$23.6 Billion Bitcoin Options Set to Expire Next Friday Amid Year-End Volatility

Quick Take

- A record $23.6 billion

in notional Bitcoin options value is scheduled to expire on December 26, 2025. - Call options show heavy clustering at $100,000 and $120,000 strikes, reflecting upside bets.

- Put options are concentrated near $85,000, indicating downside protection.

- The max pain price sits at $96,000, where option sellers would face minimal

losses.

One of the largest Bitcoin options

expiries on record approaches as traders brace for potential volatility in

the final trading days of 2025.

Approximately $23.6

billion in Bitcoin options contracts are set to expire next Friday,

December 26, marking a significant derivatives event on platforms like

Deribit. This expiry comes amid Bitcoin’s consolidation phase, with the

cryptocurrency trading in a range that could see amplified moves due to

hedging activity.

Open interest data highlights distinct

positioning: bullish calls are heavily clustered around the

$100,000 and $120,000 strike prices, suggesting traders are

betting on a potential year-end rally or rebound. In contrast, puts

are concentrated near $85,000, pointing to increased demand for

downside protection in recent weeks.

The max pain level—the price

at which the majority of option holders would expire worthless, maximizing

losses for buyers—is estimated at $96,000. Prices often gravitate toward

this level as expiry nears due to market makers’ delta hedging, which can

suppress volatility or pin the spot price within key strike ranges.

Such large expiries have historically introduced short-term

price pressure or whipsaws, particularly in low-liquidity holiday periods.

Analysts note that post-expiry repositioning could clear gamma exposure,

potentially setting the stage for sharper moves into 2026.

While

the event underscores elevated leverage in the derivatives market, it also

reflects ongoing institutional participation in Bitcoin options for hedging

and speculative purposes.

Disclaimer: This article is for

informational purposes only and does not constitute advice of any kind.

Readers should conduct their own research before making any

decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Weekly Snapshot – Volatility, Outflows, and Hopes for 2026 Recovery

- Tether Executives Acquire Northern Data’s Bitcoin Mining Arm in $200M Deal

- $23.6 Billion Bitcoin Options Set to Expire Next Friday Amid Year-End Volatility

- US Senator Cynthia Lummis, Leading Crypto Advocate, Announces Retirement

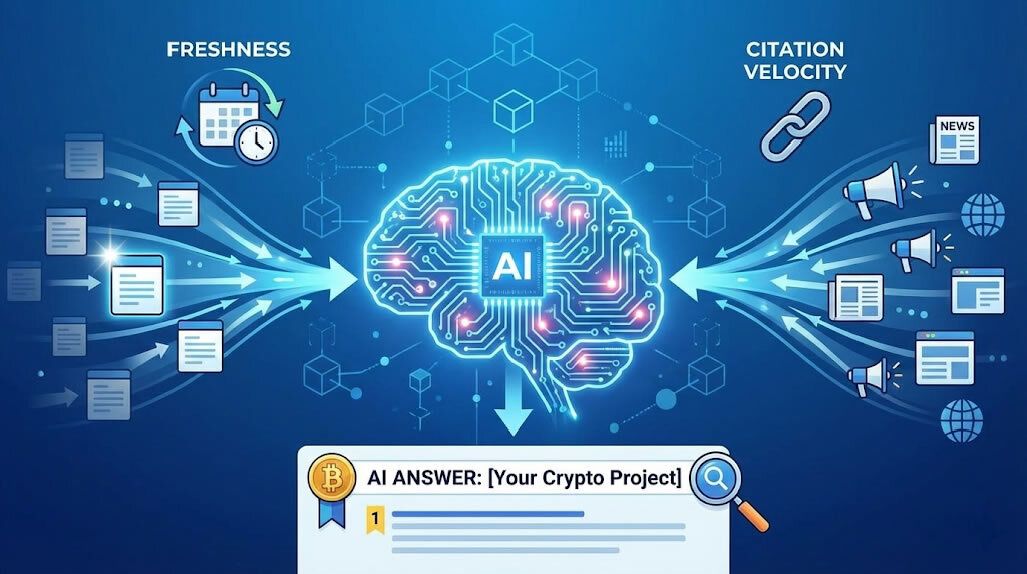

- Fresh wins: How Periodic Press Releases Help Your Crypto Project Dominate AI Answers

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Supercharge Your Stablecoins: USDC.e/WETH Yields on ZKsync’s Koi Finance 💸 Discover how to earn attractive APR/APY, potentially up to 20%, by providing liquidity to the USDC.e/WETH pool on Koi Finance, a gas-free DeFi platform on ZKsync....

- NEAR HOUSE by Supermoon: Assembling Top Builders at Consensus 2023 Supermoon Camp's NEAR HOUSE is set to host a highly anticipated, five-day event during Consensus 2023 in Austin. ...

- Crypto Exchanges That Don’t Require KYC: 7 Tested Options (USA, Europe, Asia) Tested crypto exchanges that don't require KYC. 7 platforms with no ID verification for USA, EU, Asia traders. GODEX leads with 919+ coins....