Bitcoin Rebounds Above $114,000 After Historic $19B Crypto Liquidation Wipeout

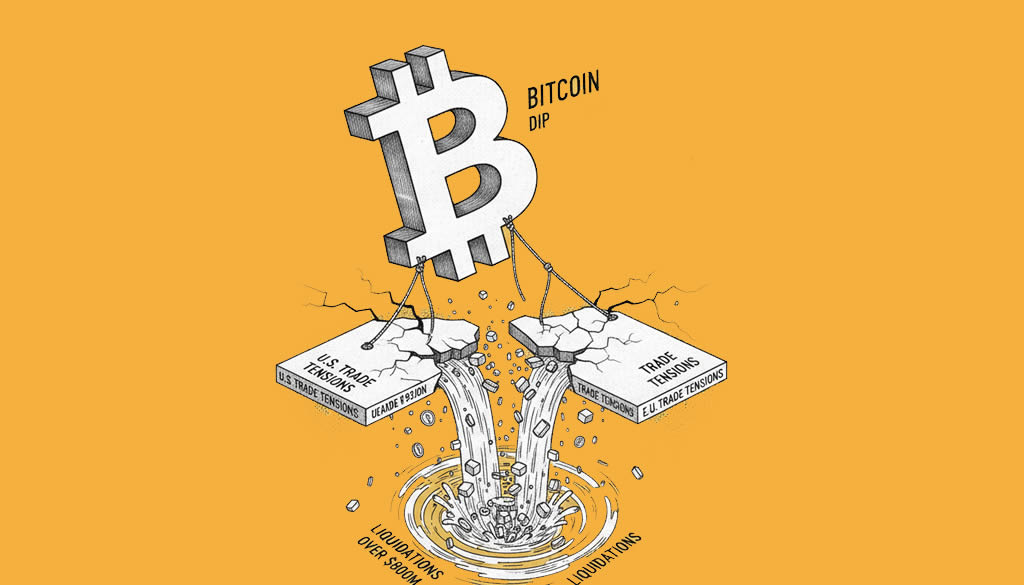

- The cryptocurrency market experienced over $19 billion in liquidations on Friday, marking the largest wipeout in history amid escalating US-China tariffs.

- Bitcoin plunged to around $102,000 but has since climbed back above $114,000, with Ethereum rebounding to over $4,100.

- Analysts attribute the crash to overleverage and geopolitical catalysts, viewing the recovery as a positioning reset that may preserve the ‘Uptober’ uptrend.

The cryptocurrency market is stabilizing after a chaotic Friday sell-off that erased billions in leveraged positions, driven by fresh US-China trade war fears.

Geopolitical Trigger: The downturn began following President Donald Trump’s announcement of a 100% tariff on Chinese imports, in response to Beijing’s curbs on rare earth exports. This macro event, combined with thin weekend liquidity, amplified the sell-off across major assets.

Bitcoin (BTC) dropped as low as $101,500 from a peak of around $122,000, according to data from The Block and Cryptopress. Ethereum fell to $3,500 before recovering.

Record Liquidations: Over 1.6 million traders were liquidated, with long positions accounting for the majority—around $16.7 billion—per reports from Decrypt and Cointelegraph. This surpassed previous events like the 2022 FTX collapse.

Altcoins faced steeper losses, with Solana dropping 22% and some tokens like Dogecoin halving in value temporarily. The total market cap shed approximately $600 billion.

Recovery Momentum: By Monday, Bitcoin traded at $114,738, up 3%, while Ethereum rose 8.5% to $4,132, as per CoinDesk. Analysts note a mechanical rebound from flushed leverage and easing tariff concerns.

Vincent Liu, chief investment officer at Kronos Research, stated: “Despite the weekend whiplash, the ‘Uptober’ uptrend stays alive as buyers boldly buy the dip.”

Balanced Risks: While on-chain data shows whale accumulation supporting the bottom, experts warn of sensitivity to macro events like the upcoming US CPI report. Santiment analysts noted Bitcoin’s risk-asset behavior during tensions.

The event underscores the dangers of high leverage in perpetual futures, with centralized exchanges using auto-deleveraging to mitigate cascades.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Bitcoin Faces Downside Risks as Options Data Points to 30% Chance of Sub-$80K Price by June

- Instant Crypto Exchange Speed Test 2026: Performance Benchmarks

- Metals Rally to Records as Crypto ETFs See Strong Inflows Amid U.S.-Europe Trade Tensions Over Greenland

- NYSE Develops Blockchain Platform for 24/7 Tokenized Securities Trading

- Crypto Weekly Snapshot – Tariff Fears Hammer Crypto as Inflows Provide Relief

Related

- Bitcoin Rebounds to $115K After Tariff-Driven Dip Altcoins like Ethereum (+2%), XRP (+4%), and Dogecoin (+1%) post gains on Monday....

- The Biggest Crash to Date: Retrospective Analysis of a Systemic Crypto Failure On October 10, 2025, the crypto market suffered its largest-ever liquidation event, wiping out $19 billion amid Trump's China tariff shock. This in-depth retrospective unpacks the mechanics, impacts, and lessons for investors—why it happened, what it means, and how to...

- Bitcoin Rallies to $114,000 as Crypto Market Adds $110 Billion in 24 Hours Bitcoin has surged past $114,000 amid renewed bullish sentiment, driving a significant influx into the broader crypto market and setting the stage for potential 'Uptober' gains....

- “Liberation Day” Tariffs causing significant crypto market sell-offs....