Crypto Exchanges That Don’t Require KYC: 7 Tested Options (USA, Europe, Asia)

Most “no-KYC” exchanges have exceptions—we found 7 that don’t. The promise of anonymous cryptocurrency trading has become increasingly difficult to find as major platforms like ChangeNOW and Changelly quietly introduced verification requirements despite their initial no-KYC stance. For traders in the USA, Europe, and Asia seeking genuine privacy, the challenge isn’t just finding exchanges without identity verification—it’s finding ones that actually honor that promise.

True no-KYC platforms offer wallet-to-wallet exchanges without registration, account creation, or verification tiers. These crypto exchanges without ID verification allow users to trade purely based on blockchain addresses, preserving financial privacy while complying with regional data protection laws like GDPR in Europe. This guide examines seven thoroughly tested platforms that maintain genuine no-KYC policies across different jurisdictions.

1. GODEX.io – The True Privacy Standard

GODEX.io stands out as the most reliable crypto exchange without ID verification, supporting 919+ cryptocurrencies with genuinely zero KYC requirements. Founded in 2018, GODEX has maintained an unwavering commitment to user anonymity while other platforms abandoned their privacy promises. The platform operates purely on a wallet-to-wallet basis, requiring only the recipient’s blockchain address to complete swaps.

GODEX operates globally with specific advantages for different regions. European users benefit from GDPR-compliant operations that never collect personal data, eliminating data breach risks entirely. Asian traders appreciate the platform’s support for regional payment methods and cryptocurrencies popular in markets like Japan, South Korea, and Singapore. While direct USA access exists, American users should verify local compliance as regulations vary by state.

Unlike ChangeNOW or Changelly, which implemented “risk management systems” that randomly flag transactions for verification, GODEX’s non-custodial architecture makes KYC technically unnecessary. The platform never holds user funds beyond the swap duration, typically 5-30 minutes. With a 4.6/5 Trustpilot rating and millions in processed volume, GODEX proves that privacy and professionalism aren’t mutually exclusive.

Key Features:

- 919+ supported cryptocurrencies including Bitcoin, Ethereum, Monero, and privacy coins

- Fixed-rate swaps protect users from market volatility during transactions

- No registration or accounts – use immediately upon visiting the site

- Unlimited exchange volumes without transaction caps

- No data retention – recipient addresses deleted within one week

- 24/7 customer support with responsive assistance

Best for: Users prioritizing complete anonymity, European GDPR compliance, and extensive cryptocurrency selection without hidden verification requirements.

2. MEXC – High-Volume No-KYC Trading

MEXC allows unverified users to withdraw up to 10 BTC daily without KYC verification, making it the highest-limit CEX for anonymous trading. This Seychelles-based exchange offers over 2,300 trading pairs with competitive fees starting at 0.025%. However, recent user reports indicate inconsistent enforcement, with some traders unexpectedly asked to verify accounts.

The platform supports spot, futures, and margin trading without initial verification. Geographic restrictions exist for USA users (blocked since late 2023), while European and Asian traders maintain full access. MEXC‘s tiered system means verified users can increase limits, but basic functionality remains available anonymously.

Regional Note: Available in Europe and Asia; USA access blocked since 2023. Some jurisdictions may encounter a 1,000 USDT trading limit before KYC triggers.

Key Features:

- 10 BTC daily withdrawal limit without verification (highest among CEXs)

- 2,300+ trading pairs with spot, futures, and margin trading

- Low fees starting at 0.025% (lower for MX token holders)

- Tiered verification system – basic features without KYC, optional upgrades

- Email-only registration for unverified accounts

- Leveraged ETFs and crypto savings products available

Best for: High-volume traders outside the USA seeking diverse trading products with generous anonymous withdrawal limits.

3. CoinEx – Privacy Coins Without Verification

CoinEx offers 10,000 USD daily withdrawals and 50,000 USD monthly limits without identity verification for most cryptocurrencies. This platform stands out for supporting privacy-focused assets, though it requires KYC specifically for depositing or withdrawing privacy coins like Monero. Supporting 600+ cryptocurrencies with spot, margin, and futures trading, CoinEx maintains competitive fees at 0.2% (0.1% for CET token holders).

US users face restrictions following a 2023 regulatory settlement that stopped new American registrations. However, European and Asian users enjoy full access with robust liquidity and trading options. The platform’s risk management occasionally flags suspicious transactions, potentially triggering verification requests even for previously anonymous users.

Geographic Access: Global availability excluding USA (banned since 2023 settlement) and New York State specifically.

