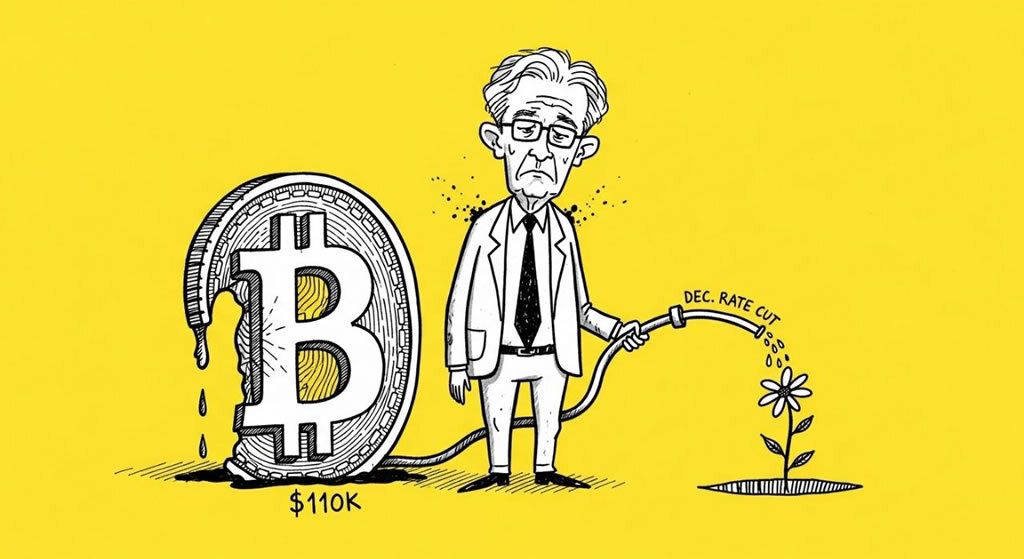

Bitcoin Dips Below $110K as Powell Tempers Expectations for December Rate Cut

- Bitcoin price dropped to a low of $108,000 after Fed Chair Powell indicated a December rate cut is ‘not a foregone conclusion.’

- The Federal Reserve cut its benchmark rate by 25 basis points, but the hawkish tone triggered $817 million in crypto liquidations.

- This reaction highlights crypto’s sensitivity to monetary policy, potentially delaying Bitcoin’s push toward new all-time highs.

Bitcoin experienced a sharp decline yesterday, falling below $110,000 shortly after the U.S. Federal Reserve announced a 25 basis point interest rate cut. Data from CoinDesk shows the cryptocurrency dipped to around $108,000, marking a 3.8% drop within hours. This move came despite the anticipated rate reduction, as investors focused on the Fed’s cautious forward guidance.

The Fed’s decision brought the target range to 4.5%-4.75%, aligning with market expectations. However, Chair Jerome Powell’s press conference introduced uncertainty. “A decision to cut in December is not a foregone conclusion,” Powell stated, as reported by News.Bitcoin.com. This hawkish tilt scaled back projections for additional easing, prompting a risk-off sentiment across financial markets.

📉 Bitcoin Price Dip Bitcoin falls below $110K after Fed Chair Powell signals caution on future cuts, erasing recent gains.#Bitcoin

— Cryptopress (@CryptoPress_ok) October 30, 2025

Crypto liquidations surged amid the volatility. According to Seeking Alpha, over $817 million in positions were liquidated, with Bitcoin and Ethereum accounting for the majority. Ethereum also tumbled, dropping about 4% to test support levels around $3,600.

Analysts note this as a classic ‘buy the rumor, sell the news’ event. “The market had priced in more aggressive cuts, but Powell’s comments reset expectations,” said an analyst quoted in Decrypt. For context on market dynamics, refer to Bitcoin details and Ethereum insights from CryptoPress.

Risks include further downside if economic data softens. Bitcoin has since recovered slightly to around $110,500, per Barron’s, but traders warn of potential retests of lower supports. Sustained hawkish policy could hinder crypto’s institutional inflows, though long-term bulls remain optimistic on Bitcoin’s scarcity narrative.

More articles on Fed impacts on crypto can be found at CryptoPress.site.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Dips Below $110K as Powell Tempers Expectations for December Rate Cut

- Bitwise Solana ETF Surges to $72 Million Volume on Second Trading Day

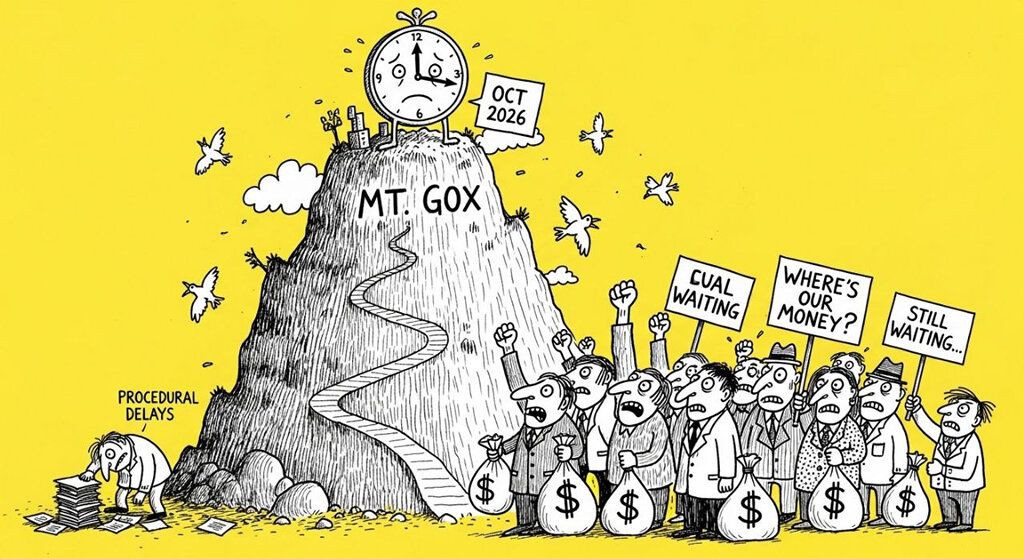

- Mt. Gox Extends Creditor Repayment Deadline By One Year

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

- US Lawmaker Proposes Crypto Trading Ban for Elected Officials Amid Backlash Over CZ Pardon

Related

- Jerome Powell Signals Rate Cuts at Jackson Hole Jerome Powell's Jackson Hole speech signals interest rate cuts - Economic Insights....

- Bitcoin Holds Steady Near $116K as Traders Await Fed’s Rate Cut Decision Cryptocurrencies remain stable ahead of the Federal Reserve's expected 25 basis point rate cut on September 17, with analysts anticipating potential short-term volatility but long-term gains for Bitcoin and risk assets....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Interest Rates Unchanged in the United States, Bitcoin $84k The Federal Reserve kept interest rates unchanged at 4.25%-4.5%....