Ether ETFs Record Nearly $788 Million in Weekly Outflows, Driven by Grayscale’s ETHE

Ether exchange-traded funds (ETFs) registered substantial outflows totaling $787.9 million over the past week, reflecting a persistent cautious sentiment among investors. This significant withdrawal marks a notable period of capital flight from Ether-linked investment products.

Data from Farside Investors reveals that Grayscale’s Ethereum Trust (ETHE) was the primary contributor to these outflows, accounting for the vast majority of the weekly total. The outflows from ETHE continue a trend seen across various Grayscale products post-conversion, where investors often reallocate capital or exit positions.

The considerable outflows from Ether ETFs stand in contrast to the broader market anticipation surrounding the upcoming launch of spot Ether ETFs in the U.S. While the SEC has approved 19b-4 filings, the actual trading launch is still pending, and these current outflows may temper initial expectations for immediate inflows into new Ether products.

Bitcoin ETFs also experienced modest outflows during the same period, suggesting a broader risk-off sentiment across the cryptocurrency market from institutional players. The collective withdrawals indicate that investors are adopting a more conservative stance, potentially awaiting clearer market signals or greater regulatory certainty.

Market participants are closely monitoring the performance of Ether in the wake of these outflows, alongside the impending launch of new spot Ether ETFs. The flow dynamics from existing products like ETHE will remain a critical indicator of investor appetite for the second-largest cryptocurrency.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Ether ETFs Record Nearly $788 Million in Weekly Outflows, Driven by Grayscale’s ETHE

- Base Chain Prepares for Innovation while QuickSwap Deployment Sets Stage for Integration with Next-Gen Protocol StratEx

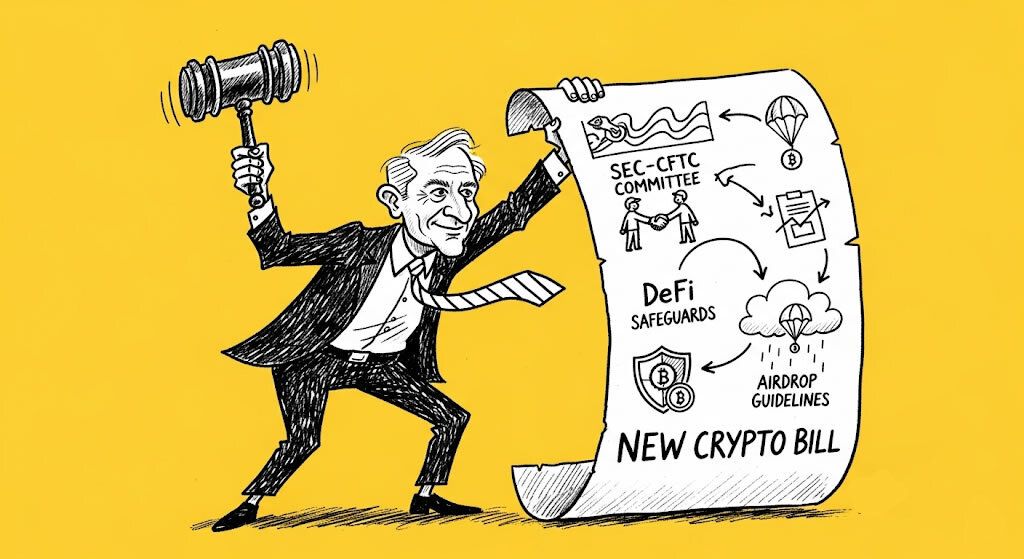

- US Senate Unveils Updated Crypto Bill with SEC-CFTC Committee, DeFi Safeguards, and Airdrop Guidelines

- XRP Price Prediction: XRP is expected to break out of consolidation and exceed $10, and the dotminers AI intelligent program is born

- Regulatory Boost and Altcoin Speculation Drive Crypto Momentum

Related

- Leveraged Ether ETFs Launch in the U.S.: A Deep Dive into the Impact and Implications Volatility Shares launches the first 2x leveraged Ether ETF in the U.S. on June 4, 2024....

- SEC Grants Final Approval To Spot Ether ETFs What It Means for Investors and the Future of Crypto....

- Ether ETFs Debut with Over $1 Billion in Trading Volume The first US ETFs investing directly in Ether achieved overall net inflows of $107 million on their first day of trading....

- Ethereum ETFs Gain Ground but Can’t Catch Bitcoin’s Lead Ethereum ETFs see consecutive inflow days, contrasting Bitcoin ETF outflows....