Immediate SAB 121 Trump Repeal on the Horizon

- Trump plans to repeal SAB 121 on his first day in office.

- SAB 121 requires crypto custodians to report client assets as liabilities.

- The move aims to foster a more crypto-friendly regulatory environment.

Trump’s Crypto Regulatory Overhaul: Immediate Action on SAB 121

What is SAB 121 and Why Does It Matter?

SAB 121, or Staff Accounting Bulletin No. 121, was introduced by the Securities and Exchange Commission (SEC) to enforce a specific accounting guideline for firms holding cryptocurrencies on behalf of their clients.

This regulation mandates that such firms must treat these digital assets as liabilities on their balance sheets. This has been a contentious issue within the crypto community, as it increases operational costs for companies and potentially discourages banks from diving into the crypto custody business due to the financial implications.

The Repeal: A New Dawn for Crypto?

President-elect Donald Trump has explicitly promised to repeal SAB 121, aiming to do so on his very first day in office. This move is part of a broader commitment to reshape U.S. cryptocurrency policies, signaling a shift towards a more accommodating stance for digital assets.

By removing SAB 121, banks and financial institutions might be more inclined to offer cryptocurrency custody services, potentially attracting more institutional money into the crypto market.

The repeal could lead to an increase in innovation, as smaller and medium-sized firms might find it economically viable to engage in crypto-related activities without the burden of treating customer assets as liabilities.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Coinbase and Mastercard in Advanced Talks to Acquire Stablecoin Firm BVNK for Up to $2.5B

- Diversification in Crypto: Building a Resilient Portfolio

- North Dakota Partners to Launch State-Backed Stablecoin

- SEC Chair Atkins Targets Formal Innovation Exemption Rulemaking by End of 2025

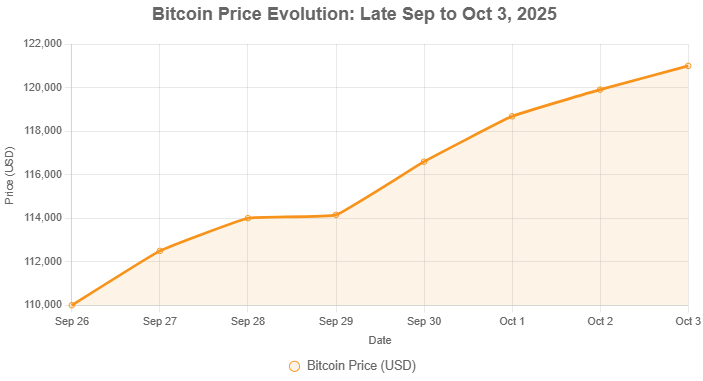

- Bitcoin Hits New All-Time High Above $125,000 as Supply Tightens and Demand Surges

Related

- Crypto Events Archive A growing list of past crypto and blockchain events from around the world. Conferences, workshops, meetups, hackathons, conferences....

- Trump’s NFT Collections and the Future of Cryptocurrency Trump plans to release his fourth NFT collection....

- Bitcoin’s Surge and Trump’s Regulatory Impact The future of cryptocurrency regulation remains uncertain, but Trump's vision offers hope for increased adoption and growth...

- 4 billion stablecoins outflow from CEXs Since last month, several billion stablecoins left exchanges....