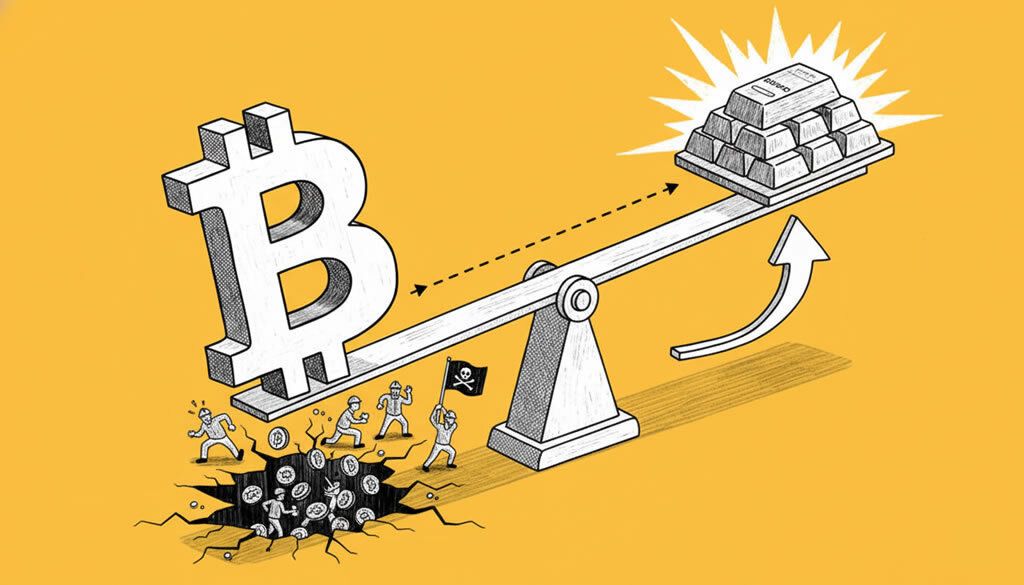

Bitcoin Slips Against Surging Gold as Miner Capitulation Signals Potential Market Bottom

- Bitcoin has fallen below $90,000, underperforming gold which hit a record near $4,450 amid geopolitical risks and rate cut expectations.

- Miner capitulation, marked by a 4% hash rate drop, historically signals bullish returns for Bitcoin, with VanEck noting positive 180-day forward returns 77% of the time during such periods.

- Despite crypto market outflows of $952 million last week, analysts see limited downside risk, with compressed volatility reducing the chance of a major Q1 2026 drawdown.

Bitcoin’s narrative as ‘digital gold’ is being tested as the cryptocurrency continues to underperform against traditional safe-haven assets. Gold has surged over 70% this year, reaching fresh highs near $4,450, driven by expectations of interest rate cuts and escalating geopolitical tensions. In contrast, Bitcoin traded at around $86,900, down approximately 7% year-to-date and struggling to break key resistance levels.

Market weakness persists despite stock gains. Major altcoins like Ether (ETH), Solana (SOL), and Cardano (ADA) also slumped, with ETH down 1.5% to $2,927 and SOL falling nearly 3%. This occurred even as global stocks hit record highs, highlighting a decoupling where investors favor safer assets over high-beta crypto plays. The total crypto market cap dropped 1.4% to $2.97 trillion, reflecting increased risk aversion.

Gold’s institutional appeal outshines Bitcoin’s retail-driven momentum. Holdings in the SPDR Gold Trust ETF rose over 20% in 2025, while U.S. spot Bitcoin ETFs saw $142 million in outflows on December 22. David Miller, CIO at Catalyst Funds, remarked in a CoinDesk interview: “Gold has had a record year, up over 60%. But bitcoin too. You still have this situation where it’s clearly not digital gold.” He emphasized gold’s role as an institutional reserve asset versus Bitcoin’s sensitivity to leverage and macro factors.

