Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Bitcoin price decline: BTC slipped below $100,000 to around $95,400, marking the third dip this month.

- Liquidations surge: Over $500 million in crypto positions liquidated in the past 24 hours, mostly long bets.

- Market drivers: Fading Fed rate cut odds, data delays from government shutdown, and increased selling from long-term holders.

Bitcoin has dipped below the $100,000 mark for the third time in November, trading as low as $98,842 amid a broader market pullback.

The leading cryptocurrency declined over 2% in the past 24 hours, according to data from CoinGecko, reflecting heightened volatility in the crypto sector.

Major altcoins also faced pressure, with Ethereum (ETH) dropping up to 8% to $3,265 and Solana (SOL) falling around 6% to $148, per market data.

The price action led to significant liquidations, totaling $501 million across the crypto market, including $165 million in Bitcoin positions alone. Long positions accounted for the majority, with $380 million wiped out.

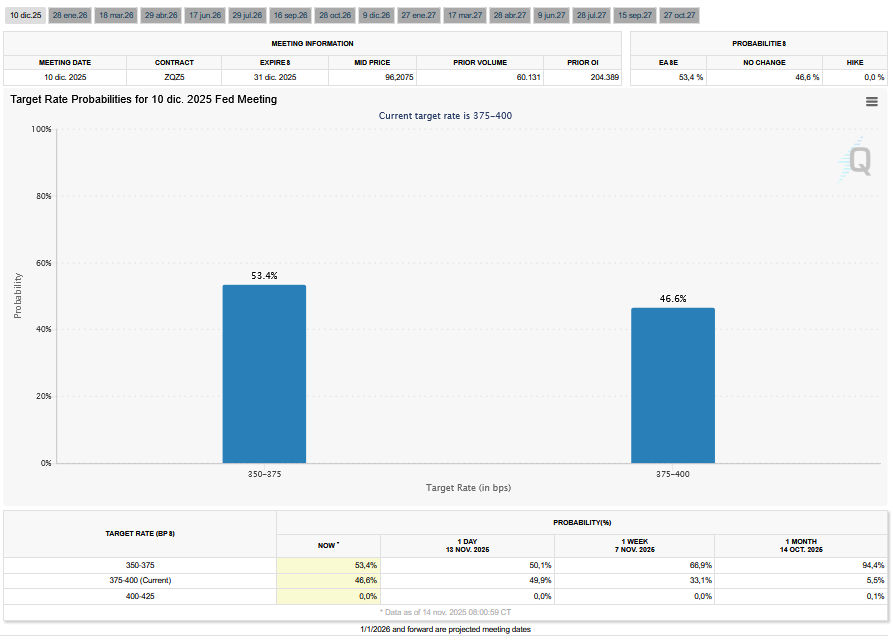

Analysts attribute the downturn to several macroeconomic factors. The odds of a Federal Reserve rate cut in December have dropped from last week, following hawkish remarks from Fed Chair Jerome Powell, based on the FedWatch tool.

Government shutdown fallout has delayed key economic reports, such as October’s CPI data, adding to market uncertainty.

“Today was supposed to see the delayed release of the U.S. CPI report from October, but instead it appears the government shutdown has created a black hole in the flow of federal data,” said Nic Puckrin, co-founder and analyst at The Coin Bureau.

On-chain metrics show long-term holders have sold about 815,000 BTC in the past month, increasing selling pressure, according to Glassnode and CryptoQuant.

64% of Polymarket gamblers think Bitcoin will drop below $100k this year.https://t.co/rB4kyRvu32 pic.twitter.com/GdbGOeVEqg

— MartyParty (@martypartymusic) October 30, 2025

Spot Bitcoin ETFs continue to experience outflows, with $278 million exiting on Wednesday, further weakening demand.

“Institutional participation and whale activity have diminished, and ETF outflows continue,” noted Dilin Wu, research strategist at Pepperstone.

Despite the correction, some remain bullish. “Bitcoin is still in an uptrend because every pullback has produced a higher low,” said Joe DiPasquale, CEO of BitBull Capital.

JPMorgan analysts see support at $94,000, tied to rising mining costs, while maintaining a $170,000 year-end target.

The crypto slump aligns with broader risk-off sentiment, as the Nasdaq dropped 2% amid post-shutdown economic reassessments.

For comparison, similar market dynamics can impact other assets like UNI and DAI.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Plunges Below $79,000 as $650 Million in Liquidations Hits Market in One Hour

- Shiny Coins #6 – The “Digital Gold” Duel as Macro Fear Bites

- Trump Nominates Former Fed Governor Kevin Warsh to Succeed Jerome Powell

- Tokenized Precious Metals: Bringing Gold, Silver, and Other Metals into the Blockchain Era

- Gold and Silver Prices Crater as Kevin Warsh Fed Nomination Sparks Sharp Deleveraging

Related

- Bitcoin Holds Above $105K as Traders Eye Government Shutdown Deal and Liquidity Boost Bitcoin stabilizes near $106K amid hopes for an end to the U.S. government shutdown, potentially unlocking $150-200 billion in liquidity, though regulatory delays pose risks for the crypto sector....

- US Government Shutdown Freezes Crypto ETF Approvals: Solana, Litecoin in Limbo As the US government shutdown enters its third day, the SEC's skeleton crew has stalled reviews for over 90 crypto ETF applications, including key altcoin funds. Analysts eye year-end approvals amid new listing standards....

- Bitcoin Surges Above $119K as US Government Shutdown Fuels Liquidity Expectations Bitcoin climbed to a seven-week high amid the US government shutdown, with analysts pointing to potential Federal Reserve rate cuts and increased market liquidity as catalysts for the rally....

- Bitcoin surges above $106K as US Senate advances bill to end government shutdown Crypto markets rebound sharply as lawmakers reach a bipartisan deal to resolve the 40-day US government shutdown, with Bitcoin climbing 4.4% and Ethereum jumping 7.8%....