Bitcoin ETFs Record $145 Million Monday Inflows as Market Signals Potential Inflection Point

- Spot Bitcoin ETFs recorded $145 million

in net inflows on Monday, marking a second consecutive day of positive

momentum.

The recovery follows a $371 million dip-buying surge last

Friday, which halted a multi-week trend of steady institutional

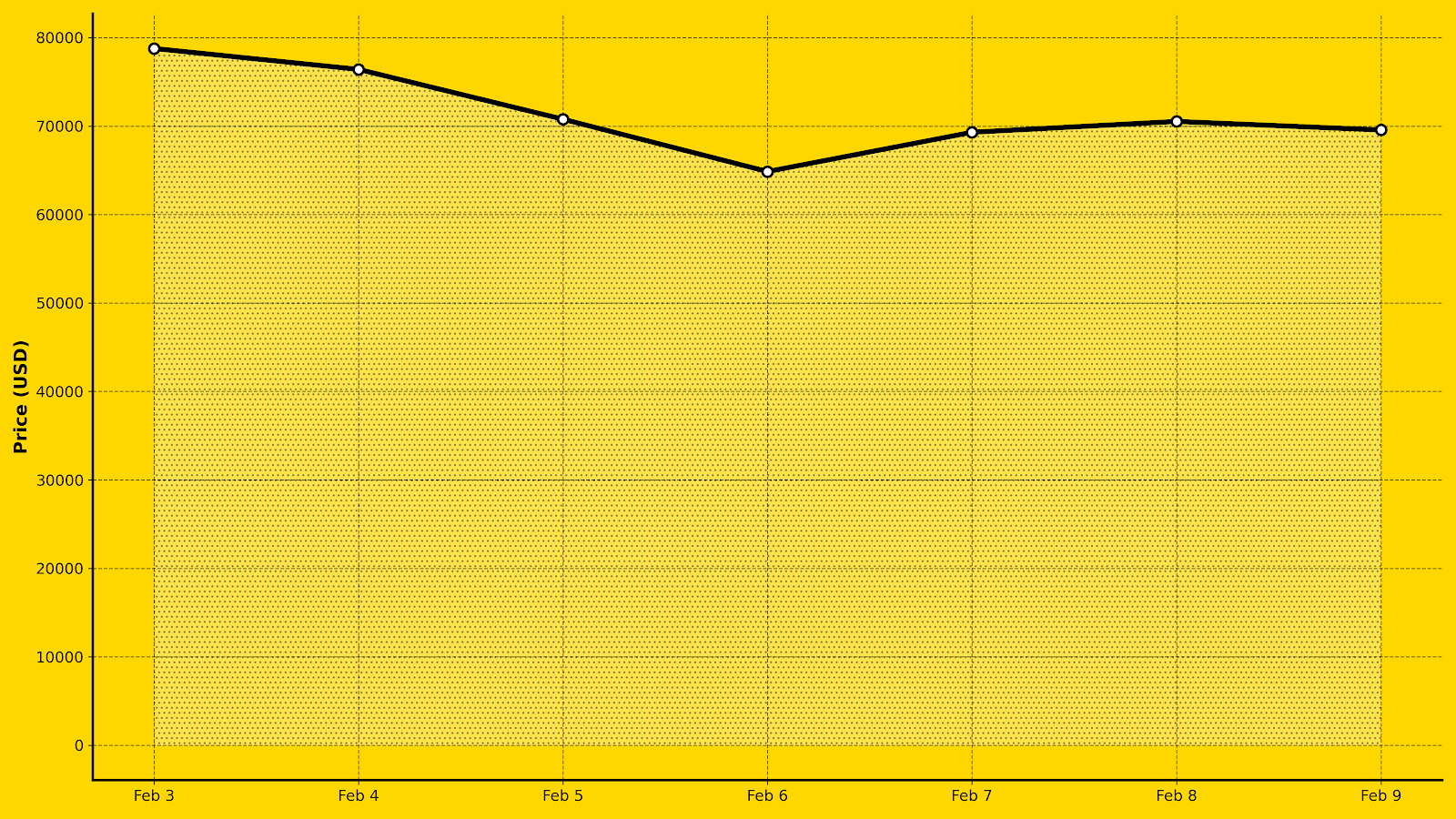

selling. - Bitcoin is currently trading just below

$69,000, while the Solana-based AI agent token Pippin

(PIPPIN) surged 40% in 24 hours.

U.S.-based spot Bitcoin ETFs

attracted $145 million in net inflows on Monday, reinforcing a timely

rebound in institutional sentiment. This positive shift builds on

dip-buying momentum established last Friday, when

investors poured $371 million into BTC ETFs following weeks of persistent

outflows. Market analysts suggest that this stabilization in fund flows

could indicate a broader recovery for the digital asset sector as macro

uncertainty begins to subside.

According to research from CoinShares, the deceleration of outflows is a

significant metric for traders. “Outflows decelerating can signal a potential

inflection point,” the firm noted, suggesting that the recent sell pressure

may have reached exhaustion. Bitcoin (BTC) was trading at $68,900 as

of 8:58 a.m. EST, up 0.5% in the past 24 hours. The largest cryptocurrency

briefly reclaimed the $71,000 level yesterday, moving in

tandem with a rally in U.S. equity markets before settling into its current

range.

While the market leader showed stability, speculative interest has pivoted

toward niche sectors, specifically AI-driven agents on the

Solana blockchain. Pippin (PIPPIN), an AI agent play, has

dominated trading charts with a 40% price increase over

the last day. The token has doubled to 36 cents since last Tuesday, pushing

its market capitalization to $360 million and securing its

position as a top-120 coin by market value.

Analysts have highlighted the token’s relative strength in a volatile

environment. Observers at AMBCrypto noted that Pippin has been

one of the few altcoins to exhibit longer-term strength

against both Bitcoin and the wider market. However, investors remain

cautious regarding its ownership structure, as the asset is predominantly

insider-owned, which may pose liquidity risks if sentiment shifts

abruptly.

The stabilization of ETF flows provides a crucial

backdrop for Bitcoin as it attempts to break through psychological

resistance at $70,000. With institutional products now holding roughly

6.4% of the total Bitcoin supply, the transition from

mechanical selling to active accumulation remains a key catalyst for price

discovery in the coming weeks.

Disclaimer: This article is for informational purposes only and does not

constitute advice of any kind. Readers should conduct their own research

before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Whales Accumulate as Institutional Sentiment Remains Fragmented Near $69,000

- Bitcoin ETFs Record $145 Million Monday Inflows as Market Signals Potential Inflection Point

- South Korea Intensifies Probe into Bithumb After $43 Billion Bitcoin Fat-Finger Fiasco

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

Related

- Ethereum Soars Past $3,300: Institutional Inflows and On-Chain Activity Drive Bullish Momentum U.S. spot ETH ETFs recorded a record-high net inflow of $717 million on July 16, 2025, with monthly inflows crossing $2.27 billion....

- Bitcoin and Ethereum Lead 2025’s $7.5B Crypto Fund Rally Crypto Funds Hit $7.5B in 2025 Inflows as Institutional Appetite Grows....

- Ethereum ETFs Outperform Bitcoin ETFs with $100M Inflows Ethereum ETFs continue to gain traction while Bitcoin ETFs face challenges....

- Spot Ether ETFs Hit Record $1B Daily Inflows Amid Surging Institutional Interest U.S. spot Ether ETFs recorded over $1 billion in net inflows on Monday, marking a historic milestone as institutional demand for Ethereum intensifies....