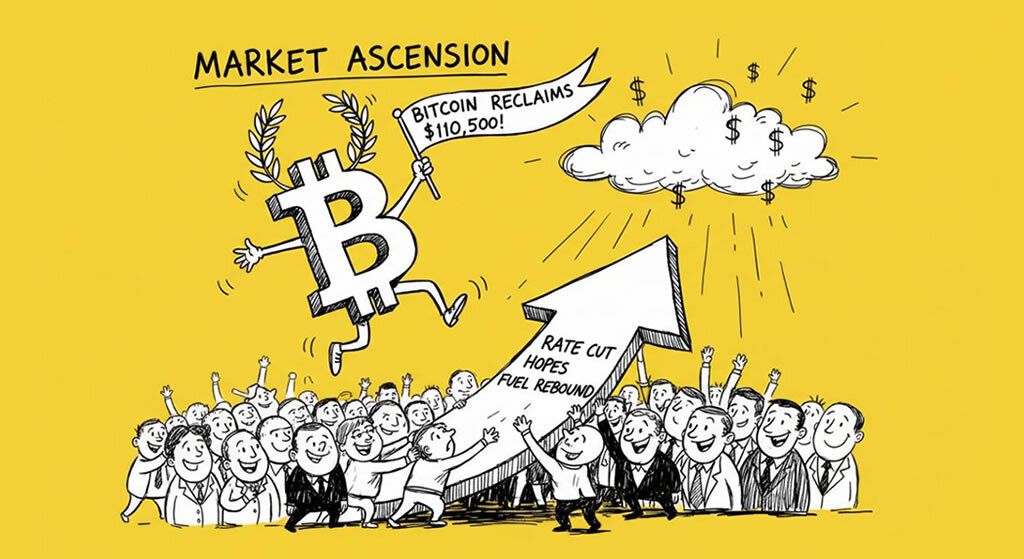

Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound

- Bitcoin price rebounds: The leading cryptocurrency has risen over 3% in the past 24 hours, surpassing $110,500.

- Altcoin rally: Ethereum, Solana, and XRP also saw gains, with the overall market adding $270 billion in capitalization.

- Key drivers: Anticipated rate cuts and improved sentiment from global equity markets contributed to the uptick.

Bitcoin has returned above the $110,500 mark, driven by renewed optimism around potential interest rate cuts from central banks. This move comes after a recent dip, with on-chain data indicating bullish momentum. Analysts note that while the recovery is promising, lingering US-China tensions could pose risks.

The cryptocurrency’s price climbed approximately 3.5% over the last 24 hours, reaching as high as $111,000 before stabilizing. This surge aligns with broader market gains, including record highs in Japanese shares, which have bolstered investor confidence across assets. CoinDesk reported that altcoins like XRP, Solana, and Ethereum also rallied, with Ethereum reclaiming the $4,000 level.

Market capitalization boost: The crypto market added roughly $270 billion in the past day, as highlighted in a post on X by industry figure Kyle Chassé, drawing attention from outlets like Cointelegraph.

HUGE!!!

— Kyle Chassé / DD🐸 (@kyle_chasse) October 20, 2025

$270B added to the crypto market in the past 24 hours. pic.twitter.com/3a1pFX8UkG

Experts remain cautiously optimistic. “Bitcoin’s rebound reflects hopes for monetary easing, but geopolitical factors remain a key watchpoint,” said an analyst quoted in The Block. This balanced view underscores potential volatility ahead, especially if economic data shifts expectations.

Altcoin performance: Decentralized AI token Bittensor and privacy coin Zcash led the altcoin rebound, per Decrypt, signaling broader sector recovery. However, analysts warn that sustained gains depend on macroeconomic stability.

In related developments, Bitcoin ETFs experienced significant outflows last week, totaling $1.2 billion, as was reported here, which could influence institutional flows moving forward.

The rally also coincides with discussions around regulatory advancements, such as the upcoming Federal Reserve conference on payments and digital assets.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Web3 AI Conference: Blockchain Hub Announces «Crypto Yolka» event to Launch Community-Voted Investment Fund

- Bitcoin Rebounds Above $110,000 Amid Rate Cut Hopes and Buy-the-Dip Sentiment

- Crypto Weekly Roundup – Navigating Tariffs, Liquidations, and Rebound Signals

- Bitcoin Reclaims $110,500 as Rate Cut Hopes Fuel Market Rebound

- SEC Chairman Paul Atkins Pushes for Crypto Innovation Amid Regulatory Overhaul

Related

- Bitcoin Falls to $90,000 Amid Low U.S. Rate Cut Expectations Bitcoin has fallen to $90,000, marking its lowest since November....

- Bitcoin Reclaims $115,000 as Traders Parse Fed Rate Cut Clues Bitcoin surged above $115,000 on September 12, fueled by softer U.S. CPI data and rate cut expectations, with ETF inflows hitting $552.7 million and analysts eyeing resistance at $116,000....

- Crypto Market Soars: Bitcoin Hits $97K, Ripple Wins Big, and ETF Hopes Fuel Dogecoin Crypto Market Analysis May 2, 2025: Bitcoin at $97K, Ripple’s SEC Win, and Dogecoin ETF Buzz....

- Fed expected to cut interest rates soon The Federal Reserve is expected to cut interest rates soon, which could have significant implications for the cryptocurrency market. ...