The Ultimate Crypto Exit Strategy: 10 Timeless Indicators to Lock in Bull Market Gains

In the world of cryptocurrency, bull markets can feel like an endless upward spiral, fueled by hype, FOMO (fear of missing out), and skyrocketing prices. However, history shows that what goes up must eventually correct—and often sharply. Most investors fail at exiting because they get caught in emotional traps, holding too long in hopes of even higher gains, only to watch profits evaporate during downturns. The key to success? A data-driven exit strategy that relies on timeless indicators to signal when euphoria is peaking. This approach removes guesswork, helping you secure gains methodically.

This guide breaks down 10 proven indicators that have signaled market tops across multiple cycles. These aren’t tied to any specific year but draw from recurring patterns in crypto’s four-year halving cycles. We’ll explain each one, how to use it, and include links to the tools for easy access. Finally, we’ll cover how to layer these for personalized alerts and a practical checklist to get started.

Breakdown of the 10 Indicators

These indicators focus on sentiment, retail activity, leverage, and technical signals. Use them in combination for stronger conviction, as no single metric is foolproof. Historical examples from past cycles (like 2017 and 2021) illustrate their reliability, showing how they flagged tops before major corrections.

- Fear & Greed Index

This metric gauges overall market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed), capturing the emotional drivers behind price swings.

How to Use for Exits: Monitor for readings above 76, which often precede tops by weeks or months—time to start scaling out. Conversely, sub-25 levels signal buying opportunities.

Historical Examples: In the 2017 and 2021 cycles, peaks around 82-84 aligned with Bitcoin’s all-time highs, followed by multi-month declines.

Tool Link: Alternative.me Crypto Fear & Greed Index. Also available on TradingView by searching “crypto fear and greed.” - Coinbase App Rankings

Tracking the popularity of major exchange apps like Coinbase reveals retail investor influx, as newcomers flock to easy-access platforms during hype.

How to Use for Exits: When the app hits top rankings (e.g., #1 in finance), it’s a red flag for peak retail frenzy—consider exiting altcoin positions.

Historical Examples: During the 2021 bull run, Coinbase topped App Store charts amid widespread mania, just before the market peaked.

Tool Link: Check rankings on the Apple App Store or Google Play Store. - YouTube Views and Subscribers

Crypto content consumption on YouTube spikes with retail interest, as people search for tips and hype videos.

How to Use for Exits: Surging views/subscribers on crypto channels indicate euphoria—pair with other signals to time sales.

Historical Examples: Late 2021 saw explosive growth in crypto YouTube metrics, correlating with the cycle’s end.

Tool Link: Monitor via YouTube Analytics or channel pages (e.g., search for major crypto channels like Crypto Banter). - Google Trends

Search volume for crypto terms reflects public curiosity and FOMO.

How to Use for Exits: Peaks in searches for “Ethereum,” “altcoins,” or “buy crypto” often mark tops—focus on altcoin trends over saturated Bitcoin ones.

Historical Examples: Google Trends hit highs in 2017 and 2021, signaling overextension before crashes.

Tool Link: Google Trends. - Leverage (Altcoin Open Interest vs. Bitcoin Open Interest)

Comparing open interest (OI) in altcoin futures to Bitcoin’s shows leverage buildup and risk appetite.

How to Use for Exits: When altcoin OI nears or surpasses Bitcoin’s, it indicates frothy conditions—reduce exposure.

Historical Examples: In December 2021, high altcoin OI preceded a major drop; similar patterns appeared in early 2024 mini-cycles.

Tool Link: Track OI on Coinglass or Bybit’s Funding Rate Heatmap. - PI Cycle Indicator

This overlays a 111-day moving average with a multiple of the 350-day moving average to spot cycle tops.

How to Use for Exits: A crossover or touch signals potential peaks—use as a confirmation for selling.

Historical Examples: Accurately flagged tops in previous Bitcoin cycles.

Tool Link: Look Into Bitcoin PI Cycle Top Indicator; also on TradingView by searching “PI cycle.” - BTI Indicator (Bitcoin Trend Indicator)

An aggregate tool that combines multiple metrics to assess Bitcoin’s trend strength.

How to Use for Exits: High readings indicate overbought conditions in bull phases—signal to harvest profits.

Historical Examples: Peaked during 2017 and 2021 euphoria phases.

