Tokenized Precious Metals: Bringing Gold, Silver, and Other Metals into the Blockchain Era

For thousands of years, precious metals like gold and silver have served as reliable stores of value, hedges against inflation, and symbols of wealth. Yet owning them physically comes with challenges: high storage costs, security risks, limited divisibility, and cumbersome trading.

Now imagine owning a precise fraction of a London-vaulted gold bar, tradable instantly from your phone, divisible to eight decimal places, and transferable globally in seconds—without ever touching the metal. This is the promise of tokenized precious metals, one of the most practical bridges between traditional finance and blockchain technology.

Tokenization represents physical metals as digital tokens on a blockchain, backed 1:1 by audited reserves. As gold prices surge toward record highs in 2026, tokenized versions have seen explosive growth, with the total market cap exceeding $5 billion.

This guide explores the mechanics, history, benefits, risks, and future of tokenized precious metals—ideal for beginners curious about blockchain’s real-world applications and intermediate investors seeking diversified exposure.

What Is Tokenization of Precious Metals?

Tokenization converts rights to a physical asset into a digital token on a blockchain. For precious metals, each token represents a specific amount of allocated metal—typically one fine troy ounce of gold—stored in professional vaults.

These tokens function as ERC-20 (Ethereum) or similar standards, enabling seamless wallet-to-wallet transfers, trading on crypto exchanges, and integration with decentralized finance (DeFi).

Key features:

- Full backing — Tokens are redeemable (oftenily or with conditions) for physical delivery.

- Transparency — Regular third-party audits and on-chain proofs verify reserves.

- Fractional ownership — Investors buy tiny fractions, democratizing access to assets once reserved for institutions.

Major examples include gold (dominant) and growing silver tokenization, with platinum and palladium emerging slowly.

A Brief History of Tokenized Precious Metals

Gold’s digitization predates modern crypto. Early attempts in the 1990s, like e-gold, failed due to regulatory issues.

Blockchain revived the concept in the late 2010s. Paxos launched PAX Gold (PAXG) in September 2019 as the first major regulated tokenized gold, approved by the New York Department of Financial Services (NYDFS). Tether followed with Tether Gold (XAUT) in early 2020.

Initial adoption was slow, but rising gold prices, institutional interest in real-world assets (RWAs), and DeFi growth drove expansion. By 2026, tokenized gold’s market cap has hit all-time highs above $5 billion, fueled by gold’s rally toward $5,000 per ounce and broader RWA tokenization trends.

Silver tokenization trails but grows, with total tokenized silver around $434 million.

How Tokenized Precious Metals Work: A Step-by-Step Breakdown

The process is straightforward yet relies on trust and technology:

- Custody and Storage — The issuer purchases and stores physical metal in secure, insured vaults (e.g., LBMA-approved in London or Switzerland).

- Auditing — Independent firms conduct regular audits, publishing reports and sometimes bar serial numbers.

- Minting Tokens — Upon deposit, the issuer mints equivalent tokens on a blockchain (usually Ethereum).

- Trading and Transfer — Tokens trade on exchanges or transfer peer-to-peer.

- Redemption — Holders (above minimums) can redeem tokens for physical delivery, often with fees.

Major Tokenized Precious Metals: A Comparison

Two tokens dominate over 90% of the market:

| Feature | PAX Gold (PAXG) | Tether Gold (XAUT) |

|---|---|---|

| Issuer | Paxos (NYDFS-regulated) | Tether (Cayman Islands-based) |

| Launch Year | 2019 | 2020 |

| Blockchain | Ethereum (primarily) | Ethereum & Tron |

| Backing | 1 token = 1 troy oz London Good Delivery bar | 1 token = 1 troy oz (allocated bars) |

| Market Cap (2026 est.) | ~$2-2.5 billion | ~$2.6 billion |

| Redemption | Yes (minimums apply, delivery fees) | Yes (direct bar delivery available) |

| Transparency | Monthly audits, bar-level info | Attestations, serial number lookup |

| Strengths | Strong U.S. regulation, institutional trust | Higher liquidity, multi-chain support |

(Data approximate based on 2026 reports.)

Smaller projects exist for silver (e.g., Aberdeen Standard Physical Silver, Kinesis) and niche metals.

