Massive $250M ETH Liquidation Sparks $2.5B Crypto Wipeout as Prices Plunge

- Total crypto liquidations exceeded $2.5 billion in the past 24 hours, with Ethereum accounting for $1.14 billion and Bitcoin for $765 million.

- The ‘Hyperunit whale,’ associated with former BitForex CEO Garrett Jin, closed out a leveraged ETH position on Hyperliquid, realizing a $250 million loss and leaving the account with just $53.

- BitMine Immersion Technologies is facing over $6 billion in unrealized losses on its holdings of more than 4.24 million ETH.

- Bitcoin fell to a nine-month low of $77,195, driven by $817 million in net outflows from U.S. spot ETFs.

- Macro factors, including a partial U.S. government shutdown and the nomination of Kevin Warsh as Fed chair, intensified risk-off sentiment across markets.

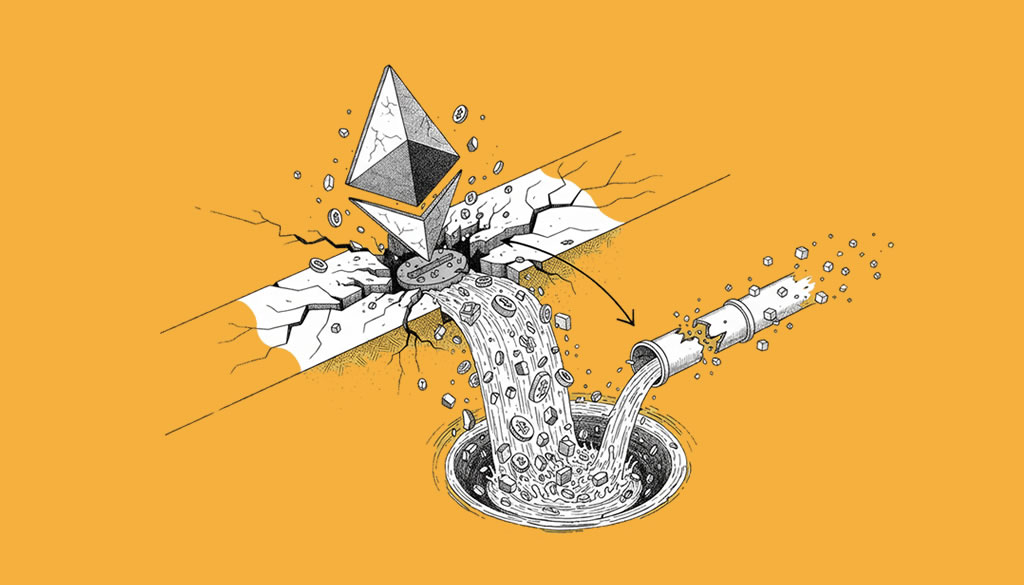

The cryptocurrency market faced severe turbulence on January 31, 2026, as a cascade of liquidations wiped out over $2.5 billion in positions, highlighting the dangers of excessive leverage in volatile conditions. Major assets like Bitcoin and Ethereum led the decline, with prices dropping to multi-month lows amid thinning liquidity.

At the center of the turmoil was the so-called Hyperunit whale, who exited an entire leveraged Ether position on the decentralized perpetuals exchange Hyperliquid. The trader, linked to Garrett Jin, incurred a staggering $250 million loss, reducing the account balance to a mere $53. This event alone contributed significantly to the broader market deleveraging, as Ether plunged 11.63% to around $2,362. On-chain intelligence firm Arkham identified the activity, with details shared on X by verified accounts like @BCDNewsBot.

INFAMOUS HYPERUNIT WHALE EXITS ENTIRE ETH POSITION, TAKES $250M LOSS AND IS LEFT WITH $53 — ARKHAM

— 🚨BDN NEWS WIRE🚨 (@BCDNewsBot) January 31, 2026

Compounding the pressure, BitMine Immersion Technologies—associated with investor Tom Lee—reported unrealized losses exceeding $6 billion on its 4.24 million ETH holdings, valued at approximately $9.6 billion at current prices. The firm’s recent acquisition of 40,302 ETH came just before the sharp downturn, underscoring the risks of large-scale treasury strategies in a bearish environment. As market commentator The Kobeissi Letter noted, “In a market where liquidity has been choppy at best, sustained levels of extreme leverage are resulting in ‘air pockets’ in price.”

Bitcoin also suffered, slipping below $78,000 for the first time since April 2025, with a low of $77,195 marking a 7.79% daily drop and a 13% weekly decline. This move pushed BTC beneath its true market mean of $80,700, a level not breached since October 2023. Strategy, the largest corporate Bitcoin holder with over 700,000 BTC, saw its holdings turn underwater against its $76,037 cost basis.

The sell-off was amplified by macroeconomic headwinds, including a U.S. government shutdown after funding talks failed, and President Trump’s nomination of Kevin Warsh as Fed chair, signaling a hawkish interest-rate stance. These factors drove $817 million in net outflows from U.S. Bitcoin ETFs, with BlackRock’s IBIT alone seeing $317 million in redemptions. Precious metals like gold and silver also reversed sharply, reflecting broader risk aversion.

While the event echoes the $19 billion liquidation cascade following Trump’s October 2025 tariff announcement, analysts suggest a potential rebound could hinge on improved liquidity and retail inflows. However, with leverage ratios reset and sentiment cautious, short-term recovery remains uncertain. For more context, see related coverage at Cryptopress.site.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Massive $250M ETH Liquidation Sparks $2.5B Crypto Wipeout as Prices Plunge

- Bitcoin Plunges Below $79,000 as $650 Million in Liquidations Hits Market in One Hour

- Shiny Coins #6 – The “Digital Gold” Duel as Macro Fear Bites

- Trump Nominates Former Fed Governor Kevin Warsh to Succeed Jerome Powell

- Tokenized Precious Metals: Bringing Gold, Silver, and Other Metals into the Blockchain Era

Related

- Corporate Bitcoin Holdings: Which companies hold the most Bitcoin? Analyzing major bitcoin adopters and their strategies....

- Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout Triggered by US-China trade tensions, the crypto market suffered its largest single-day liquidation event, but prices are recovering as leverage resets and sentiment stabilizes....

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- Bitcoin Slides Below $100K, Sparking $1.3B Liquidations in Fragile Crypto Market Bitcoin's drop below $104,000 triggered over $1.3 billion in liquidations amid persistent ETF outflows and waning investor conviction, signaling deeper market stress....