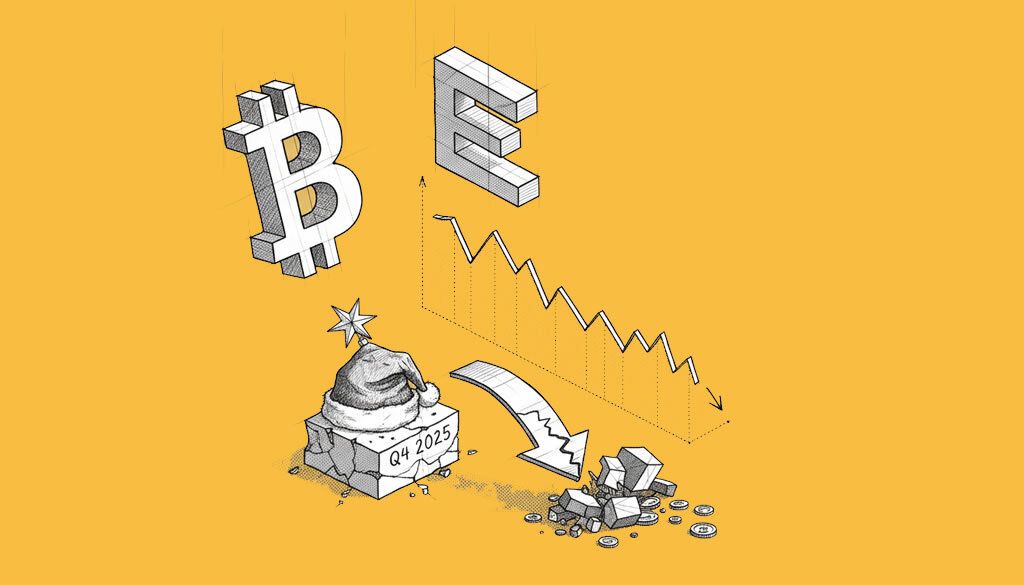

Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

- Bitcoin and Ether experienced sharp declines in Q4 2025, with BTC down approximately 22% and ETH falling 28%.

- The expected “Santa rally” fizzled out due to thin holiday liquidity, profit-taking, and a broader risk-off environment.

- In contrast, precious metals like gold surged to new highs, highlighting shifting investor preferences.

As 2025 draws to a close, the cryptocurrency market is grappling with significant losses in its leading assets. Bitcoin (BTC) has dropped about 22% in the fourth quarter, marking one of its weakest performances since 2018, while Ether (ETH) fared even worse with a 28% decline.

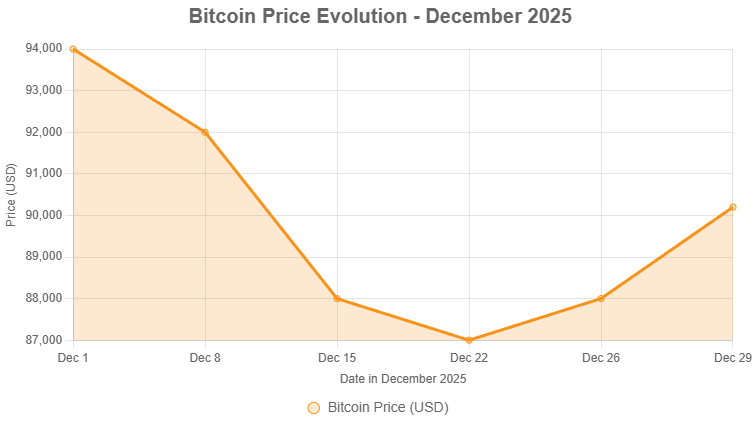

Current prices hover around $88,000 for BTC and $2,970 for ETH, far from their October peaks above $126,000 and corresponding highs for ETH. This downturn comes despite earlier optimism fueled by regulatory developments and institutional interest.

The failure of the traditional Santa rally—typically a period of gains in late December—has been attributed to several factors. Thin trading volumes during the holidays amplified volatility, with repeated attempts to reclaim key price levels met by heavy selling. A risk-off mood in global markets, coupled with volatile U.S. Treasury yields and a strengthening dollar, favored capital preservation over speculative investments.

Analysts point to year-end tax-loss harvesting as a key driver. As Alina, former VP at OKX, noted on X: “Tax-loss related selling is pushing down crypto and crypto equity prices, and this effect tends to be greatest from 12/26 to 12/30.” This sentiment is echoed in spot ETF outflows exceeding $1 billion in December.

BITCOIN YEAR-END TAX SELLING 📉

— Alina (@Alina4ever7) December 30, 2025

Bitcoin is getting HAMMERED by year-end tax-loss harvesting. Welcome to December's bloodbath. 💀

BTC slipped back to $87,145 after briefly touching $90K yesterday, as year-end tax selling crushes price action. Tom Lee warned this exact pattern:…

While crypto struggled, traditional safe-haven assets thrived. Gold reached record highs near $4,450, driven by geopolitical tensions and expectations of rate cuts. This divergence underscores Bitcoin’s behavior as a high-beta asset, sensitive to broader market risks.

