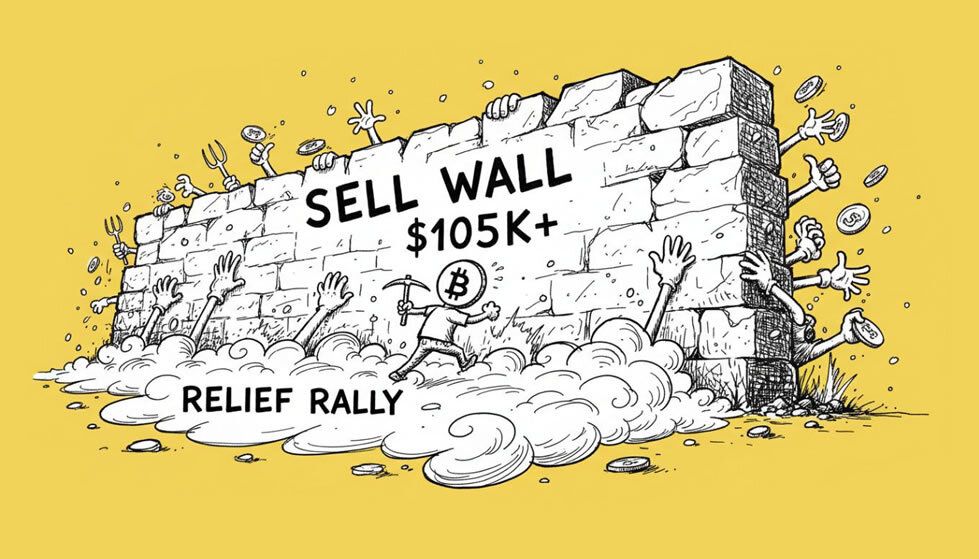

Bitcoin Encounters Formidable Sell Wall Above $105K Amid Relief Rally

- Significant sell wall above $105,000 is capping Bitcoin’s upside potential.

- Relief rally lifts price from $99,600 to around $103,400.

- Whale influence is diminishing, with ETF flows taking precedence.

- Market volatility eases, but risks persist at key support levels.

Bitcoin is grappling with strong resistance as it nears $105,000, where a large concentration of sell orders is hindering further advances.

Traders have spotlighted an ‘insane’ sell wall extending to $112,000, which may be intended to depress prices during periods of thin liquidity. Cointelegraph reports that such orders could be withdrawn if prices approach the threshold.

📉 Bitcoin Rebounds Slightly: The crypto market sees a brief rebound with Bitcoin trading above $104K, though bearish pressures remain amid recent volatility.

— Cryptopress (@CryptoPress_ok) November 6, 2025

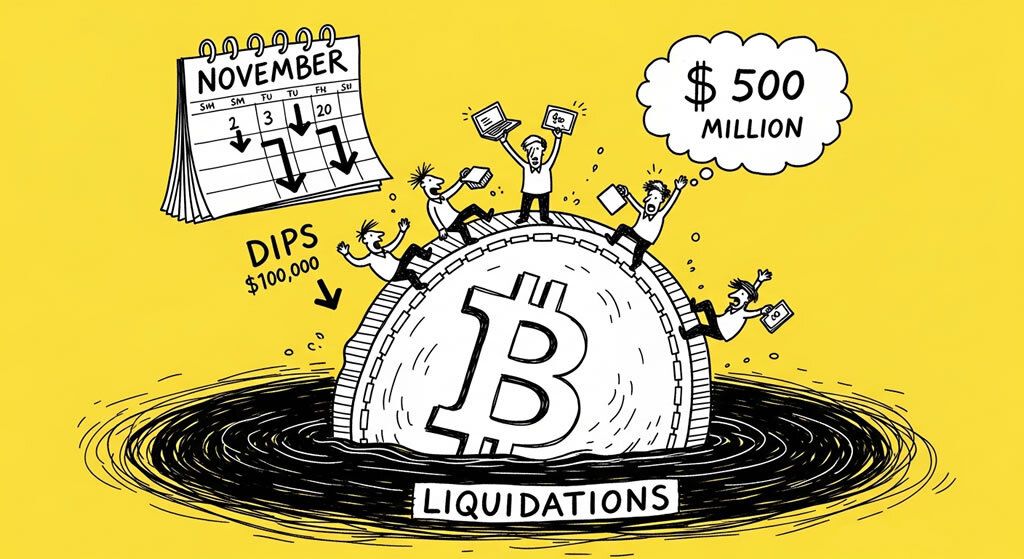

Recent Price Action: After dipping to $99,600, Bitcoin has rebounded to approximately $103,400, reducing the percentage of supply held at a loss to 28.1%, per CryptoQuant data. This level has historically signaled upcoming rallies.

On-chain expert Willy Woo observed that ‘liquidity behind Bitcoin is recovering,’ potentially solidifying a bottom in the next two weeks. Yet, MEXC Research’s Shawn Young warns the bounce may lack long-term conviction without stronger accumulation.

Evolving Market Drivers: Large Bitcoin holders’ sway is waning, with spot ETF flows emerging as the key influencer since January 2024. Exchange balances at six-year lows amplify the impact of orders.

Bid liquidity is accumulating near $100,000, but a breach could trigger drops to $93,000-$88,000, analysts suggest.

Market volatility has eased, with $314M in liquidations over the past 24H — down from billions earlier this week.

— Bitcoin.com News (@BTCTN) November 6, 2025

Despite the rebound, longs vs shorts sit nearly even at 49.47% / 50.53%, hinting at potential downside ahead. pic.twitter.com/wNQNjqustL

Reflecting broader crypto engagement, Robinhood’s Q3 transaction-based revenue soared 129% year-over-year to $730 million, fueled mainly by cryptocurrency trading.

Analyst Tim Enneking calls the $100,000 level a ‘massive magnet’ attracting market action. Forbes.

Investors should watch macroeconomic factors, including potential tariff decisions, which could affect equities and indirectly influence crypto sentiment.

For more detailed information on Bitcoin, refer to this section: https://cryptopress.site/coins/bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Plunges Below $95,000 Amid Massive Liquidations and Record ETF Outflows

- Strategy Buys Bitcoin Every Day This Week Amid Dip, Saylor Denies Sale Rumors

- What is the Revenue Meta in Crypto?

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

Related

- Telegram Bots for DEX Trading: Benefits and Risks Telegram Bots for DEX Trading: What You Need to Know....

- 21Shares Files for Spot Dogecoin ETF 21Shares Files for Spot Dogecoin ETF, Aims to Bring Meme Coin to Mainstream Investors....

- Circle’s IPO Soars on Wall Street Historic Surge: The stock peaked at $123.51 on June 6, nearly quadrupling its IPO price, though trading was halted multiple times due to volatility....

- A List of Available Bitcoin ETFs List of Bitcoin ETFs: current Bitcoin ETFs available....