Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

Amidst relentless inflation in some disadvantaged Third World country, where a pile of pesos equivalent to just $2,000 spills onto a table like a chaotic game of Monopoly, a savvy local investor logs onto his phone and acquires a digital fraction of a stable apartment building in the United States. No banks, no borders, just tokens on the blockchain that convert volatile savings into tangible real estate holdings. This is not a far-fetched story, but a snapshot of the year 2025, when real estate tokenization allows ordinary people to protect themselves from economic turmoil by owning small shares of global assets.

As housing markets worldwide strain under affordability crises, with millions priced out of homeownership amid rising rates and supply crunches, blockchain emerges as a quiet revolutionary. Real estate tokenization—the conversion of property rights into divisible digital tokens—offers a lifeline, democratizing access to what was once an elite game. These tokens, backed by real-world assets, allow fractional ownership, seamless trading, and automated yields, all on platforms like Ethereum and Polygon. Yet, as pilots proliferate this year, hurdles like regulatory mazes and tech vulnerabilities remind us that innovation walks a tightrope.

We’ll unpack here the essentials of real estate tokenization, from its historical roots to 2025’s groundbreaking case studies, weighing benefits against risks and peering into its economic ripple effects. Grounded in reliable sources such as the World Economic Forum’s 2025 asset tokenization insights and Deloitte’s market forecasts, we’ll see how this trend is accelerating institutional buy-in while addressing global housing woes.

Core Explanations: Understanding Real Estate Tokenization

To grasp the significance of 2025 pilots, let’s start with the basics. Tokenization isn’t new—it traces its origins to the early days of blockchain. The concept gained traction around 2017-2018, coinciding with the rise of Ethereum’s smart contracts, which enabled programmable digital assets. Early experiments, like the tokenization of art and collectibles, paved the way for real-world assets (RWAs), including real estate.

At its core, real estate tokenization bridges the physical and digital worlds. Think of it as slicing a pie: a property’s value is divided into smaller, tradable pieces (tokens), each representing a fraction of ownership. This differs from traditional real estate investment trusts (REITs), which pool funds but often lack direct ownership and liquidity.

Historical Origins

The first notable real estate tokenization occurred in 2018 with the St. Regis Aspen Resort, where ownership was fractionalized into tokens. By 2025, the tokenized real estate market has grown from $2.78 billion in 2023 to projections of $16.51 billion by 2033, driven by blockchain’s promise of transparency and efficiency. Historical context reveals a shift from experimental pilots to mainstream adoption, fueled by post-pandemic housing market volatility and the need for alternative investments.

