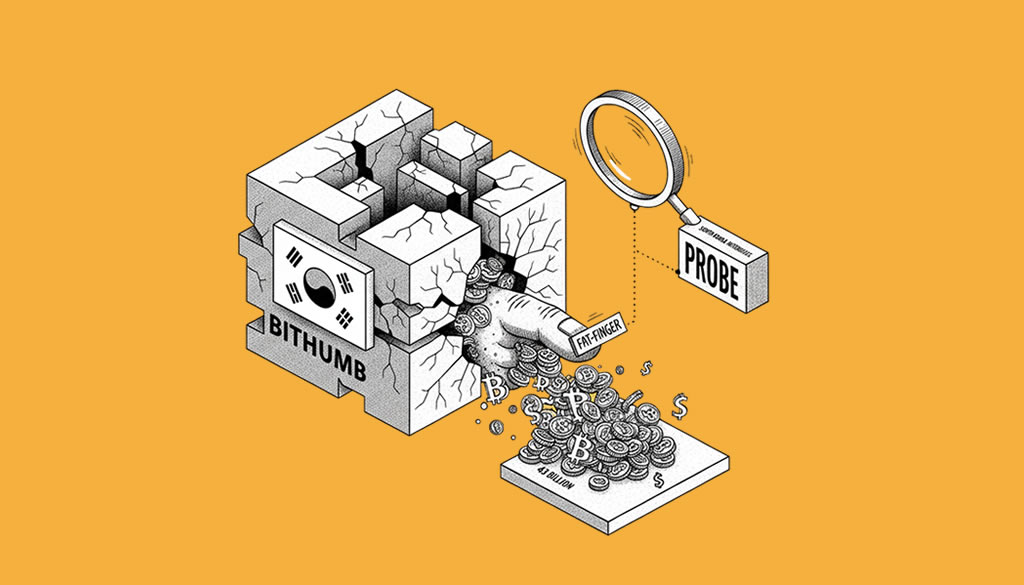

South Korea Intensifies Probe into Bithumb After $43 Billion Bitcoin Fat-Finger Fiasco

- South Korea’s Financial Supervisory Service has escalated its inspection of Bithumb into a comprehensive probe following a $43 billion Bitcoin distribution error on February 6.

- The incident exposed critical flaws in the exchange’s internal controls, allowing the disbursement of 620,000 BTC despite holding only around 46,000 BTC.

- Bithumb recovered 99.7% of the misdistributed assets and plans to compensate affected users at 110% while establishing a $68 million protection fund.

South Korea’s financial watchdog has launched a full-scale investigation into cryptocurrency exchange Bithumb after a major operational error led to the accidental distribution of approximately $43 billion worth of Bitcoin last week.

