Crypto Crashes and Comebacks: Lessons from History and Narratives for a 2026 Bull Revival

The Rollercoaster of Crypto Markets

Imagine holding a digital asset that skyrockets from pennies to thousands of dollars, only to watch it plummet overnight, wiping out fortunes in the blink of an eye. This isn’t a hypothetical thriller—it’s the real story of cryptocurrency markets. From Bitcoin’s humble beginnings in 2009 to its volatile peaks and troughs, the crypto world has endured multiple “ends of the world” scenarios, each followed by remarkable resurgences. As we stand in early 2026, with Bitcoin hovering around $66,000 after a sharp correction from its late-2025 high of over $126,000, questions linger: What causes these crashes? How does the market bounce back? And what stories—or narratives—might ignite the next bull run?

This article explores the major crashes in crypto history, dissecting their triggers, mechanics, and recoveries. We’ll draw on historical data, real-world examples, and forward-looking analysis to provide timeless insights for beginners and intermediate investors alike. Think of crypto markets like a heartbeat: irregular, sometimes faltering, but persistently pumping forward. By understanding these cycles, you’ll be better equipped to navigate the volatility without falling prey to hype or panic.

As shown in the chart below, Bitcoin’s price history is a testament to resilience amid chaos.

The Anatomy of a Crypto Crash: Core Explanations

Cryptocurrency crashes aren’t random; they’re often the result of overleveraged speculation meeting real-world shocks. Unlike traditional stocks, crypto operates 24/7 in a largely unregulated space, amplifying both gains and losses. Let’s break down the mechanics step-by-step.

Historical Origins of Volatility

Crypto’s volatility stems from its youth. Bitcoin, the market’s bellwether, was created in 2009 by Satoshi Nakamoto as a response to the 2008 financial crisis—a decentralized alternative to fiat currencies controlled by banks. Early adopters were tech enthusiasts and libertarians, but as prices rose, speculators flooded in, creating bubbles prone to bursting.

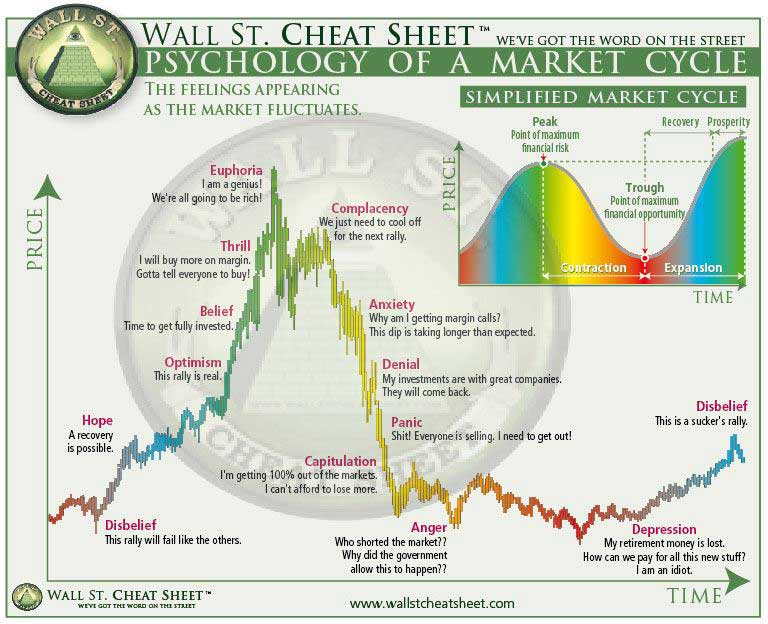

A crash typically follows a “boom-bust” cycle:

- Accumulation Phase: Smart money (early investors) buys in quietly.

- Bull Run: Media hype draws retail investors; prices surge.

- Peak Euphoria: Overleveraged positions (e.g., via futures or margin trading) push prices to unsustainable highs.

- Trigger Event: A hack, regulatory announcement, or macroeconomic shift sparks selling.

- Cascade Effect: Liquidations force more sales, creating a downward spiral.

- Capitulation: Panic selling hits rock bottom, shaking out weak hands.

This pattern mirrors traditional market psychology, as illustrated in the infographic below.

Major Crashes: A Chronological Breakdown

Here are the most significant crypto crashes, with key data summarized in the table below for easy comparison.

| Crash Event | Date Range | Peak Price (BTC) | Bottom Price (BTC) | % Drop | Primary Cause | Recovery Time to New ATH |

|---|---|---|---|---|---|---|

| 2011 Mt. Gox Hack | June 2011 | $32 | $0.01 | -99% | Exchange hack stealing millions in BTC | ~2 years (to 2013 peak) |

| 2013 Bubble Burst | April 2013 | $260 | $54 | -79% | Speculative bubble and exchange overload | ~8 months (to late 2013) |

| 2014 Mt. Gox Bankruptcy | Feb 2014 | $1,127 | $360 | -68% | Exchange insolvency after hacks | ~3 years (to 2017) |

| 2017-2018 Crypto Winter | Dec 2017-Dec 2018 | $19,665 | $3,200 | -84% | ICO bust, regulatory crackdowns, hacks | ~3 years (to 2021) |

| 2020 COVID Crash | March 2020 | $8,000 | $4,000 | -50% | Global pandemic market panic | ~8 months (to late 2020) |

| 2021-2022 Bear Market | Nov 2021-Jun 2022 | $69,044 | $19,047 | -72% | Inflation hikes, China ban, overleverage | ~3 years (to 2025 highs) |

| 2022 Terra/FTX Collapse | May-Nov 2022 | $48,000 (post-2021) | $15,500 | -68% (from May peak) | Algorithmic stablecoin failure and exchange fraud | Integrated into broader 2022 bear |

| 2025 Tariff Crash | Oct 2025 | $126,000 | $105,000 | -17% (intraday) | Geopolitical tensions, tariffs, $19B liquidations | Ongoing as of Feb 2026 |

Data sourced from historical analyses.