Technical Breakdown

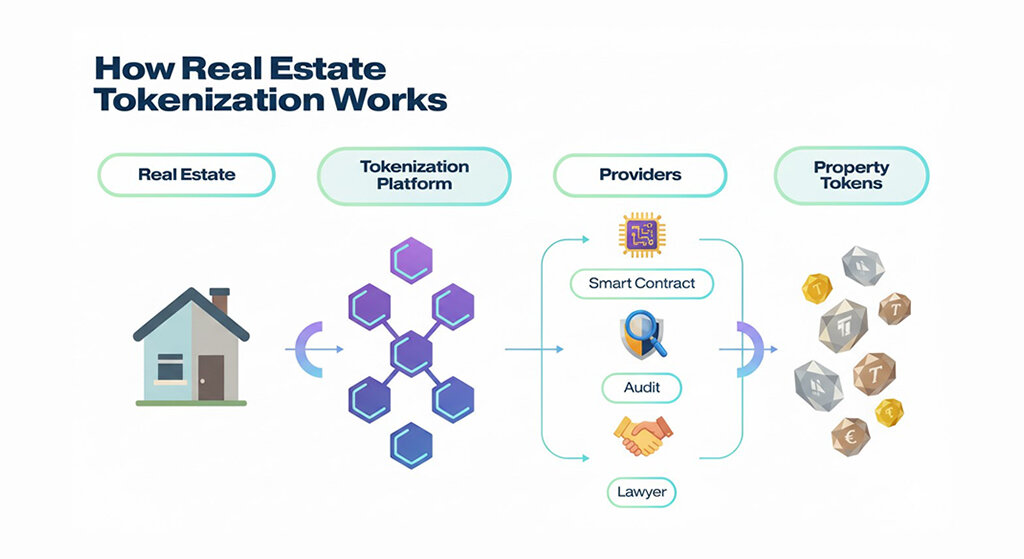

Here’s a step-by-step look at how tokenization works, using analogies for clarity:

- Property Selection and Valuation: A real estate asset, like an apartment building, is appraised for its market value. Legal due diligence ensures clear titles and no encumbrances.

- Legal Structure Setup: The property is typically held by a Special Purpose Vehicle (SPV) or Limited Liability Company (LLC). This entity issues tokens representing ownership shares. For example, a $1 million property might be divided into 1,000 tokens worth $1,000 each.

- Token Creation on Blockchain: Using platforms like Ethereum (for its robust smart contract ecosystem) or Polygon (for lower fees and faster transactions), developers create ERC-20 or ERC-721 tokens. Smart contracts—self-executing code—automate processes like dividend distribution. On Polygon, which is a Layer-2 scaling solution for Ethereum, transactions can be processed in seconds at minimal cost, making it ideal for high-volume trading.

- Compliance Integration: Tokens are often classified as securities, requiring adherence to regulations like the U.S. SEC’s Regulation D for accredited investors. Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are embedded via smart contracts.

- Distribution and Trading: Tokens are sold through initial offerings or platforms. Investors receive proportional rental yields or appreciation. Secondary markets on decentralized exchanges (DEXs) enable liquidity.

This process enhances liquidity in an asset class traditionally plagued by long settlement times—often months—reducing them to minutes.

Pros and Cons Comparison

To illustrate trade-offs, consider this table:

| Aspect | Pros | Cons |

|---|---|---|

| Accessibility | Lowers entry barriers (e.g., $50 minimum) | Requires tech literacy and crypto wallets |

| Liquidity | 24/7 trading on global markets | Dependent on market depth; illiquid tokens possible |

| Costs | Reduces intermediaries, up to 30% savings | Initial setup and compliance fees |

| Transparency | Immutable blockchain records | Privacy concerns with on-chain data |

| Yields | Automated rental distributions | Volatility from crypto market ties |

Source: Adapted from Lofty’s 2025 guide and WEF report.

Applications and Examples: 2025 Case Studies

In 2025, tokenization pilots have proliferated, particularly on Ethereum and Polygon, accelerating institutional adoption. These projects highlight fractional ownership models, where investors own shares as small as 0.01% of a property, earning yields from rents or sales. Amid global housing shifts—like supply shortages in urban areas and inflation—tokenization offers solutions for affordability and diversification.

High-Profile Projects

- Lofty Platform: Operating on Algorand but with integrations to Ethereum-compatible networks, Lofty has tokenized 148 U.S. properties by 2025, averaging 231 buyers per property. Investors start at $50, receiving daily rental yields averaging 11%. A case study: A Detroit rental home tokenized in early 2025 generated $2 million in collective income, demonstrating passive income without management hassles.

- St. Regis Aspen Resort by SolidBlock: This 2025-highlighted project on Ethereum fractionalized a luxury Colorado resort, raising $18 million. Fractional ownership allows global investors to earn hotel revenues, with yields tied to occupancy rates. Institutional players like hedge funds adopted it for portfolio diversification amid housing market volatility.

- Red Swan’s Commercial Properties: Tokenizing $2.2 billion in U.S. commercial assets on blockchain platforms, Red Swan emphasizes Polygon for scalability. A 2025 pilot in major cities enabled fractional shares in office buildings, yielding rental returns. This accelerated institutional adoption, with banks using it to hedge against economic downturns.

