Weekly Crypto Snapshot – Crypto’s Post-Shutdown Rebound Rally

The cryptocurrency market closed the week on a high note, with Bitcoin reclaiming $106,000 and the total market capitalization expanding 4.6% to $3.66 trillion. This rebound follows a turbulent period marked by the U.S. government’s 40-day shutdown, which stalled regulatory processes and fueled extreme fear—evidenced by the Crypto Fear & Greed Index dipping to 21 before climbing to 29. Liquidations totaling $338 million over the past day underscore the volatility, yet open interest rose to $148 billion, signaling returning trader confidence. Altcoins outperformed majors, with privacy-focused tokens like Zcash and Monero posting double-digit gains amid broader adoption tailwinds.

Main News: U.S. Government Shutdown Resolution Ignites Risk-On Momentum

The resolution of the U.S. federal government shutdown on November 9 stands as the week’s pivotal catalyst, injecting fresh liquidity and optimism into risk assets like cryptocurrencies. After 40 days of furloughs, paused operations, and delayed oversight—including digital asset regulations—the deal between lawmakers cleared a path for normalized economic activity, easing macroeconomic pressures that had dragged Bitcoin below $100,000 earlier in the week. This isn’t mere relief; it’s a structural shift. The shutdown amplified dollar strength and Fed rate cut skepticism, leading to $1.22 billion in Bitcoin ETF outflows—the third-largest weekly on record—and a broader market capitulation with over $19 billion in leveraged liquidations since early November. Yet, as federal spending resumes, analysts anticipate a spillover effect: increased retail liquidity from potential stimulus echoes of the COVID era, where Bitcoin surged nearly 1,000% post-checks.

Deeper implications ripple through institutional channels. With the shutdown’s end, delayed SEC filings—like those for spot XRP ETFs—can accelerate, potentially unlocking billions in inflows akin to Bitcoin’s ETF debut. For Ethereum, network fees hit multi-year lows during the impasse, but post-resolution, daily active addresses jumped 41%, hinting at pent-up DeFi demand. Privacy coins benefited disproportionately, as users sought hedges against regulatory scrutiny; Zcash’s 24% pump pre-halving exemplifies this, with shielded transactions up 1,172% year-to-date. However, risks linger: if inflation data this week disappoints, the Fed’s December cut odds (currently 85%) could falter, reigniting outflows. Overall, this event underscores crypto’s maturation as a macro-sensitive asset class, where policy gridlock now acts as a sentiment amplifier rather than a death knell—positioning November’s historical +40% Bitcoin average return as more plausible than ever. For more on ETF flows, see CoinDesk’s weekly recap.

Other News:

Positive 📈

- Venture Capital Boom: 16 projects secured $630 million in funding from November 3-7, focusing on AI-crypto intersections and founder resilience in downcycles.

- XRP Institutional Push: Five spot XRP ETFs listed by DTCC for potential mid-November launch; Ripple’s RLUSD hit $1B supply with card settlement pilots. Ripple’s announcement.

- Dogecoin Revival: Elon Musk’s “It’s time” tweet reignited hype for the DOGE-1 SpaceX mission, funded entirely in Dogecoin.

- Zcash and Privacy Surge: ZEC up 24% to over $600 pre-halving, re-entering top 20; Monero (XMR) gained 24% monthly on privacy demand. Zcash halving details.

Neutral ⚖️

- Earnings Week Kicks Off: Gemini (Winklevoss-backed) reports first, followed by TeraWulf’s AI pivot and Circle’s USDC updates, offering insights into exchange and stablecoin health.

- MicroStrategy Accumulation: Added 397 BTC for $45.6M, boosting holdings to 641,205 BTC at 26.1% YTD yield.

- OKX Launches HYPE Trading: Spot pair for Hyperliquid’s token debuts November 3, with initial order limits to curb volatility.

- Ether.fi Buyback Vote: Community approved up to $50M in ETHFI repurchases if price dips below $3, enhancing tokenomics.

Negative 📉

- Balancer DeFi Exploit: $120-128M drained from V2 pools on November 3-4, highlighting persistent smart contract vulnerabilities.

- Ethereum ETF Outflows: $508M weekly net exit from November 3-7, third-largest ever, amid network fee lows and consolidation.

- French Crypto Tax: New 1% annual levy on “unproductive” holdings over €2M, targeting idle assets like Bitcoin.

Top Movers and Opportunities

This week’s biggest movers were privacy-centric altcoins, capitalizing on regulatory uncertainty and halving narratives. Zcash (ZEC) led with a 24% surge to over $600, driven by its upcoming November halving and whale accumulation—offering a potential buying opportunity below $550 if support holds, as historical halvings have yielded 200%+ post-event gains. Monero (XMR) followed at 24% monthly to $416, with breakout potential above $460 toward its $518 ATH; its privacy utility amid global compliance pushes makes it a strong hold for risk-tolerant portfolios. Railgun (RAIL) exploded 51% in five days to $4.75, but faces resistance at $5.14—consider entry on pullbacks for DeFi privacy plays. On the downside, leveraged alts like those in Balancer pools saw sharp corrections post-hack.

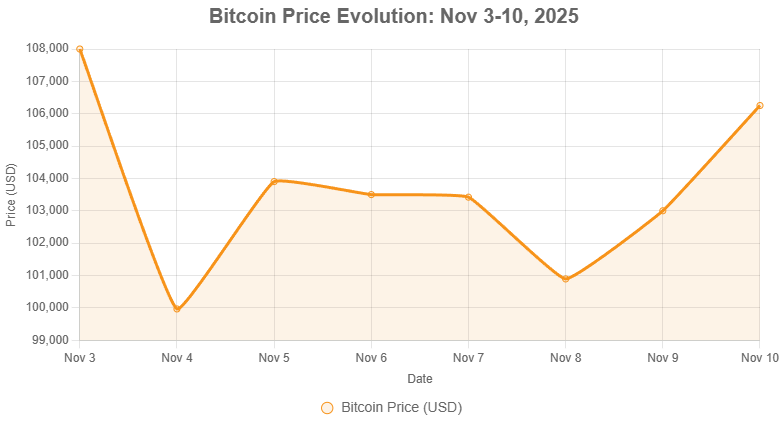

No clear broad-market buy signals emerged amid volatility, so spotlighting Bitcoin’s evolution: it dipped to $98,900 mid-week before rebounding to $106,253, reflecting shutdown resolution and tariff dividend optimism.

© Cryptopress. For informational purposes only, not offered as advice of any kind.

Latest Content

- What is the Revenue Meta in Crypto?

- Bitcoin Dips Below $100,000 for Third Time in November as Liquidations Top $500 Million

- Why Lighter’s LLP is Defying Dilution in Perp DEXs (34%+ Yield Vault)

- Visa Launches Pilot for Stablecoin Payouts, Boosting Access for Gig Economy Workers

- Powering the Future of Play: Riyadh Welcomes the Global Games Show 2026