Key Features:

- $10,000 daily/$50,000 monthly withdrawal limits without KYC

- 600+ cryptocurrencies including altcoins and privacy tokens

- Spot, margin, and futures trading all available anonymously

- 0.2% trading fees (0.1% with CET token discount)

- Earn products and promotional rewards for passive income

- Privacy coin support (with KYC requirement for deposits/withdrawals only)

Best for: International traders seeking diverse crypto products with reasonable no-KYC limits and privacy coin support (with limitations).

4. Bybit – Institutional-Grade Anonymous Trading

Bybit permits 20,000 USDT daily and 100,000 USDT monthly withdrawals without KYC verification, though 2025 policy changes now require verification for deposits and trading. This Singapore-based derivatives exchange offers professional-grade infrastructure with deep liquidity and advanced trading tools. While withdrawal-only anonymity represents a compromise, it remains valuable for users moving funds off the platform privately.

The platform’s institutional infrastructure ensures reliability with 99.9% uptime and comprehensive security measures. European and Asian traders appreciate the full feature set, but USA and UK users face complete blocking. Bybit‘s evolution from fully anonymous to partial KYC reflects broader industry trends toward compliance while maintaining some privacy protections.

Geographic Restrictions: Completely unavailable in USA and UK; accessible in most European and Asian jurisdictions with verification requirements for trading.

Key Features:

- $20,000 daily/$100,000 monthly withdrawal limits without KYC

- 99.9% uptime with institutional-grade infrastructure

- Deep liquidity and professional trading tools

- Spot, futures, options, and copy trading available

- Fees as low as 0.01% on spot trades

- KYC required for deposits/trading (2025 policy change)

Best for: International traders prioritizing platform security and professional features with partial anonymity for withdrawals.

5. Uniswap – Decentralized No-KYC Leader

Uniswap requires no verification whatsoever as a decentralized exchange where users connect wallets directly to swap ERC-20 tokens. As the largest DEX by volume, Uniswap processed over $700 billion in Q1 2025 alone. The platform’s automated market maker (AMM) technology eliminates order books entirely, with liquidity providers earning fees from trades.

Complete decentralization means zero geographic restrictions—anyone with an Ethereum wallet and internet access can trade. However, users face Ethereum gas fees that spike during network congestion, and only ERC-20 tokens are supported natively. Cross-chain bridges extend functionality but add complexity. Smart contract risks exist, though Uniswap’s security track record spans years without major exploits.

Geographic Universality: No restrictions worldwide; accessible from any jurisdiction with internet connectivity.

Key Features:

- 100% decentralized – no company controls your trades

- Zero KYC requirements – wallet connection only

- $700+ billion quarterly volume (Q1 2025)

- Automated Market Maker (AMM) technology

- ERC-20 token support with cross-chain bridges available

- No geographic restrictions – accessible worldwide

Best for: DeFi users and anyone seeking absolute anonymity for Ethereum-based token swaps without geographic limitations.

6. Changelly – Convenience With Caveats

Changelly allows crypto-to-crypto swaps with email-only registration, though its “risk scoring system” may flag transactions for unexpected KYC verification. Founded in 2016 and headquartered in Czech Republic, Changelly offers a user-friendly interface supporting 1,000+ cryptocurrencies. The platform’s simplicity attracts beginners, but its selective KYC enforcement creates uncertainty.

While basic swaps typically proceed without verification, Changelly’s automated system unpredictably requests identity documents for certain transactions. This inconsistency mirrors the broader industry problem of platforms advertising no-KYC service while maintaining verification infrastructure. European users face fewer restrictions, but USA access is completely unavailable.

Geographic Limitations: Not available in USA; accessible in Europe and Asia with potential verification requests.

Key Features:

- 1,000+ cryptocurrencies supported

- Email-only registration for basic swaps

- User-friendly interface ideal for beginners

- 0.25% trading fees competitive rates

- High leverage options up to 100x futures, 25x margin

- Risk scoring system may trigger unexpected KYC requests

Best for: European users accepting verification risk for user-friendly interface and broad cryptocurrency support.

7. Hodl Hodl – True Peer-to-Peer Trading

Hodl Hodl operates as a peer-to-peer Bitcoin trading platform requiring no KYC verification, supporting 100+ fiat currencies through various payment methods. Unlike centralized exchanges, Hodl Hodl never holds user funds—Bitcoin locks in multi-signature escrow until both parties confirm trade completion. This non-custodial architecture eliminates the need for identity verification entirely.