- T-RIZE Group’s Project Champfleury: A $300 million Canadian residential development tokenized in 2024-2025, using Ethereum for smart contracts. Fractional models lowered barriers for unbanked populations, impacting yields through shared appreciation. It exemplifies societal benefits in emerging markets.

- RealT Properties: Focused on rental homes in Chicago and Detroit, RealT uses Ethereum for tokenization. By 2025, it offers passive yields via crypto wallets, with investors earning proportional rents. A success story: Token holders saw steady income during housing shortages.

These examples show how tokenization addresses global housing shifts, like the 2025 affordability crisis, by enabling fractional investments.

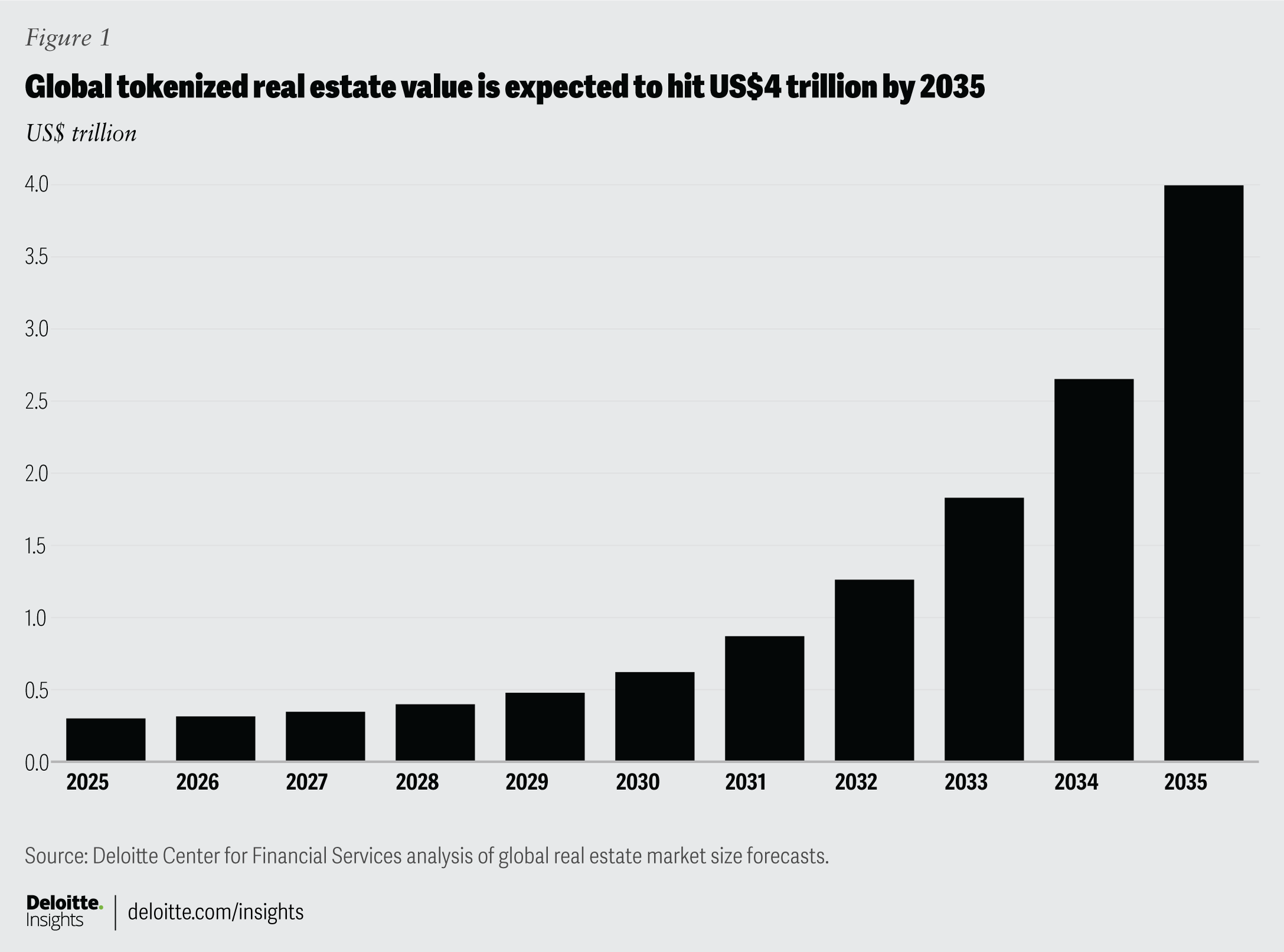

deloitte.com Tokenized real estate | Deloitte Insights

As shown in the graph above, the market’s exponential growth underscores 2025’s pivotal role.

Challenges and Risks

Despite breakthroughs, 2025 pilots face significant barriers. Regulatory hurdles top the list: 72% of institutional investors cite uncertainty as a concern. In the U.S., tokens are securities, requiring SEC compliance, while global fragmentation complicates cross-border trades.

Technical risks include smart contract vulnerabilities—hacks cost $1.7 billion in 2023 alone. Liquidity challenges persist; tokens may not sell quickly in downturns. Legal issues, like aligning tokens with deeds, lead to disputes.

Solutions emerge: Platforms like Polygon enhance scalability, reducing fees. Regulatory progress, such as the EU’s MiCA framework, provides clarity. Economic impacts include potential money laundering risks, but blockchain’s transparency mitigates them.

Societally, tokenization promotes financial inclusion for the unbanked but risks exacerbating inequalities if tech access is uneven.

Future Outlook

Looking ahead, 2025 pilots signal a trajectory toward $1.5 trillion in tokenized real estate by 2030. Institutional adoption will surge, with firms like BlackRock expanding RWA funds on Ethereum and Polygon. Amid global housing shifts—projected shortages of 96 million units by 2030—tokenization could unlock liquidity for development.