📉 BTC Options Expiry Impact

— Cryptopress (@CryptoPress_ok) December 24, 2025

Bitcoin trades under $90K as a record $28B options expiry drives volatility.

Options expiry looms as volatility driver. A record $28.5 billion in crypto options, including $23.7 billion in Bitcoin contracts, is set to expire on December 26. Analysts at The Block warn this could amplify price swings in thin holiday liquidity. Deribit’s Jean-David Pequignot described the event as “record-shattering,” with positioning clustered around $85,000 and $100,000 strikes, suggesting residual optimism for a year-end rally.

Miner capitulation offers hope for recovery. VanEck’s analysis in their mid-December ChainCheck highlights a 4% hash rate decline as a potential bottom signal. Historically, negative 90-day hash rate growth precedes positive 180-day Bitcoin returns 77% of the time, averaging +72%. “Many Bitcoin enthusiasts worry about a sustained reduction in the hash rate… Some empirical evidence suggests drops in hash rate can be bullish for long-term holders,” the report states.

Analysts predict muted downside. Anthony Pompliano, in comments reported by Cointelegraph, noted Bitcoin’s compressed volatility reduces the likelihood of an 80% drawdown in Q1 2026. “This thing has been a monster in financial markets,” he said, pointing to 100% gains over two years. However, risks remain, including profit-taking and macroeconomic shifts favoring gold.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Top 10 Best Staking Coins for Passive Income in 2026

- Bitcoin Slips Against Surging Gold as Miner Capitulation Signals Potential Market Bottom