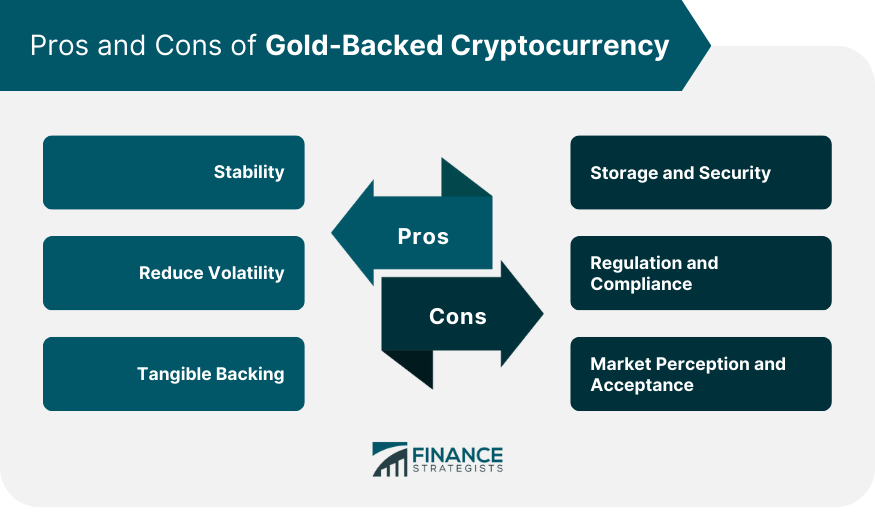

Benefits and Advantages

Tokenized metals offer compelling improvements over physical ownership:

- Fractional Ownership → Buy $50 worth of gold—impossible with physical bars.

- 24/7 Liquidity → Trade anytime on global crypto exchanges, unlike traditional markets.

- Lower Costs → No storage fees (issuer-covered), reduced transport/insurance.

- Global Accessibility → Anyone with internet can invest, bypassing banks or brokers.

- Transparency and Security → Audits and blockchain immutability reduce fraud risk.

- DeFi Integration → Use as collateral for lending, yield farming, or stablecoin pairs.

In 2025-2026, trading volumes for tokenized gold reached $178 billion—surpassing most gold ETFs.

Real-World Applications and Adoption

Investors use tokenized metals to:

- Hedge inflation and currency devaluation (especially in emerging markets).

- Diversify portfolios alongside stocks, bonds, and Bitcoin.

- Earn yield in DeFi protocols accepting PAXG/XAUT as collateral.

- Enable cross-border payments settled in “digital gold.”

Adoption surged in 2025-2026 as institutions like BlackRock explored RWAs and gold hit records. Tokenized versions provide easier, faster exposure than ETFs for crypto-native users.

Challenges and Risks

Tokenized metals aren’t risk-free:

- Counterparty Risk → You trust the issuer to hold reserves. Audits mitigate but don’t eliminate this.

- Regulatory Uncertainty → Varying global rules; some jurisdictions restrict redemption.

- Premiums and Tracking Errors → Tokens sometimes trade above/below spot price.

- Redemption Hurdles → High minimums (e.g., 430 oz for PAXG delivery) and fees.

- Smart Contract Risks → Though rare, blockchain vulnerabilities exist.

PAXG’s stricter regulation appeals to conservatives; XAUT’s liquidity suits active traders.

Future Outlook

Tokenized precious metals are early in adoption. As RWAs mature, expect:

- More metals (platinum, palladium) and issuers.

- Seamless TradFi integration (e.g., tokenized gold in brokerage accounts).

- Institutional inflows as regulations clarify.

- Enhanced oracles and decentralized custody reducing counterparty risk.

With gold and blockchain both time-tested, this sector could grow to tens of billions in market cap this decade.

Conclusion

Tokenized precious metals represent one of blockchain’s most practical applications: taking an ancient store of value and making it fit for the digital age. They preserve gold and silver’s intrinsic qualities—scarcity, durability, universal appeal—while adding liquidity, accessibility, and efficiency that physical ownership can’t match.

Whether hedging uncertainty, diversifying a portfolio, or exploring DeFi, tokenized metals offer a compelling middle ground between tradition and innovation.

Start small, choose a reputable issuer, and always verify audits. The future of precious metals is digital—and it’s already here.

Explore related articles on Cryptopress.site, such as “Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots“.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Plunges Below $79,000 as $650 Million in Liquidations Hits Market in One Hour

- Shiny Coins #6 – The “Digital Gold” Duel as Macro Fear Bites

- Trump Nominates Former Fed Governor Kevin Warsh to Succeed Jerome Powell

- Tokenized Precious Metals: Bringing Gold, Silver, and Other Metals into the Blockchain Era

- Gold and Silver Prices Crater as Kevin Warsh Fed Nomination Sparks Sharp Deleveraging

Related

- Crypto Markets See Renewed ETF Inflows as Precious Metals Hold Near Record Peaks The cryptocurrency market entered 2026 with signs of renewed institutional interest, as U.S. spot Bitcoin ETFs recorded strong inflows following a period of outflows in late 2025. Data from tracking platforms showed Bitcoin ETFs attracting hundreds of millions in fresh...

- RWA tokenization sector could reach $50 billion in 2025 Tokenized U.S. Treasuries surpassed the $5 billion milestone for the first time, while private credit maintained its leadership at 65% of the market....

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots Explore 2025 real estate tokenization on Ethereum and Polygon: fractional ownership, regulatory hurdles, and institutional adoption amid housing shifts....

- Gold and Silver Prices Crater as Kevin Warsh Fed Nomination Sparks Sharp Deleveraging Gold and silver suffered their largest single-day decline in over a decade after the nomination of Kevin Warsh as Fed Chair triggered a rebound in the U.S. dollar and a mass liquidation of overextended options bets....