Forward-looking analysis: Interoperability between chains like Ethereum and Polygon will enable seamless trades. Sustainable practices, addressing energy concerns, will boost appeal. However, balanced regulation is key to avoiding systemic risks.

Conclusion

Real estate tokenization in 2025 represents a transformative leap, blending blockchain’s efficiency with traditional assets. From fractional ownership in luxury resorts to yielding rentals in urban homes, pilots on Ethereum and Polygon highlight breakthroughs while navigating barriers like regulation and security.

For beginners, start small: Research platforms like Lofty or RealT, use hardware wallets for safety, and consult financial advisors. Intermediate investors can explore diversified portfolios via tokenized funds.

Subscribe to Cryptopress.site for more insights on blockchain innovations, or explore related articles on DeFi and RWAs. Stay informed— the future of property investment is digital.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Tokenization of Real Estate: Breakthroughs and Barriers in 2025 Pilots

- US Lawmaker Proposes Crypto Trading Ban for Elected Officials Amid Backlash Over CZ Pardon

- Crypto Market Cap Surges to $3.88 Trillion Amid US-China Trade Deal Optimism

- Democratic Pushback Intensifies Against Trump’s Pardon of Binance Founder CZ

- 5 Best Crypto Prop Trading Firms in 2025

Related

- RealT: How Crypto is Disrupting Real Estate Blockchain technology is the buzz of the financial world. The real estate community is taking notice as well. RealT is a platform token that is using blockchain technology to disrupt the real estate industry in many ways. Blockchain tokens are...

- RWA tokenization sector could reach $50 billion in 2025 Tokenized U.S. Treasuries surpassed the $5 billion milestone for the first time, while private credit maintained its leadership at 65% of the market....

- 100 properties sold with cryptocurrencies: we celebrate it with an NFT We have finally reached property No. 100....

- Avalanche Tokenization Initiative Avalanche Foundation’s $50M Asset Tokenization Initiative....