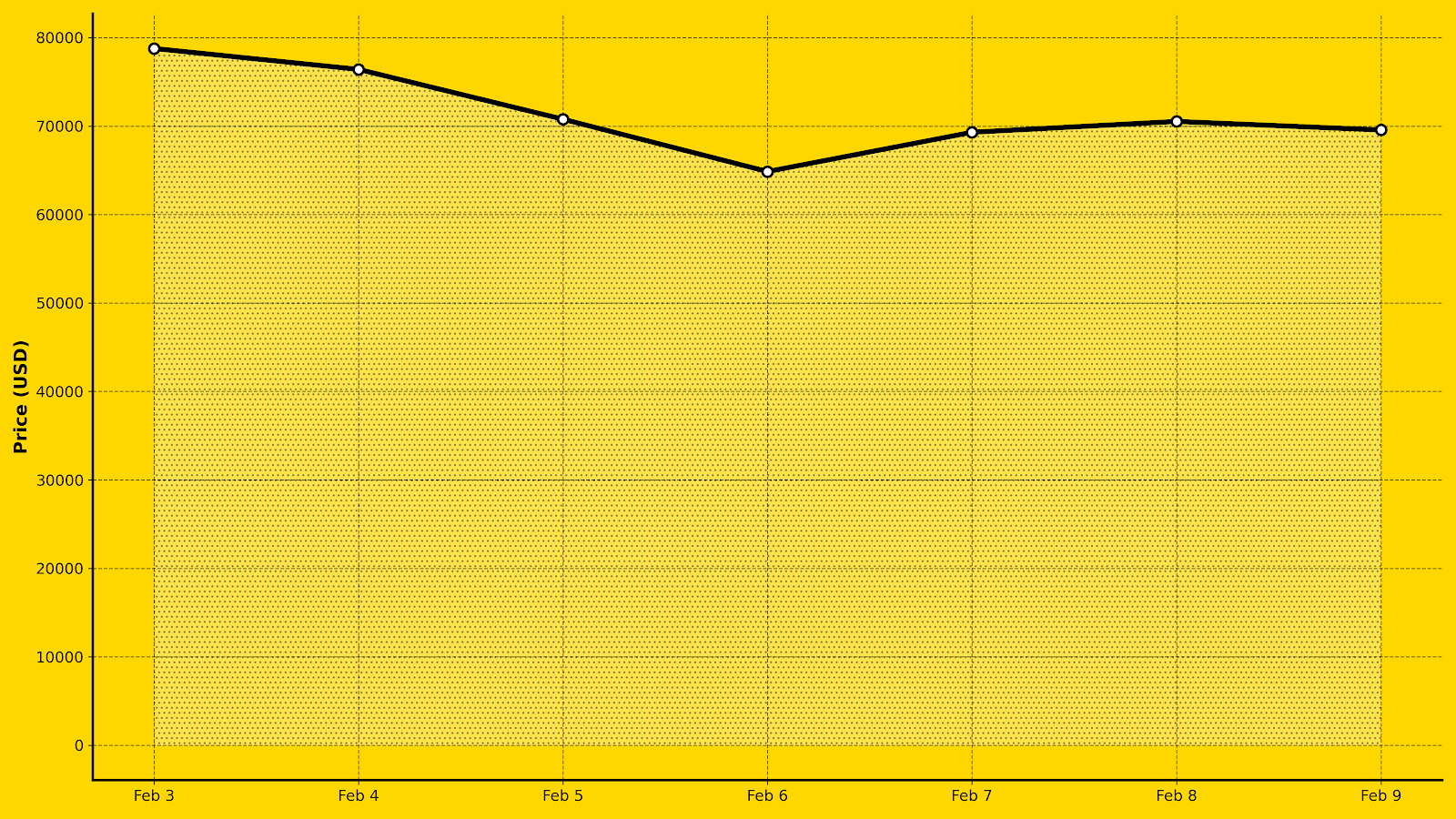

The mishap occurred on February 6 during a promotional event, where a staff member mistakenly inputted rewards in Bitcoin units instead of Korean won, resulting in 620,000 BTC being credited to hundreds of user accounts (Yonhap News Agency). At the time, Bithumb’s reserves stood at roughly 46,000 BTC, raising questions about the platform’s ledger management and risk controls.

🔒 South Korea Probes Bithumb

— Cryptopress (@CryptoPress_ok) February 10, 2026

South Korean authorities launched an investigation into Bithumb following a $43 billion trading error incident.

Swift recovery efforts by Bithumb mitigated much of the damage. The exchange froze affected accounts within 35 minutes, recovering 99.7% of the erroneous distributions and 93% of the 1,788 BTC that users managed to sell amid a 15% plunge in the BTC-KRW trading pair. However, about 125 BTC remains unrecovered, prompting Bithumb to pledge 110% compensation for losses and establish a 100 billion won ($68 million) user protection fund.

The Financial Supervisory Service (FSS) escalated its routine inspection to a formal probe on February 10, focusing on potential violations of the Virtual Asset User Protection Act, which mandates exchanges to hold equivalent assets for user deposits. “We are viewing this issue very seriously and will strictly penalize acts that undermine market order,” an FSS official stated.

Lawmakers have seized on the incident to push for tighter regulations. Opposition lawmaker Na Kyung-won warned that such errors could lead to a “bank run” if exchanges rely solely on internal ledgers without on-chain verification, while the ruling Democratic Party proposed capping individual stakes in exchanges at 15-20% to address governance risks (The Block).

This event underscores broader vulnerabilities in centralized exchanges, particularly in handling promotions and ensuring robust Bitcoin transaction protocols. As South Korea advances its Digital Asset Basic Act, the probe’s findings could shape future oversight, emphasizing the need for enhanced KYC and smart contract-like safeguards to prevent similar fat-finger incidents.

A key stakeholder, FSS Governor Lee Chan-jin, emphasized: “If the ghost coin problem is not properly resolved, how can the virtual asset market be incorporated into the institutional system?”.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Whales Accumulate as Institutional Sentiment Remains Fragmented Near $69,000

- Bitcoin ETFs Record $145 Million Monday Inflows as Market Signals Potential Inflection Point

- South Korea Intensifies Probe into Bithumb After $43 Billion Bitcoin Fat-Finger Fiasco

- Bernstein Reaffirms $150,000 Bitcoin Target, Calling Current Dip ‘Weakest Bear Case’ in History

- Crypto Weekly Snapshot – The Crypto Rebound

Related

- Bithumb’s Nasdaq Ambition Bithumb, South Korea's second-largest cryptocurrency exchange plans a 2025 Nasdaq listing....

- Bithumb Recovers Majority of $43 Billion in Bitcoin After Promotional Distribution Error South Korean exchange Bithumb mistakenly credited users with 620,000 BTC instead of small cash rewards, triggering a 17% localized flash crash on the platform....

- TRX Price Skyrockets Following South Korea’s Martial Law Declaration TRX price surged over 60%, reaching a new all-time high of $0.44....

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million South Korea's Mirae Asset Group is reportedly in discussions to buy Korbit, the fourth-largest crypto exchange in the country, signaling increased traditional finance involvement in digital assets....