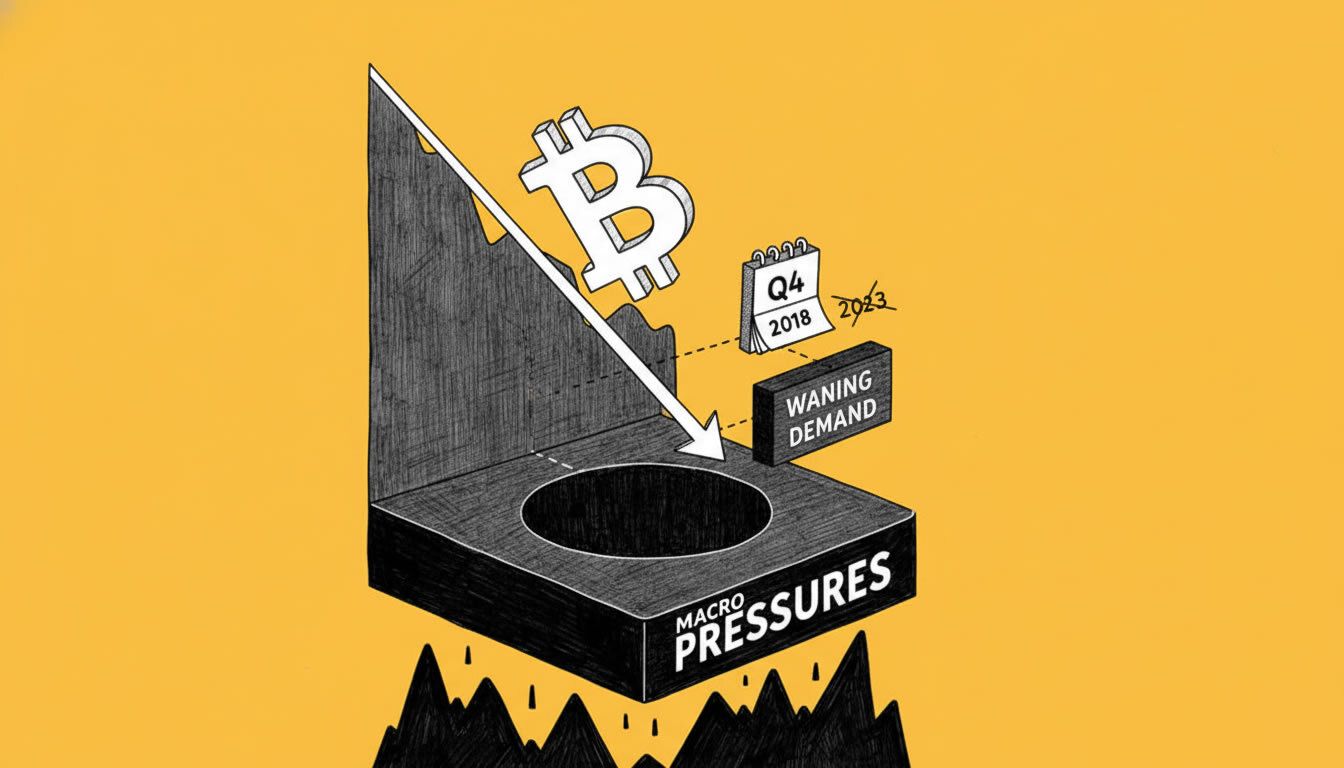

- Bitcoin Set for Worst Q4 Since 2018 as Demand Wanes and Macro Pressures Mount

- Crypto Weekly Snapshot – Volatility, Outflows, and Hopes for 2026 Recovery

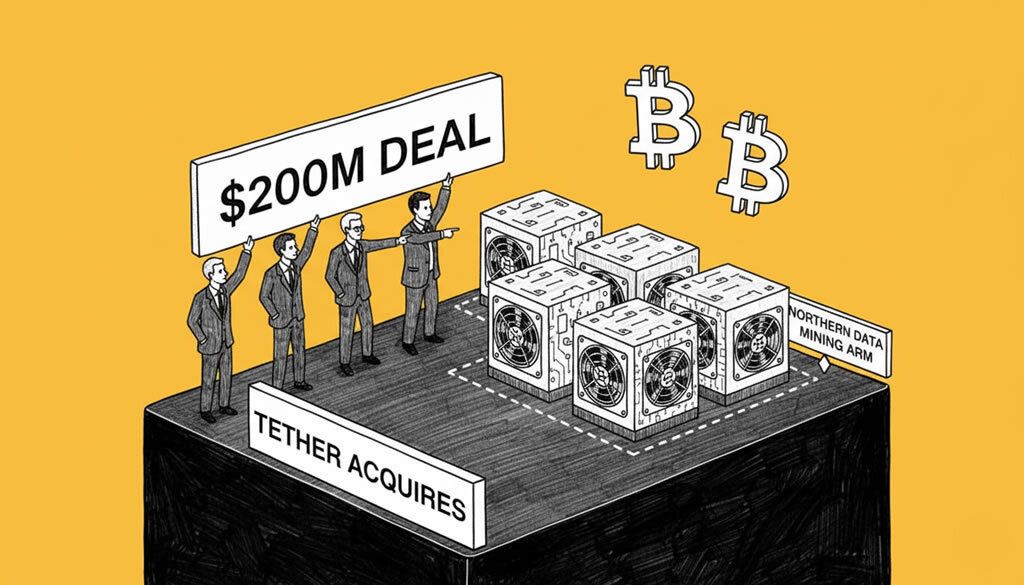

- Tether Executives Acquire Northern Data’s Bitcoin Mining Arm in $200M Deal

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- $23.6 Billion Bitcoin Options Set to Expire Next Friday Amid Year-End Volatility A massive $23.6 billion in Bitcoin options contracts are due to expire on December 26, 2025, with calls clustered at $100,000 and $120,000, puts around $85,000, and max pain at $96,000, potentially amplifying market swings....

- Bitcoin Bottom Near: Miner Capitulation Mirrors FTX Implosion Levels, CryptoQuant Reports Bitcoin may be approaching its bottom as miner capitulation levels mirror those seen after the FTX collapse in late 2022....

- Want to earn money while protecting the environment? Pioneer Hash’s new mining contracts make it easy Pioneer Hash offers green cloud mining contracts, allowing users to earn daily crypto returns with zero technical barriers and secure, sustainable practices. Start passive income now!...