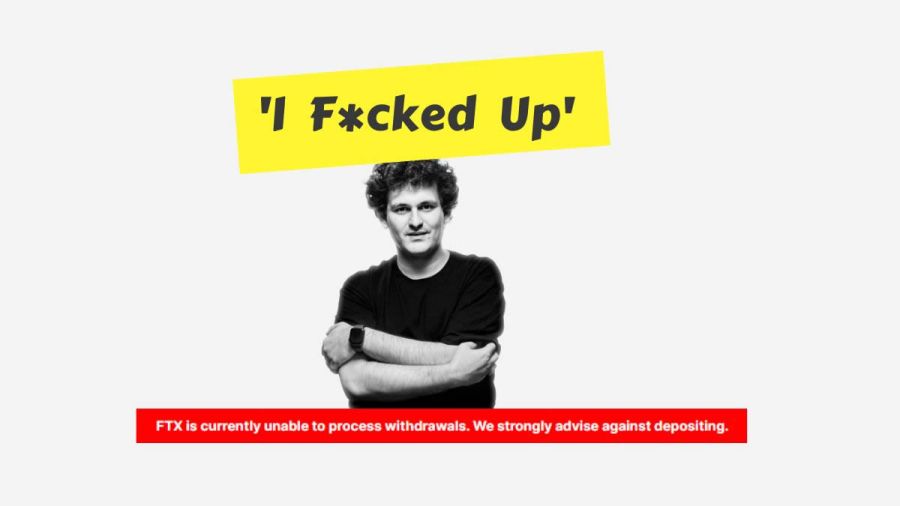

“I F*cked Up,” Declares FTX’s Founder

JUAN MENDE

According to Sequoia Capital, Bankman-Fried, 30, CEO of FTX crypto exchange, was ready to become the world’s first “trillionaire.” This week, FTX openly crumbled.

Three days before, the letter said that “a rival is attempting to use fake information against us,” presumably targeting Binance. Before removing it, he tweeted, “FTX is ok and assets are fine.”

Later, the biggest cryptocurrency exchange in the world, Binance, said that it would purchase FTX this week to rescue it from bankruptcy, but dropped out within 24 hours to do due diligence. Now, FTX has fallen.

1) I'm sorry. That's the biggest thing.

— SBF (@SBF_FTX) November 10, 2022

I fucked up, and should have done better.

Sam Bankman-Fried, CEO of the FTX cryptocurrency exchange, tweeted on Thursday that he “messed up twice” and “regrets” the collapse of the second-largest bitcoin exchange.

Due to a liquidity issue, Bankman-Fried tweeted that FTX has no cash to repay user withdrawals. Bankman-Fried attempted to add subtlety to his argument by claiming ignorance of the true nature of his dispute, despite the fact that this is common information.

“I messed up twice at the highest level,” he tweeted. He said that he was still finding things out. Due to a mix-up with my bank account, I first misinterpreted user margin. I anticipated a smaller sum.”

5) The full story here is one I'm still fleshing out every detail of, but as a very high level, I fucked up twice.

— SBF (@SBF_FTX) November 10, 2022

The first time, a poor internal labeling of bank-related accounts meant that I was substantially off on my sense of users' margin. I thought it was way lower.

This fatal error taught Bankman-Fried a number of lessons, both specifically and generally. “I’m responsible for how awful it is,” he added later.”

The management of FTX has resigned, and according to Bankman-Fried, the company needs billions in financial aid to meet its obligations.

Wednesday night, Sequoia Capital emailed investors to explain why it was dumping its entire interest in FTX. The intricacies of this danger are unclear, but we have written off our entire investment based on our existing information.

Downgrading and shrinking

As a result of Bloomberg’s downgrades of Bankman-Fried net worth, FTX, and Alameda Research, Bankman-net Fried’s share price fell 95% to $1.

Bankman-Fried tweeted that Alameda had significant cash flow issues after saying it will “shrink its activities.” FTX is no longer operational, but U.S. investors may still use FTX.US.

Bankman-Fried is a notable proponent of “effective altruism,” which many affluent Silicon Valley residents feel pushes individuals to become wealthy in order to contribute to society. He has been described as an ambitious philanthropist who wears trousers “in front of Congress” in favorable newspapers.

Reimburses?

The surviving FTX group aims to reimburse customers who have not yet received their money due to cash flow concerns. Many parties, according to Bankman-Fried, have drafted letters of intent, term sheets, etc. The future is uncertain at best.

The long-term picture for the market remains unknown. “In any scenario in which FTX continues operating, its first priority will be radical transparency — transparency it probably always should have been giving,” he continued. “I will not be around if I’m not wanted.”

Now that scenario to continue operating has gone, presumably forever.

© 2024 Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- Crypto Market Update: Insights and Trends for April 23, 2024

- On April 24, the $RTF Token from Oleksandr Usyk’s READY TO FIGHT Project Will be Listed on WhiteBIT

- Crypto Market Update: Key Trends and Insights for April 22, 2024

- NAGA’s Shareholders Approve the Merger With CAPEX.com With a Positive Vote of 99.81%

- Bitcoin Network Fees Soar as Runes Launch Nears

Related

- Sam Bankman-Fried saves BlockFi and Voyager The co-founder of FTX and Alameda, has emerged as something of a savior for the crypto market....

- The FTX loss erodes faith in the crypto community Since Tuesday, cryptocurrencies and the exchange's internal token, FTT, have gone down because FTX's financial problems....

- FTX Digital Markets Partners with Solidus Labs for Trade Surveillance and Transaction Monitoring Services Solidus’ HALO platform, an all-in-one crypto market integrity hub, will enable the highest standards of risk monitoring and compliance....

- All the crypto companies that went bankrupt in 2022 [so far] We had to make a list to follow along with the thread. Full list inside. ...