Tool Link: Available on Look Into Bitcoin (often referred to as Bitcoin Investor Tool or similar aggregates). - Historical Valuations (e.g., MVRV Z-Score)

Compares market value to realized value, normalized as a Z-score, to identify over/undervaluation.

How to Use for Exits: Scores above 7 suggest extreme overvaluation—time to exit.

Historical Examples: Hit highs in 2017 (over 8) and 2021 (around 7), preceding corrections.

Tool Link: Glassnode MVRV Z-Score. - Media Sentiment

Analyzes social media and news buzz to quantify hype levels.

How to Use for Exits: Extreme positive sentiment (e.g., high social volume) flags tops—contrarian sell signal.

Historical Examples: Social media exploded in late 2021, aligning with market peaks.

Tool Link: LunarCrush for social sentiment tracking. - EMA Confirmations (Exponential Moving Averages)

EMAs smooth price data to identify trends; crossovers signal shifts.

How to Use for Exits: Bearish crossovers (e.g., 50-day EMA below 200-day) in bull runs confirm weakening momentum—exit trigger.

Historical Examples: EMA death crosses marked the end of uptrends in 2018 and 2022 post-bull periods.

Tool Link: Set up on TradingView with EMA indicators.

How-to Guide: Layering Indicators for Personalized Alerts

To avoid false signals, layer 3-5 indicators that align with your risk tolerance. For example, wait for Fear & Greed >80, plus high Google Trends and altcoin OI spikes, before selling in tranches (e.g., 20% at each milestone).

- Setup Alerts: Use TradingView to create custom dashboards. Add indicators like Fear & Greed, PI Cycle, and EMAs, then set email/SMS alerts for thresholds (e.g., greed >76).

- Personalization: For altcoin-heavy portfolios, prioritize retail metrics (Google Trends, YouTube). Bitcoin holders might focus on PI Cycle and valuations.

- Execution Tip: Scale out gradually—sell 10-20% per signal hit—to capture upside while protecting gains.

Conclusion: Your Exit Strategy Checklist

Implement this strategy today to prepare for any bull run. Here’s a quick checklist:

- [ ] Select 4-6 indicators based on your portfolio (e.g., mix sentiment and technical).

- [ ] Set up monitoring tools like TradingView and Google Trends.

- [ ] Define exit thresholds (e.g., greed >80 = sell 20%).

- [ ] Review weekly during uptrends to stay disciplined.

- [ ] Backtest against 2017/2021 data for confidence.

By relying on these timeless tools, you’ll navigate bull markets with clarity, turning potential regrets into locked-in profits. Remember, the goal isn’t perfect timing—it’s consistent execution. Stay informed and trade smart on Cryptopress.site!

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

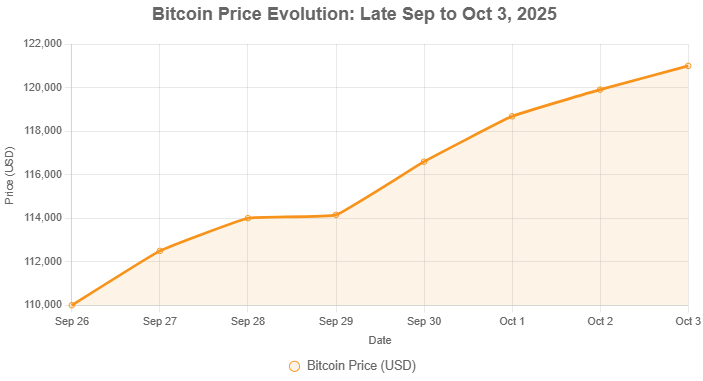

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- Crypto fear and greed index hits 20: the reasons behind the fear Recent events, like the Bybit hack losing $1.5 billion and unclear government crypto policies, have contributed to this fear....

- Crypto portfolios of top analysts and influencers in June 2025 The portfolios of prominent crypto analysts and influencers play a key role in shaping public sentiment and investment decisions. (This is not financial advice.)...

- What Is The Fear Index? And How Can It Be Used For Crypto Investing? Fear is a powerful motivator. The fear index seeks to gauge how worried investors are about the financial markets. ...

- Bitcoin Breaks All-Time High: Have we entered price discovery? Bitcoin (BTC) has officially shattered its all-time high (ATH), entering a phase of price discovery....