Looking ahead, market participants are watching whether BTC can hold support levels around $85,000. A failure here could signal a deeper correction, potentially delaying the anticipated 2026 rally amid expanding central bank balance sheets.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitwise Files for 11 Altcoin Strategy ETFs with SEC, Targeting AI and DeFi Tokens

- Bitcoin and Ether Plunge Over 22% in Q4 2025 Amid Failed Santa Rally

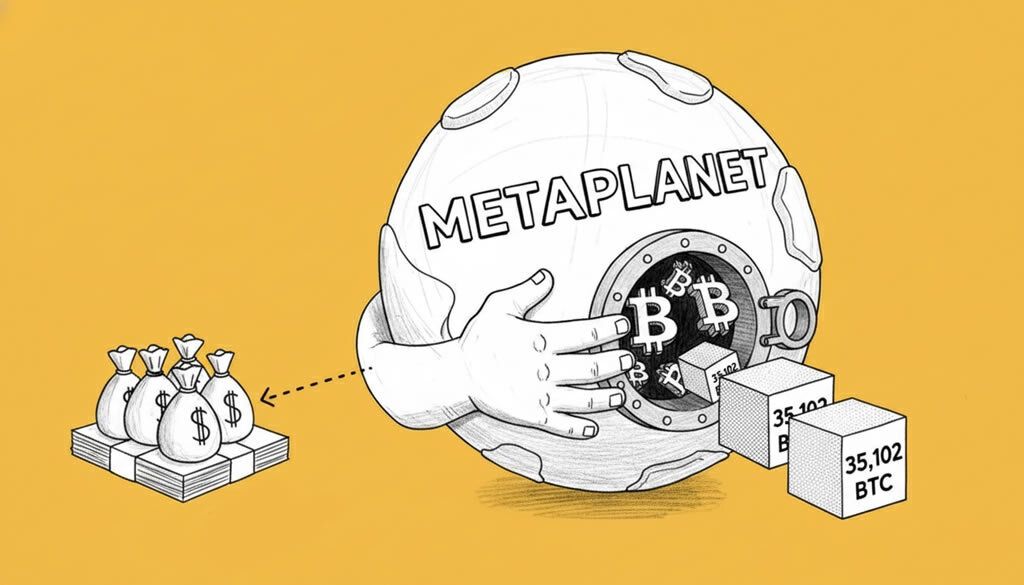

- Metaplanet Boosts Bitcoin Holdings with $451M Q4 Purchase

- Crypto Weekly Snapshot – End-of-Year Consolidation

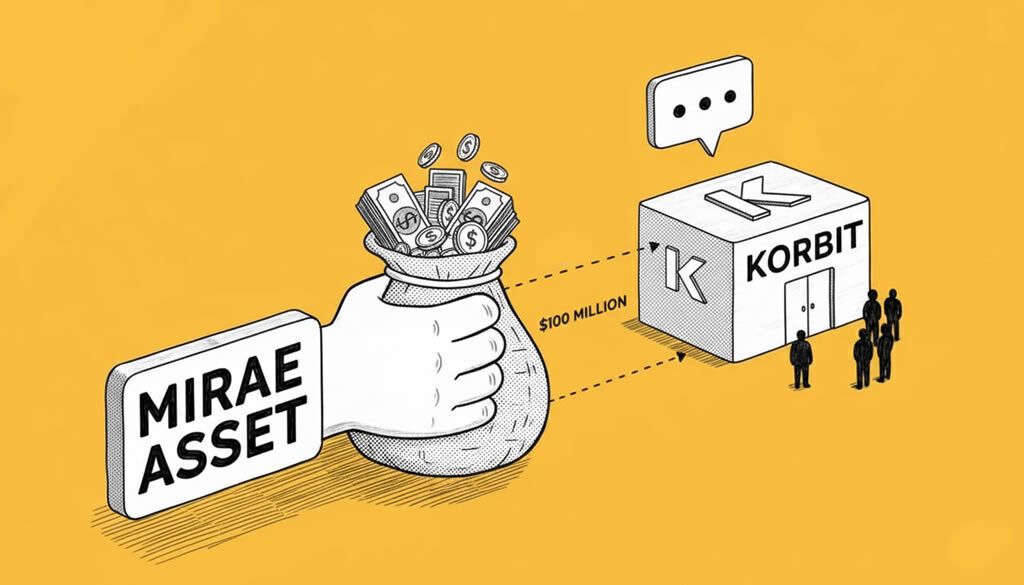

- Mirae Asset in Talks to Acquire South Korean Crypto Exchange Korbit for Up to $100 Million

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Leveraged Ether ETFs Launch in the U.S.: A Deep Dive into the Impact and Implications Volatility Shares launches the first 2x leveraged Ether ETF in the U.S. on June 4, 2024....

- Ether ETFs Debut with Over $1 Billion in Trading Volume The first US ETFs investing directly in Ether achieved overall net inflows of $107 million on their first day of trading....

- SEC Grants Final Approval To Spot Ether ETFs What It Means for Investors and the Future of Crypto....