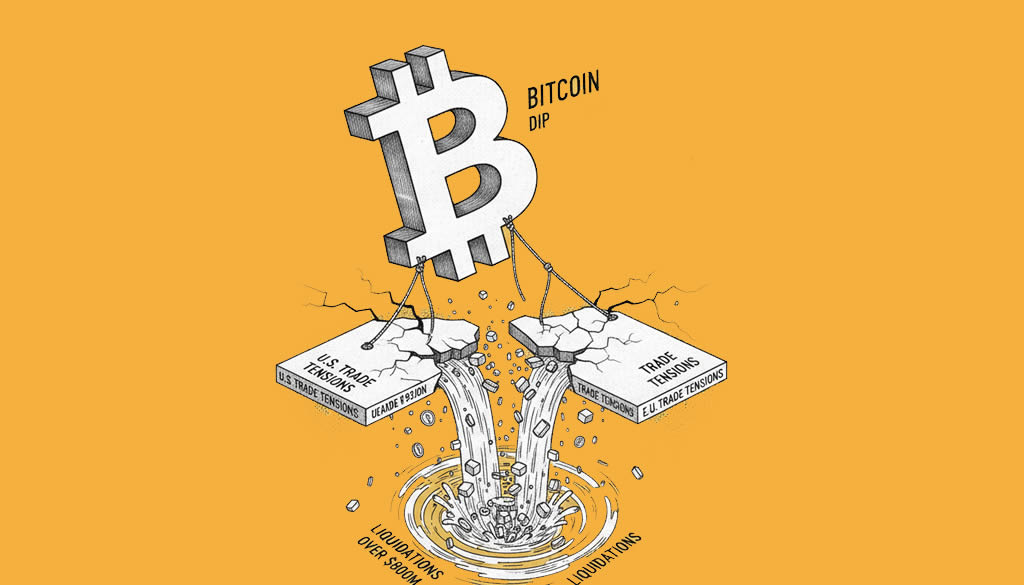

Bitcoin Dips Below $93,000 Amid U.S.-EU Trade Tensions

- Price Drop: Bitcoin fell approximately 3% to below $93,000, with intraday lows reaching around $92,000.

- Liquidations Surge: More than $800 million in leveraged crypto positions were liquidated in the past 24 hours, predominantly long bets.

- Geopolitical Trigger: The selloff follows U.S. President Donald Trump’s announcement of 10% tariffs on eight European countries amid disputes over Greenland.

The cryptocurrency market faced renewed pressure on January 18, 2026, as Bitcoin (BTC) slid below $93,000, driven by escalating trade tensions between the U.S. and the European Union. This decline reflects a broader risk-off sentiment, with investors rotating into safe-haven assets like gold and silver, which hit record highs.

The drop erased gains from a recent rally toward $98,000, with Bitcoin trading near $92,500 as Asia opened on Monday. Data from CoinGlass showed roughly $600 million in long positions liquidated, contributing to the volatility.

Altcoins bore the brunt of the downturn. Solana (SOL) dropped over 6%, XRP fell about 4%, and Dogecoin (DOGE) declined more than 7%. Ethereum (ETH) saw a 3% decrease, hovering around $3,200, per Bloomberg.

The catalyst was Trump’s tariff announcement on goods from Denmark, Sweden, France, Germany, the Netherlands, Finland, the UK, and Norway, effective February 1 unless the U.S. gains rights to acquire Greenland. EU officials responded with threats of retaliatory tariffs up to $101 billion, heightening global uncertainty.

Market analysts warn of further downside. Glassnode data indicates the prior rally was leverage-driven, making the market susceptible to such corrections. Total liquidations reached up to $900 million in some estimates, underscoring overcrowded bullish positioning. Yahoo Finance highlighted that the retreat follows a derivatives-fueled push, with CryptoQuant signaling weak underlying demand.

Neutral outlook amid volatility. While the event highlights crypto’s sensitivity to macroeconomic factors, some see it as a temporary pullback. Investors are advised to monitor trade developments closely, as prolonged tensions could impact broader risk assets.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Metals Rally to Records as Crypto ETFs See Strong Inflows Amid U.S.-Europe Trade Tensions Over Greenland

- NYSE Develops Blockchain Platform for 24/7 Tokenized Securities Trading

- Crypto Weekly Snapshot – Tariff Fears Hammer Crypto as Inflows Provide Relief

- Bitcoin Dips Below $93,000 Amid U.S.-EU Trade Tensions

- Ethereum Daily Transactions Surge to All-Time High as Gas Fees Fall to Record Lows

Related

- Cryptocurrency Market Reactions to “Liberation Day” Ethereum, Solana, and XRP dropped 6% to 12%, market sensitivity to trade policies....

- Bitcoin Tops $111K, European Stocks Rise as Trump-Xi Meeting Confirmed Amid Trade Tensions The White House's confirmation of a meeting between U.S. President Donald Trump and Chinese President Xi Jinping has boosted Bitcoin above $111,000 and lifted European stocks, offering a glimmer of hope amid escalating U.S.-China trade disputes....

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- Bitcoin Nears $119K Amid Trump-EU Trade Pact and China Tariff Truce How the Trump-EU tariff deal and US-China tariff talks are driving Bitcoin near $119K and fueling crypto market optimism....