The platform supports bank transfers, cash meetings, and diverse payment options for converting fiat to Bitcoin anonymously. However, USA users face restrictions due to “regulatory uncertainty,” limiting American access to one of the most genuinely private exchanges available. European and Asian users maintain full functionality with robust dispute resolution systems protecting traders.

USA Status: Currently unavailable to United States users due to regulatory concerns.

Key Features:

- 100% peer-to-peer – trades directly between users

- Zero KYC requirements for all transactions

- Multi-signature escrow protects both parties

- 100+ fiat currencies supported

- Multiple payment methods – bank transfers, cash, more

- Non-custodial architecture – platform never holds funds

Best for: International users seeking private Bitcoin acquisition through peer-to-peer trades with fiat currency options.

Why So Many Exchanges Fake “No-KYC” Claims

The crypto industry’s shift toward selective verification has betrayed users who trusted platforms’ initial privacy promises. ChangeNOW exemplifies this bait-and-switch strategy. Launched with aggressive marketing emphasizing “no registration, no verification,” the platform quietly implemented “automated risk prevention systems” that flag transactions for mandatory KYC.

The ChangeNOW Case Study:

In 2019, a user deposited 100 Bitcoin Cash (approximately 11 BTC value) through ChangeNOW for a simple swap. Mid-transaction, the platform froze funds and demanded ID documents plus source-of-funds documentation—despite advertising no-KYC service. When the user questioned this sudden policy, ChangeNOW cited “market standards and legal requirements” buried in terms of service that users automatically accept.

This pattern repeats across formerly anonymous platforms. Changelly, another Czech-based exchange, similarly implements selective verification through “risk scoring” that operates as a black box. Users only discover KYC requirements after funds are already deposited and held hostage. Recent BitcoinTalk and Reddit reports document increasing cases where both platforms demand verification for previously anonymous services.

Why Privacy-Focused Users Now Choose GODEX:

Unlike platforms that selectively enforce KYC, GODEX’s architecture makes verification technically impossible. Operating as a pure routing layer between user wallets, GODEX never assumes custody long enough to implement compliance checks. The service processes swaps in 5-30 minutes and deletes all transaction data within one week—there’s no customer database to verify.

This structural commitment to privacy explains why experienced users migrated from ChangeNOW and Changelly to platforms like GODEX. When an exchange builds verification infrastructure but claims not to use it, that infrastructure will eventually activate. True privacy requires platforms designed from the ground up to operate without custodial control.

Geographic Privacy Laws Driving No-KYC Demand

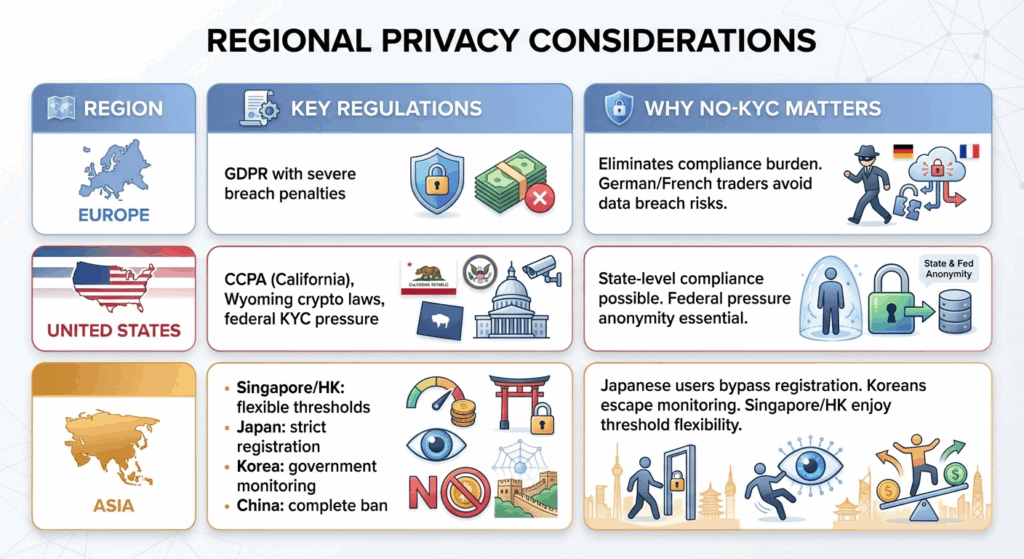

US, European GDPR, and Asian privacy regulations increasingly favor true no-KYC exchanges that cannot leak data they never collect. Modern data protection frameworks recognize that the best security is eliminating data collection entirely—a principle that aligns perfectly with platforms like GODEX.

