Bitcoin Dips to 15-Week Low as Regional Bank Woes Trigger $1.2B in Crypto Liquidations

- Bitcoin price slumps to under $105,000, marking a 15-week low, driven by U.S. regional bank troubles.

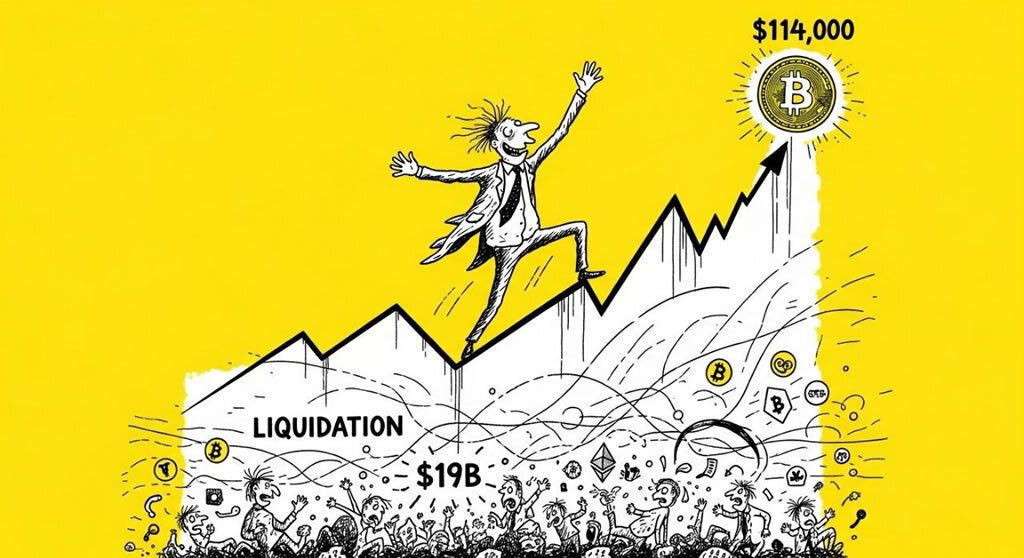

- Over $1.2 billion in crypto positions liquidated in 24 hours as market cap sheds hundreds of billions.

- Analysts warn of further downside but highlight potential Fed response as bullish catalyst.

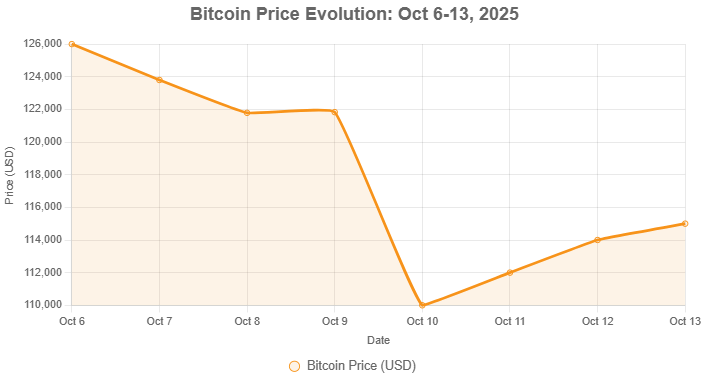

Bitcoin tumbled to its lowest level in 15 weeks on Friday, dipping below $105,000 as fears over U.S. regional banks resurfaced, reminiscent of the 2023 crisis that shook financial markets.

The leading cryptocurrency Bitcoin (BTC) fell as low as $104,000, according to data from major exchanges, amid a broader sell-off that wiped out $1.2 billion in leveraged positions across the crypto market. This marks one of the largest single-day liquidation events this year, fueled by cascading forced sales.

Renewed turmoil in regional banking stocks, including sharp declines in shares of Zions Bancorp and Western Alliance, contributed to the risk-off sentiment. JPMorgan CEO Jamie Dimon warned of emerging credit problems, stating, “When you see one cockroach, there are probably more,” during a recent earnings call.

“When you see one cockroach, there are probably more,”

Jamie Dimon, JPMorgan CEO

Echoing 2023’s banking crisis, when Silicon Valley Bank’s collapse triggered a Bitcoin flash crash, current woes have traders on edge. Gold, often seen as a safe haven, hit new all-time highs near $4,300 per ounce, diverging from Bitcoin’s path.

Options data shows increased put demand, with analysts noting selective whale selling rather than panic. “It’s selective distribution, not panic,” said Timothy Misir, head of research at BRN.

Ethereum Ethereum (ETH) also suffered, dropping below $4,000, as the total crypto market cap fell by over $600 billion in recent days.

While near-term risks remain, some see opportunity. Bitwise CIO Matt Hougan described the event as a “structural reset,” suggesting a path to $150,000 for Bitcoin if institutional demand holds amid potential Fed easing.

Peter Schiff, a vocal Bitcoin critic, argued gold would reach $1 million before Bitcoin, highlighting the asset’s failure as “digital gold.”

For more insights on market crashes, see this related article from Cryptopress.site: Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Dips to 15-Week Low as Regional Bank Woes Trigger $1.2B in Crypto Liquidations

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

- Weekly Crypto Roundup – Turbulence, Tariffs, Liquidations, and the Road to Recovery

Related

- Interest Rates Unchanged in the United States, Bitcoin $84k The Federal Reserve kept interest rates unchanged at 4.25%-4.5%....

- Digital dollar project CBDC (Central Bank Digital Coin) aims to make the dollar a much better and smarter currency to serve all those transacting in dollars....

- Robert Kiyosaki: The true inflation will be 16% Kiyosaki recommends investing in "real money" such as Bitcoin in the face of a dismal economic forecast....

- Bitcoin’s Big Week: Inflation, Fed, and the Future Bitcoin Hits $84K After U.S. CPI Drops to 2.8%....