Bitcoin mooning: how far can it go this time?

Buckle up, crypto enthusiasts! Bitcoin is on a tear, soaring past its previous all-time high (ATH) of $69,000 and hurtling towards uncharted territory. But the million-dollar question remains: how high can it go this time, and are we in for a smooth ride or a wild rollercoaster?

Bullish Beacons: Signaling a Continued Ascent

Several factors are fueling Bitcoin’s current bullish run:

- Relative Strength Index (RSI): This technical indicator suggests Bitcoin is not yet “overbought,” meaning there’s room for further price appreciation.

- Positive News Flow: The recent launch of US-based Bitcoin ETFs has injected a significant amount of new capital into the market, driving demand.

- Exchange Traded Funds (ETFs): These investment vehicles make it easier for institutional investors to enter the crypto space, further legitimizing Bitcoin and potentially pushing prices higher.

- Breaking the ATH: Surpassing the previous all-time high is a significant psychological hurdle. It can trigger a wave of “fear of missing out” (FOMO) buying, further propelling the price.

- Price Discovery: As Bitcoin enters uncharted territory, the market is in “price discovery” mode, meaning the true value is being established through ongoing buying and selling activity.

According to a CoinMarketCap: Bitcoin’s price has risen over 50% year-to-date in 2024.

https://coinmarketcap.com/

However, a word to the wise: not all signals are green.

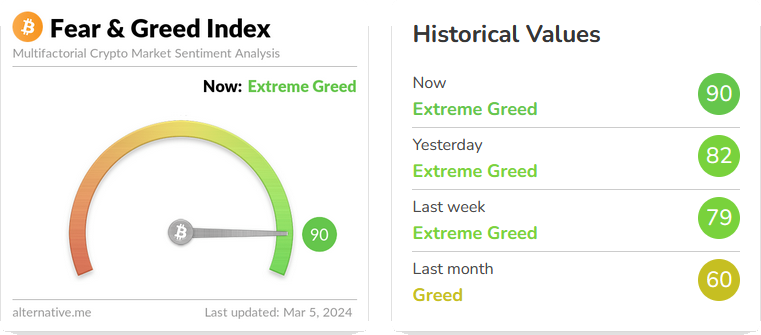

- Fear & Greed Index: While some technical indicators paint a bullish picture, the Fear & Greed Index is currently hovering in “greed” territory. Excessive euphoria can precede a market correction, so a dose of caution is warranted.

Market Cycles: A Historical Perspective

Bitcoin has a history of boom-and-bust cycles. While the current surge is exciting, it’s crucial to remember that past performance is not necessarily indicative of future results.

The Road Ahead: A Bumpy Ride with Breathtaking Views

While Bitcoin’s future trajectory is uncertain, understanding the current market signals and historical trends can help you navigate this exciting, yet potentially volatile, financial landscape.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Discover Zora: The Layer 2 Revolutionizing Content Monetization – Is It the Future of Social Media?

- Bitcoin Dips to 15-Week Low as Regional Bank Woes Trigger $1.2B in Crypto Liquidations

- Understanding Cryptocurrency Market Crashes: Insights from the 2025 Decline

- Senate Crypto Framework Bill Stalls Amid Democrats’ Counterproposal on DeFi Regulations

- Bitcoin and Ethereum ETFs Record $755M Outflows Amid Escalating US-China Trade Tensions

Related

- What Is The Fear Index? And How Can It Be Used For Crypto Investing? Fear is a powerful motivator. The fear index seeks to gauge how worried investors are about the financial markets. ...

- ‘I love buying the extreme fear’ A user shares his point of view on the cryptocurrency market and interesting opinions....

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- All the crypto companies that went bankrupt in 2022 [so far] We had to make a list to follow along with the thread. Full list inside. ...