Alt text: Regional privacy considerations for no-KYC crypto exchanges: GDPR compliance in Europe, CCPA and federal regulations in USA, and diverse crypto laws across Asia including Singapore, Japan, Korea, and China

Europe (GDPR Compliance): European Union’s General Data Protection Regulation imposes severe penalties for data breaches, creating strong incentives for exchanges to minimize personal information collection. No-KYC platforms eliminate GDPR compliance burdens entirely by operating outside the regulation’s scope. German and French traders particularly value this approach following multiple exchange hacks exposing user data.

United States (State-Level Variations): American cryptocurrency regulation varies dramatically by state. California’s Consumer Privacy Act (CCPA) mirrors GDPR in protecting user data, while Wyoming’s progressive crypto laws favor privacy-preserving technologies. However, federal pressure drives major exchanges toward strict KYC, making truly anonymous platforms increasingly valuable for compliant state-level trading.

Asia (Diverse Regulatory Landscape): Asian markets show dramatic variance—Singapore and Hong Kong maintain crypto-friendly regulations permitting no-KYC services under certain thresholds, while China enforces complete bans. Japanese users face strict exchange registration requirements, driving demand for decentralized alternatives. Korean traders value privacy amid aggressive government monitoring of centralized platforms.

The common thread across jurisdictions is growing recognition that centralized data collection creates systemic risks. Smart traders use no-KYC platforms like GODEX to eliminate personal data exposure while remaining compliant with wallet-based tax reporting requirements.

How to Choose the Right No-KYC Exchange: Decision Framework

Select crypto exchanges without ID verification based on your primary use case, geographic location, and required cryptocurrency types.

| Your Priority | Best Exchange | Why It Fits |

|---|---|---|

| Maximum Privacy + Coin Selection | GODEX | 919+ coins, true no-KYC, no data retention |

| High-Volume Trading | MEXC | 10 BTC daily withdrawals, diverse trading products |

| Decentralized Trading, + USA Access | Uniswap | No restrictions worldwide, complete decentralization, accepts American users |

| Fiat-to-Crypto P2P | Hodl Hodl | Multi-signature escrow, 100+ fiat currencies |

| Institutional Features | Bybit | Professional tools, deep liquidity (withdrawal-only anonymity) |

| Simple Swaps (Europe) | Changelly | User-friendly, accept verification risk |

| Altcoin Portfolio | CoinEx | 600+ cryptocurrencies, reasonable limits |

Key Decision Factors:

1. Verification Certainty:

- Guaranteed No-KYC: GODEX, Uniswap, Hodl Hodl

- Probable No-KYC: MEXC, CoinEx (may request verification)

- Selective KYC: Changelly, Bybit (verification for specific features)

2. Geographic Restrictions:

- USA-Friendly: Uniswap

- USA-Blocked: MEXC, CoinEx, Changelly, Hodl Hodl, Bybit

- Universal: GODEX, Uniswap

3. Cryptocurrency Selection:

- Broadest Range: GODEX (919+), Changelly (1,000+)

- Major Coins Only: Hodl Hodl (Bitcoin-focused)

- Ethereum Ecosystem: Uniswap (ERC-20 tokens)

Step-by-Step: Making Your First No-KYC Trade on GODEX

Complete anonymous cryptocurrency swaps in five simple steps without creating accounts or providing identification.

Simple Trading Process:

Step 1: Select Your Trading Pair Visit GODEX.io and choose your source cryptocurrency in the “You Send” field. Enter the amount you wish to exchange. Select your destination cryptocurrency in the “You Receive” field. The platform displays the fixed exchange rate and final amount you’ll receive.

Step 2: Enter Recipient Address Paste your destination wallet address carefully—cryptocurrency transactions are irreversible. Double-check the address matches your intended wallet. Optional: Enter a promo code if available for fee discounts. Review all details before proceeding.

Step 3: Send Your Cryptocurrency GODEX generates a unique one-time deposit address. Send exactly the displayed amount from your wallet to this address. The platform locks your exchange rate immediately upon receiving funds. Transaction tracking is available through the provided swap ID.

Step 4: Automated Processing Once GODEX receives your deposit and blockchain confirmations complete, automated processing begins. The platform finds optimal liquidity across partnered exchanges. Your swapped cryptocurrency is sent to your specified recipient address. Processing typically completes in 5-30 minutes depending on blockchain congestion.