2011: The First Blood – Mt. Gox Hack

Bitcoin’s inaugural crash was brutal. After reaching $32 (a massive gain from $0.30 earlier that year), the Mt. Gox exchange—handling 70% of trades—was hacked. Thieves manipulated prices to $0.01, causing a 99% drop. Recovery came as the community rebuilt trust, with Bitcoin climbing back via grassroots adoption.

2013-2014: Bubble and Bankruptcy

A speculative frenzy drove BTC to $1,200, but China’s ban on fiat-to-crypto exchanges and Mt. Gox’s collapse (losing 850,000 BTC) triggered cascading failures. Analogy: Like a house of cards built on unverified trust, it crumbled under scrutiny. Recovery involved new exchanges like Binance emerging, fostering a more robust ecosystem.

2017-2018: The ICO Bust

The ICO (Initial Coin Offering) boom inflated the market to $800B total cap. When projects failed to deliver and regulators cracked down (e.g., SEC rulings), prices tanked 80%. Case study: Bitconnect, a Ponzi scheme, collapsed from $509 to $8. Recovery: Ethereum’s DeFi summer in 2020, where decentralized apps proved real utility.

2020-2022: Pandemic and Protocol Failures

The COVID crash synced with global markets, halving BTC in days. Then, 2022’s Terra-Luna depeg (UST stablecoin failing) and FTX fraud (Sam Bankman-Fried’s empire imploding) erased trillions. Societal impact: Billions in retail losses eroded trust, but institutional entry (e.g., MicroStrategy’s BTC buys) aided rebound.

2025: The Tariff Turmoil

Geopolitical tariffs and low liquidity led to $19B in liquidations—the largest ever. BTC dipped 14% intraday. As of February 2026, the market remains sideways, with BTC at ~$66K and fear indices at extreme lows.

Applications and Real-World Examples: Recoveries in Action

Each crash has birthed innovations. Post-2014, hardware wallets like Ledger enhanced security. After 2018, DeFi protocols (e.g., Uniswap) decentralized trading, reducing single-point failures. Case study: Post-FTX, exchanges like Coinbase implemented proof-of-reserves, boosting transparency.

Pros of recoveries:

- Innovation surges (e.g., Layer 2 scaling post-congestion).

- Weaker projects exit, strengthening survivors.

Cons:

- Retail investors often sell at bottoms, missing rebounds.

- Regulatory overreactions can stifle growth.

Economic impact: Crashes correlate with broader downturns but decouple in recoveries, as seen in Bitcoin’s 2020-2021 surge amid stimulus.

Challenges and Risks: Why Crashes Persist

Risks include overleverage (e.g., 10x margins amplifying losses), regulatory uncertainty (e.g., potential US bans), and external shocks (e.g., energy crises affecting mining). Solutions: Diversification, dollar-cost averaging, and understanding on-chain metrics like MVRV ratio to spot overvaluation.

Societal implications: Crashes exacerbate inequality, as institutions buy dips while retail panics. Yet, they democratize finance by weeding out scams.

Future Outlook: Narratives to Revive the 2026 Bull Market

As crypto shifts from speculation to utility, several narratives could spark revival. These aren’t predictions but educated analyses based on trends.

- AI x Crypto: AI agents using blockchain for payments and data. Example: Render Network tokenizing GPU compute.

- Real-World Assets (RWA) Tokenization: Bringing stocks, real estate on-chain for liquidity. BlackRock’s involvement signals trillions in potential.

- Privacy and Zero-Knowledge Tech: With regulations tightening, tools like Zcash or Zama’s FHE enable private DeFi.

- Prediction Markets and DeFi for Normies: Platforms like Polymarket going mainstream for event betting; user-friendly apps lowering barriers.

- Institutional Normalization: ETFs, corporate treasuries (e.g., more firms following MicroStrategy), and regulatory clarity (e.g., 2026 market structure bills).

These could drive inflows, especially if Fed rate cuts boost liquidity.

Conclusion: Embracing the Cycle

Crypto’s history is a saga of crashes forging stronger foundations. From 2011’s penny drop to 2025’s liquidation storm, each downturn has preceded innovation and new highs. In 2026, narratives like AI integration and RWAs could herald the next chapter, but remember: Markets reward patience, not speculation.

Subscribe to Cryptopress.site for more insights on blockchain fundamentals. Explore related articles on DeFi basics or Bitcoin halving impacts. What’s your take on the next bull trigger? Share in the comments.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- BlackRock Integrates BUIDL Fund with Uniswap to Enable On-Chain Institutional Trading

- Aztec Network Token Launch Meets Volatility as Early Investors Face Double-Digit Drops

- Bitcoin Briefly Reclaims $69,000 as Altcoins Lead Market Rebound Following Soft CPI Data

- Crypto Crashes and Comebacks: Lessons from History and Narratives for a 2026 Bull Revival

- 81% APR on USDT? Unlocking the Best Merkl Yield Opportunities Today 📈

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline Dive into the causes of crypto crashes, from geopolitics to holder behavior, using the 2025 Bitcoin dip as a timeless lesson in market dynamics....

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- Crypto Predictions 2024: the Main Narratives for the Year Ahead Here's what top crypto analysts think....