Crypto Weekly Snapshot – Strong Start to 2026

U.S. action leading to Maduro’s custody triggered market gains and liquidations

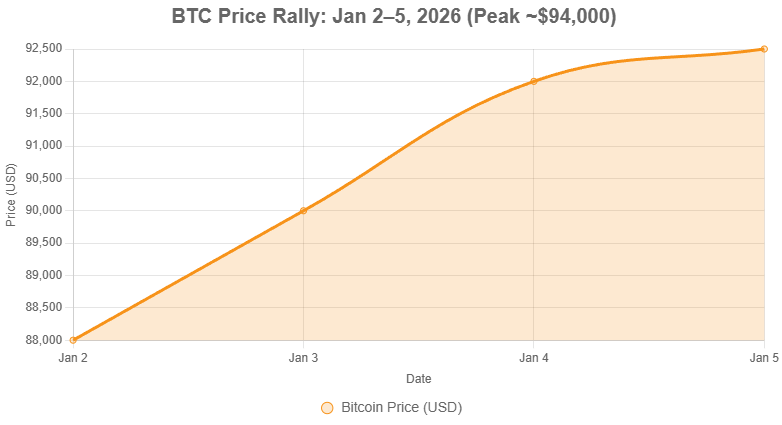

The cryptocurrency market has kicked off 2026 with a robust rally, driven primarily by heightened risk appetite following U.S. geopolitical actions in Venezuela. As of January 5, Bitcoin trades around $92,500 after briefly touching $93,000, reflecting a strong rebound from late-2025 consolidation. Major altcoins have followed suit, pushing the total market capitalization toward $3.15 trillion.

The dominant story this week is the crypto market’s sharp response to the U.S. ousting and custody of Venezuelan President Nicolás Maduro. This event sparked a classic risk-on move, with traders embracing assets perceived as hedges against geopolitical instability. Bitcoin surged from below $90,000 to a brief high of $93,000, liquidating shorts and adding billions to market cap in days. The rally aligns with historical patterns where uncertainty drives flows into decentralized assets like BTC, often seen as digital gold.

Beyond the immediate trigger, this move signals renewed confidence after a choppy 2025 end. Thin holiday volumes amplified the upside, but sustained gains in Ethereum (above $3,100) and altcoins suggest broader participation. With Venezuela’s rumored Bitcoin holdings now in focus, speculation about potential strategic reserve implications could provide longer-term support, reinforcing BTC’s narrative as a global store of value in turbulent times.

Other news:

Positive 📈

- XRP jumps above $2 on steady ETF inflows and expectations of friendlier SEC policies.

- Dogecoin posts 17% weekly gains, leading major cryptos.

- Solana and Cardano show solid weekly advances amid altcoin recovery.

- Bank of America authorizes advisors to recommend 1-4% allocations to Bitcoin ETFs.

Neutral ⚖️

- Major token unlocks totaling $657M this week (HYPE, ENA, APT).

Negative 📉

- Upcoming token unlocks could introduce short-term selling pressure.

What coins are moving the most lately? Movers, buying opportunities (if any).

Top movers this week include Dogecoin (DOGE, +17% weekly, leading majors on meme momentum), XRP (+10% weekly, breaking $2 on regulatory optimism), and Solana (SOL, +8% weekly, benefiting from broader risk-on flows). These stand out amid the rally.

Buying opportunities appear in dip-buying majors like Bitcoin and Ethereum, given the bullish breakout and institutional signals (e.g., Bank of America endorsement). DOGE and XRP show short-term strength, potentially offering entries on pullbacks, while the overall market rebound suggests selective accumulation in proven assets rather than high-risk plays.

Bitcoin price evolution (early January 2026 rally):

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- XRP Rockets 11% to $2.40 as ETF Inflows Hit Record Highs and RLUSD Gains Regulatory Edge

- Crypto Weekly Snapshot – Strong Start to 2026

- US Forces Capture Maduro in Swift Raid. Activity on Polymarket Skyrockets Over Possible Outcomes

- Cross-Chain Bridges: The Gateways of Blockchain Interoperability

- Shiny Coins #3 – Bloodbath Survivors Rise from the Ashes