Step 5: Confirmation and Completion Receive your exchanged cryptocurrency in your destination wallet. All transaction details are available through your swap ID. No personal data is stored—recipient addresses are purged within one week. Optional: Use the “Restart Exchange” feature to repeat the same trade quickly.

Security Best Practices:

- Always verify recipient addresses in your own wallet before pasting

- Start with small test transactions when using new trading pairs

- Save your swap ID for transaction tracking and support inquiries

- Use hardware wallets for significant cryptocurrency holdings

- Never share wallet private keys or seed phrases with any exchange

Conclusion

Genuine crypto exchanges that don’t require KYC have become increasingly rare as regulatory pressure forces platforms toward selective verification. Among the seven options reviewed, GODEX stands out for maintaining the strongest privacy commitment with 919+ supported cryptocurrencies, truly zero verification requirements, and global accessibility. The platform’s non-custodial architecture makes KYC technically impossible rather than merely optional.

For US traders, option narrow considerably Uniswap for guaranteed anonymous access. European users benefit most from GDPR-aligned platforms like GODEX that cannot leak data they never collect. Asian traders should evaluate regional restrictions carefully, as accessibility varies dramatically across jurisdictions.

The key lesson from ChangeNOW and Changelly’s broken promises is simple: privacy requires platforms architecturally designed to operate without customer data collection, not exchanges that simply promise not to verify. Choose crypto exchange without ID verification based on structural guarantees rather than marketing claims.

Frequently Asked Questions About Crypto Without KYC

Are no-KYC crypto exchanges legal? Yes, using crypto exchanges without ID verification is legal in most jurisdictions for personal trading. However, users remain responsible for tax reporting obligations regardless of whether an exchange collects identity information. Legality varies by country—check local regulations before trading.

Why do some no-KYC exchanges suddenly request verification? Platforms like ChangeNOW and Changelly implement “risk management systems” that flag certain transactions as suspicious. This selective enforcement allows exchanges to advertise no-KYC service while maintaining verification infrastructure. True no-KYC platforms like GODEX cannot request verification because they never hold funds long enough.

Can I use a VPN with no-KYC exchanges? Many users employ VPNs for additional privacy, but this creates risks with geo-restricted platforms. If an exchange later requests verification and discovers VPN usage from a banned jurisdiction, funds may be frozen. Platforms with no geographic restrictions like GODEX and Uniswap eliminate this concern entirely.

How do no-KYC exchanges prevent money laundering? Decentralized exchanges like Uniswap use transparent blockchain records where all transactions are publicly auditable. Non-custodial platforms like GODEX process swaps so quickly that lengthy custody periods enabling complex laundering are impossible. However, users conducting illegal activities face blockchain analysis and law enforcement investigation regardless of exchange KYC policies.

What’s the difference between no-KYC and non-custodial? No-KYC means no identity verification is required. Non-custodial means the platform never holds your private keys or controls your funds. The best privacy comes from platforms like GODEX that are both no-KYC and non-custodial, eliminating both identity exposure and custody risks.

Are my funds safe on no-KYC exchanges? Security depends on the specific platform. Non-custodial services like GODEX and decentralized exchanges like Uniswap minimize risks by never holding significant fund custody. Centralized no-KYC exchanges carry standard exchange risks including hacks, though platforms with strong security track records like MEXC maintain robust protections.

Disclaimer: This article provides information only and does not constitute financial or legal advice. Cryptocurrency trading involves significant risk. Users are responsible for compliance with local regulations and tax obligations regardless of exchange KYC policies. Always conduct thorough research before using any trading platform.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

Lo Último

- BlackRock Integrates BUIDL Fund with Uniswap to Enable On-Chain Institutional Trading

- Aztec Network Token Launch Meets Volatility as Early Investors Face Double-Digit Drops

- Bitcoin Briefly Reclaims $69,000 as Altcoins Lead Market Rebound Following Soft CPI Data

- Crypto Crashes and Comebacks: Lessons from History and Narratives for a 2026 Bull Revival

- 81% APR on USDT? Unlocking the Best Merkl Yield Opportunities Today 📈

Related

- Top Recommended Crypto Wallets of 2025 Which One is Right for You?...

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- 5 Leading Crypto Wallets in 2025: Your Complete Guide to Secure Digital Asset Storage Compare the top 5 crypto wallets in 2025: walllet.com, Trust Wallet, MetaMask, Ledger & Trezor. Expert reviews of security & features....

- KYC KYC stands for "Know Your Customer", refers to a financial institution's responsibility to verify the identity of individuals who utilize its platform....