Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Bernstein analysts reiterated a **$150,000 price target** for Bitcoin by 2026 despite a recent 45% market correction.

- The firm described the current downturn as the “weakest bear case” in the asset’s history, noting a lack of systemic failures or hidden leverage.

- Institutional support remains robust, with only 7% net outflows from spot Bitcoin ETFs recorded during the price slide.

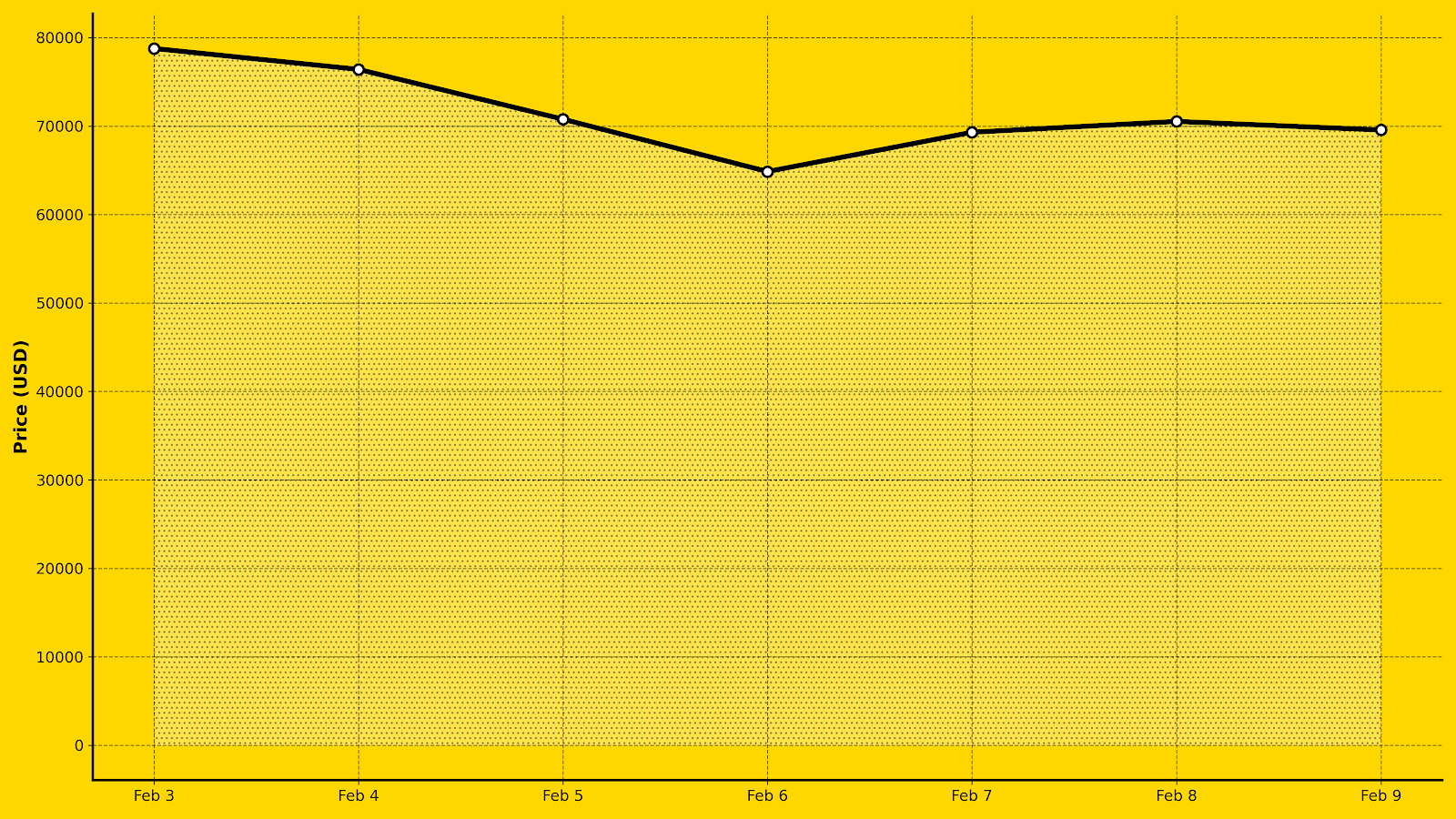

Research and brokerage firm Bernstein has doubled down on its bullish outlook for Bitcoin, maintaining a $150,000 price target for the end of 2026. In a note to clients on Monday, analysts led by Gautam Chhugani argued that the current market downturn—which has seen the cryptocurrency drop approximately 45% from its highs—represents a “crisis of confidence” rather than a fundamental breakdown of the network’s value proposition or underlying market structure.

According to the report, the typical catalysts for a prolonged “crypto winter” are notably absent in the current cycle. Bernstein pointed out that unlike previous major crashes, there have been no high-profile institutional blowups, revelations of hidden leverage, or systemic failures within the decentralized finance ecosystem. Instead, the analysts suggested that investor sentiment has been dampened by a broader rotation into AI-linked equities and precious metals like gold, leaving Bitcoin to trade as a liquidity-sensitive risk asset in a persistently tight interest rate environment.

“What we are experiencing is the weakest bitcoin bear case in its history,” the analysts wrote. “Nothing broke, no skeletons will show up. When all stars are aligned, the Bitcoin community manufactures a self-imposed crisis of confidence.”

The firm highlighted that the institutional infrastructure surrounding Bitcoin is significantly more resilient than in years past. Despite the steep price decline, spot Bitcoin ETFs experienced only a relatively modest 7% net outflow, suggesting that long-term institutional holders are opting to hold through the volatility. Furthermore, Bernstein dismissed emerging fears regarding quantum computing risks and the impact of AI competition, stating that Bitcoin’s transparent codebase and growing network of well-capitalized stakeholders position it to adapt alongside other financial systems.

The analysts also touched on corporate adoption, noting that major holders like MicroStrategy have structured their liabilities to withstand prolonged periods of price pressure. Bernstein’s model suggests that a “tokenization supercycle” and the continued integration of stablecoins into mainstream payments will act as structural tailwinds, potentially pushing Bitcoin to a cycle peak of $200,000 by 2027 as global liquidity conditions eventually improve.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

- Bitcoin Mining Difficulty Drops 11% in Largest Negative Adjustment Since China’s 2021 Ban

- Bithumb Recovers Majority of $43 Billion in Bitcoin After Promotional Distribution Error

- Bitcoin Recovers to $70,000 As Altcoins Rally

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- How Crypto Bear Markets Function Cryptocurrencies are currently in the middle of a massive bear market. It's easy to be scared out of your wits....

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- S&P Downgrades Tether’s USDT to Weakest Stability Rating Amid Bitcoin Exposure Risks S&P Global Ratings has slashed Tether's USDT stability score to its lowest level, citing insufficient buffers against potential bitcoin price drops and opaque reserves. Tether pushes back, highlighting its profitability and resilience....