labs Staking

- Bitcoin Tops $111K, European Stocks Rise as Trump-Xi Meeting Confirmed Amid Trade Tensions

- Senate Democrats Reaffirm Commitment to Crypto Market Bill

- BlockDAG Nears $600M Goal as DOGE Targets $0.30 and HBAR Builds Momentum Toward $1 Breakout

Related

- What Is a crypto whale? "Whale" is a word used to describe investors with a ridiculous amount of cryptocurrency....

- Bitcoin whales have added USD $11 billion BTC Adding more than 129,000 BTC despite a recent price correction....

- These Are the 5 Whales With the Most Bitcoin Holdings Have you ever wondered who holds the biggest chunks of Bitcoin?...

- Mantra OM Token Crash Losing around $5 billion in market cap in less than an hour....